Question: Valuing Inventory and Recording Entries Using Relative Sales Value Method Arizona Developers purchased and subdivided a tract of land that cost $900,000 cash into garden

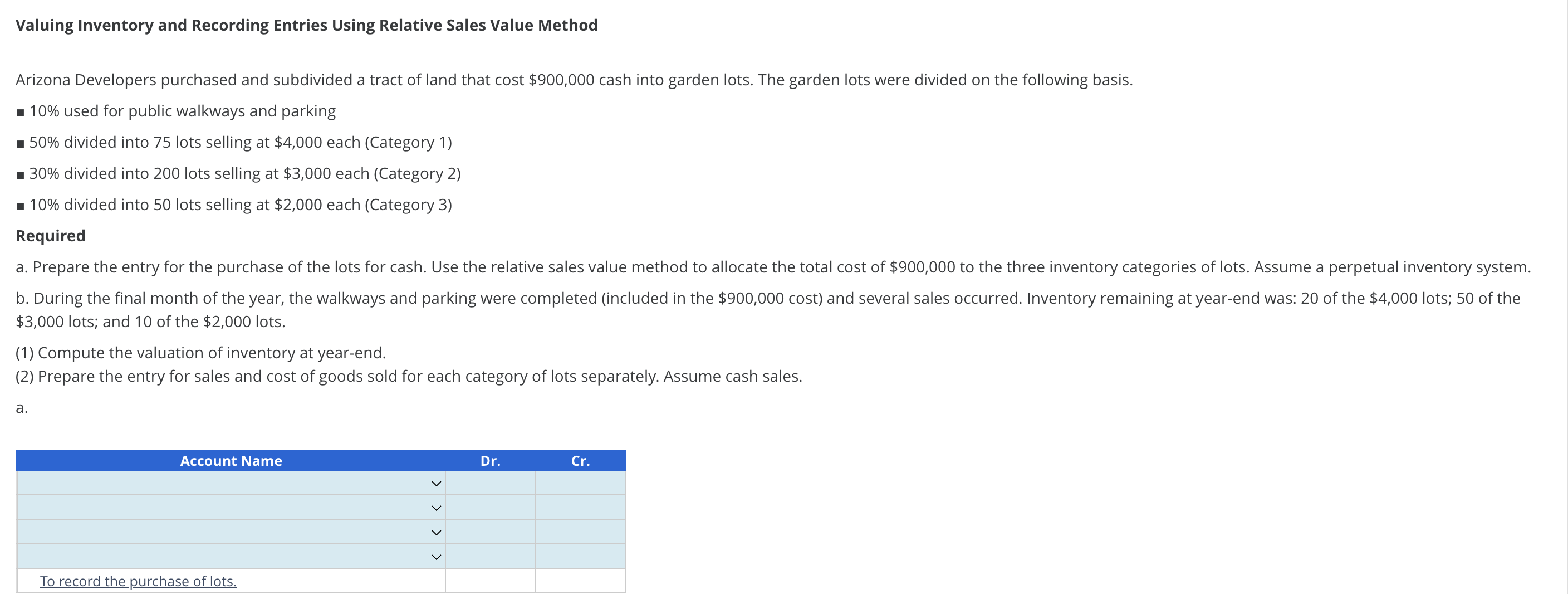

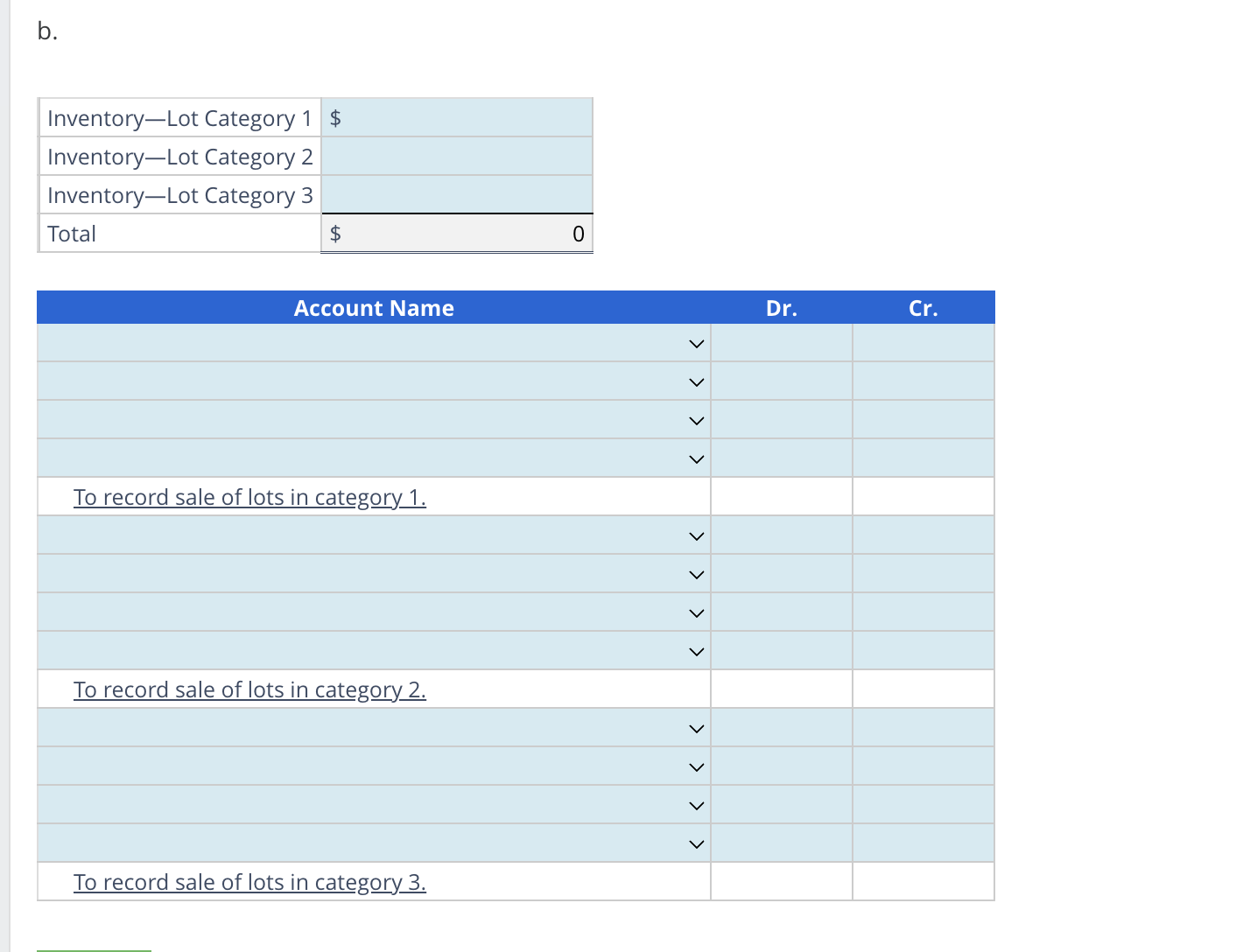

Valuing Inventory and Recording Entries Using Relative Sales Value Method Arizona Developers purchased and subdivided a tract of land that cost $900,000 cash into garden lots. The garden lots were divided on the following basis. - 10% used for public walkways and parking 50% divided into 75 lots selling at $4,000 each (Category 1) - 30\% divided into 200 lots selling at $3,000 each (Category 2) - 10% divided into 50 lots selling at $2,000 each (Category 3 ) Required $3,000 lots; and 10 of the $2,000 lots. (1) Compute the valuation of inventory at year-end. (2) Prepare the entry for sales and cost of goods sold for each category of lots separately. Assume cash sales. b. \begin{tabular}{|l|ll|} \hline Inventory_Lot Category 1 & $ \\ \hline Inventory-Lot Category 2 & & \\ \hline Inventory_Lot Category 3 & & \\ \hline Total & $ & 0 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline Account Name & Dr. & Cr. \\ \hline V & & \\ \hlinev & & \\ \hline & & \\ \hlinev & & \\ \hline \multicolumn{3}{|l|}{ To record sale of lots in category 1.} \\ \hline & & \\ \hline & & \\ \hline & & \\ \hlinev & & \\ \hline \multicolumn{3}{|l|}{ To record sale of lots in category 2.} \\ \hline & & \\ \hline & & \\ \hlinev & & \\ \hline & & \\ \hline To record sale of lots in category 3. & & \\ \hline \end{tabular} Valuing Inventory and Recording Entries Using Relative Sales Value Method Arizona Developers purchased and subdivided a tract of land that cost $900,000 cash into garden lots. The garden lots were divided on the following basis. - 10% used for public walkways and parking 50% divided into 75 lots selling at $4,000 each (Category 1) - 30\% divided into 200 lots selling at $3,000 each (Category 2) - 10% divided into 50 lots selling at $2,000 each (Category 3 ) Required $3,000 lots; and 10 of the $2,000 lots. (1) Compute the valuation of inventory at year-end. (2) Prepare the entry for sales and cost of goods sold for each category of lots separately. Assume cash sales. b. \begin{tabular}{|l|ll|} \hline Inventory_Lot Category 1 & $ \\ \hline Inventory-Lot Category 2 & & \\ \hline Inventory_Lot Category 3 & & \\ \hline Total & $ & 0 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline Account Name & Dr. & Cr. \\ \hline V & & \\ \hlinev & & \\ \hline & & \\ \hlinev & & \\ \hline \multicolumn{3}{|l|}{ To record sale of lots in category 1.} \\ \hline & & \\ \hline & & \\ \hline & & \\ \hlinev & & \\ \hline \multicolumn{3}{|l|}{ To record sale of lots in category 2.} \\ \hline & & \\ \hline & & \\ \hlinev & & \\ \hline & & \\ \hline To record sale of lots in category 3. & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts