Question: Valuing Options Structures We determined in class the value of a call with a strike of $175 on APPL stock when So= $100, T= 3,

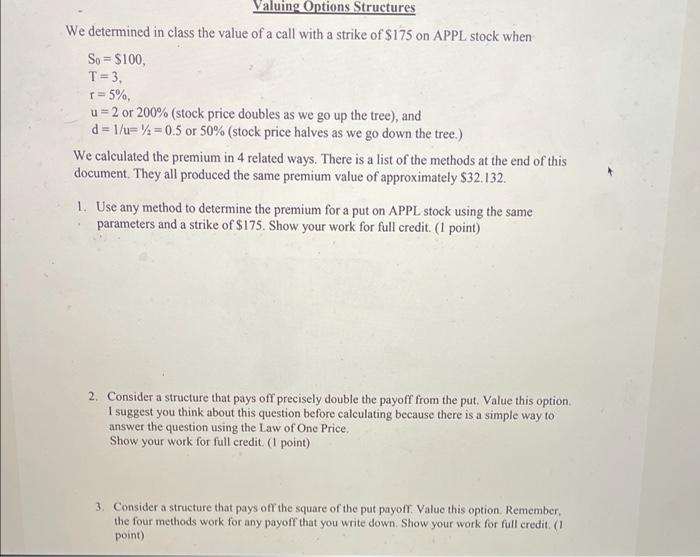

Valuing Options Structures We determined in class the value of a call with a strike of $175 on APPL stock when So= $100, T= 3, r = 5%, u=2 or 200% (stock price doubles as we go up the tree), and d=1/u==0.5 or 50% (stock price halves as we go down the tree.) We calculated the premium in 4 related ways. There is a list of the methods at the end of this document. They all produced the same premium value of approximately $32.132. 1. Use any method to determine the premium for a put on APPL stock using the same parameters and a strike of $175. Show your work for full credit. (1 point) 2. Consider a structure that pays off precisely double the payoff from the put. Value this option. I suggest you think about this question before calculating because there is a simple way to answer the question using the Law of One Price, Show your work for full credit. (1 point) 3. Consider a structure that pays off the square of the put payoff. Value this option. Remember, the four methods work for any payoff that you write down. Show your work for full credit. (1) point) Valuing Options Structures We determined in class the value of a call with a strike of $175 on APPL stock when So= $100, T= 3, r = 5%, u=2 or 200% (stock price doubles as we go up the tree), and d=1/u==0.5 or 50% (stock price halves as we go down the tree.) We calculated the premium in 4 related ways. There is a list of the methods at the end of this document. They all produced the same premium value of approximately $32.132. 1. Use any method to determine the premium for a put on APPL stock using the same parameters and a strike of $175. Show your work for full credit. (1 point) 2. Consider a structure that pays off precisely double the payoff from the put. Value this option. I suggest you think about this question before calculating because there is a simple way to answer the question using the Law of One Price, Show your work for full credit. (1 point) 3. Consider a structure that pays off the square of the put payoff. Value this option. Remember, the four methods work for any payoff that you write down. Show your work for full credit. (1) point)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts