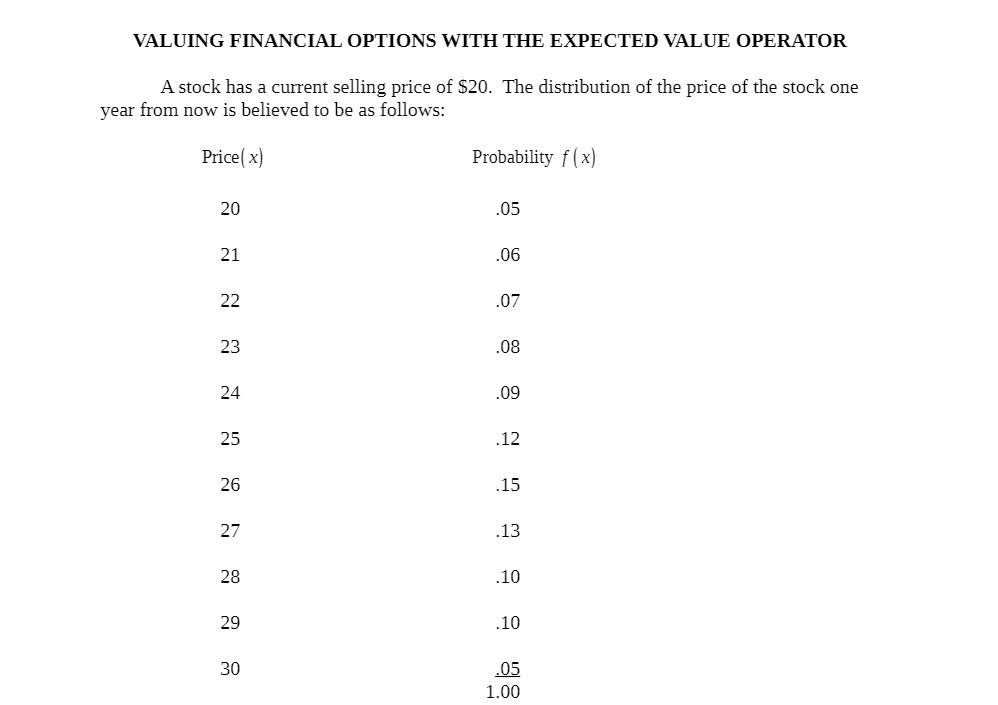

Question: VALUING FINANCIAL OPTIONS WITH THE EXPECTED VALUE OPERATOR A stock has a current selling price [If $20. The distribution of the price of the stock

VALUING FINANCIAL OPTIONS WITH THE EXPECTED VALUE OPERATOR A stock has a current selling price [If $20. The distribution of the price of the stock one year from now is believed to be as foilows: Price[ X] Probability f { X] 20 .05 21 .06 22 .07 23 .08 24 .09 25 .12 26 .15 27 .13 28 .10 29' .10 30 05 1E

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts