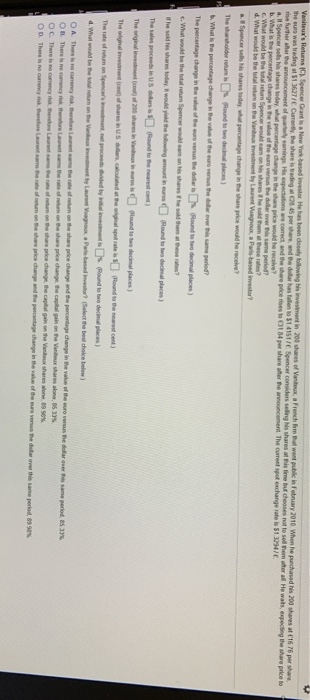

Question: Van ex's Returns C Spencer Gratis a New York based investor He has been doney following his investment in 200 shares of various a French

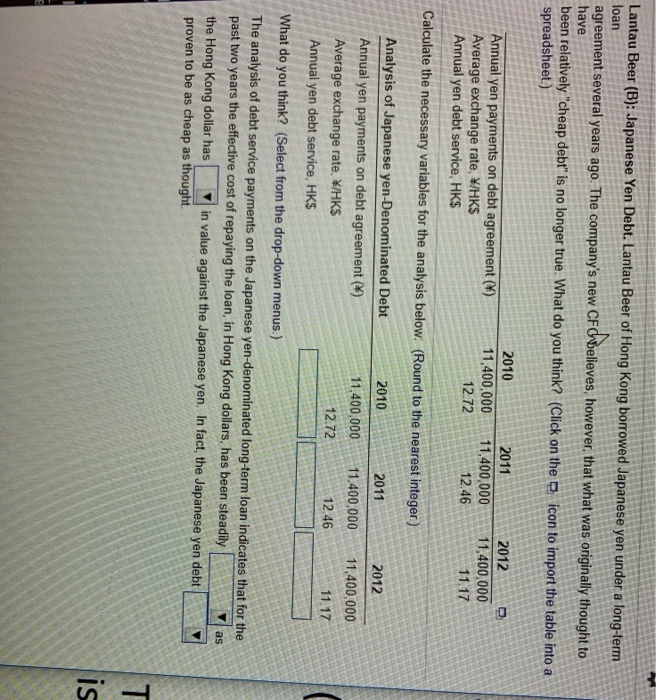

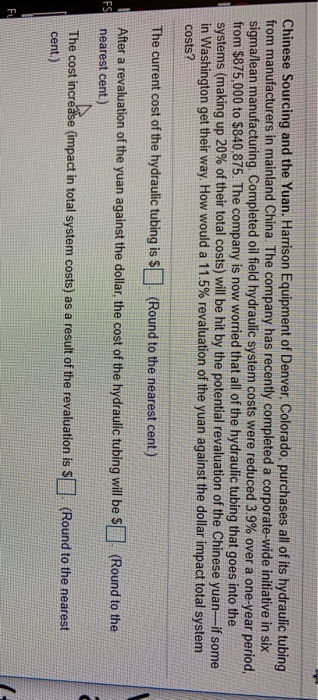

Van ex's Returns C Spencer Gratis a New York based investor He has been doney following his investment in 200 shares of various a French from that went puble in February 2010 When he purchased Nis 200 shares at 76 76 per share the curs was trading 1362710 Curry the share is vading 15 per shers, and the door has falten to 314151/6 Spencer considers selling is shares at this time but chooses not to sell them for all He was, expecting the share price to rise father after the announcement of glycarmings. His expectations are correct, and the share prices to 14 per share after the amouncement The current pot exchange rate is $13034/6 a. Il Spencer ses his shares today, what percentage change in the share price would he receive? b. What is the percentage change in the value of the suro versus the dollar over this same period c. What would be the return Spencer would cam on his shares the sold them at the rates d. What would be the total tan on the Vanvestment by Lauren Vegou a Paris based investor? a. Spencer sols his shares today, what percentage change in the share price would be receive? The wholderrature is Round to two decimal places) b. What is the percentage change in the value of the curves the dollar over this same period The percentage change in the value of the suns versus te collar I Pound to two decimal place) c. What would be the total rum Spencer would can on his shares the sold them at these? " he said his share today. It would you the following out how and to two decimal place) The proceeds in US dolas Round to the rest.com) The original Invest 200 shares in Venis Round to be decimal places) The original moment to share on US dollars, cated at the airport Round to the nearest cent) d. What would be the mother ment by Largou a Puis based in Select the best choice below) OA There is no currency, therefore was the cate of tuman the share price change and the percentage change in the value of the euro vers the dollar over a period, as OB. There is no curis therefore it came the rate of rum on the share price change the capital gain on the Vandex shares sone, 533 OC. There is no centre as the rate of sum on the shore price change the capital gain on the Vandex shares on 19 se OD. There is no carency, there at the rate on the shore price change and the percentage change in the value of the curs venus the dular ever this same period, as ses Lantau Beer (B): Japanese Yen Debt. Lantau Beer of Hong Kong borrowed Japanese yen under a long-term agreement several years ago. The company's new cF chvelieves, however, that what was originally thought to have been relatively "cheap debt" is no longer true. What do you think? (Click on the icon to import the table into a spreadsheet.) Annual yen payments on debt agreement (*) Average exchange rate, W/HKS Annual yen debt service, HK$ 2010 11,400,000 12.72 2011 11,400,000 12.46 2012 11,400,000 11.17 Calculate the necessary variables for the analysis below. (Round to the nearest integer.) 2010 2011 2012 Analysis of Japanese yen-Denominated Debt Annual yen payments on debt agreement (4) Average exchange rate, W/HK$ Annual yen debt service, HK$ 11,400,000 11.400,000 12.72 11,400,000 11.17 12.46 What do you think? (Select from the drop-down menus.) The analysis of debt service payments on the Japanese yen-denominated long-term loan indicates that for the past two years the effective cost of repaying the loan, in Hong Kong dollars, has been steadily the Hong Kong dollar has in value against the Japanese yen. In fact, the Japanese yen debt proven to be as cheap as thought. as T is Chinese Sourcing and the Yuan. Harrison Equipment of Denver, Colorado, purchases all of its hydraulic tubing from manufacturers in mainland China. The company has recently completed a corporate-wide initiative in six sigma/lean manufacturing. Completed oil field hydraulic system costs were reduced 3.9% over a one-year period, from $875,000 to $840,875. The company is now worried that all of the hydraulic tubing that goes into the systems (making up 20% of their total costs) will be hit by the potential revaluation of the Chinese yuan-if some in Washington get their way. How would a 11.5% revaluation of the yuan against the dollar impact total system costs? The current cost of the hydraulic tubing is $. (Round to the nearest cent) FS After a revaluation of the yuan against the dollar, the cost of the hydraulic tubing will be $ nearest cent.) (Round to the The cost increase (impact in total system costs) as a result of the revaluation is S cent.) (Round to the nearest FL Van ex's Returns C Spencer Gratis a New York based investor He has been doney following his investment in 200 shares of various a French from that went puble in February 2010 When he purchased Nis 200 shares at 76 76 per share the curs was trading 1362710 Curry the share is vading 15 per shers, and the door has falten to 314151/6 Spencer considers selling is shares at this time but chooses not to sell them for all He was, expecting the share price to rise father after the announcement of glycarmings. His expectations are correct, and the share prices to 14 per share after the amouncement The current pot exchange rate is $13034/6 a. Il Spencer ses his shares today, what percentage change in the share price would he receive? b. What is the percentage change in the value of the suro versus the dollar over this same period c. What would be the return Spencer would cam on his shares the sold them at the rates d. What would be the total tan on the Vanvestment by Lauren Vegou a Paris based investor? a. Spencer sols his shares today, what percentage change in the share price would be receive? The wholderrature is Round to two decimal places) b. What is the percentage change in the value of the curves the dollar over this same period The percentage change in the value of the suns versus te collar I Pound to two decimal place) c. What would be the total rum Spencer would can on his shares the sold them at these? " he said his share today. It would you the following out how and to two decimal place) The proceeds in US dolas Round to the rest.com) The original Invest 200 shares in Venis Round to be decimal places) The original moment to share on US dollars, cated at the airport Round to the nearest cent) d. What would be the mother ment by Largou a Puis based in Select the best choice below) OA There is no currency, therefore was the cate of tuman the share price change and the percentage change in the value of the euro vers the dollar over a period, as OB. There is no curis therefore it came the rate of rum on the share price change the capital gain on the Vandex shares sone, 533 OC. There is no centre as the rate of sum on the shore price change the capital gain on the Vandex shares on 19 se OD. There is no carency, there at the rate on the shore price change and the percentage change in the value of the curs venus the dular ever this same period, as ses Lantau Beer (B): Japanese Yen Debt. Lantau Beer of Hong Kong borrowed Japanese yen under a long-term agreement several years ago. The company's new cF chvelieves, however, that what was originally thought to have been relatively "cheap debt" is no longer true. What do you think? (Click on the icon to import the table into a spreadsheet.) Annual yen payments on debt agreement (*) Average exchange rate, W/HKS Annual yen debt service, HK$ 2010 11,400,000 12.72 2011 11,400,000 12.46 2012 11,400,000 11.17 Calculate the necessary variables for the analysis below. (Round to the nearest integer.) 2010 2011 2012 Analysis of Japanese yen-Denominated Debt Annual yen payments on debt agreement (4) Average exchange rate, W/HK$ Annual yen debt service, HK$ 11,400,000 11.400,000 12.72 11,400,000 11.17 12.46 What do you think? (Select from the drop-down menus.) The analysis of debt service payments on the Japanese yen-denominated long-term loan indicates that for the past two years the effective cost of repaying the loan, in Hong Kong dollars, has been steadily the Hong Kong dollar has in value against the Japanese yen. In fact, the Japanese yen debt proven to be as cheap as thought. as T is Chinese Sourcing and the Yuan. Harrison Equipment of Denver, Colorado, purchases all of its hydraulic tubing from manufacturers in mainland China. The company has recently completed a corporate-wide initiative in six sigma/lean manufacturing. Completed oil field hydraulic system costs were reduced 3.9% over a one-year period, from $875,000 to $840,875. The company is now worried that all of the hydraulic tubing that goes into the systems (making up 20% of their total costs) will be hit by the potential revaluation of the Chinese yuan-if some in Washington get their way. How would a 11.5% revaluation of the yuan against the dollar impact total system costs? The current cost of the hydraulic tubing is $. (Round to the nearest cent) FS After a revaluation of the yuan against the dollar, the cost of the hydraulic tubing will be $ nearest cent.) (Round to the The cost increase (impact in total system costs) as a result of the revaluation is S cent.) (Round to the nearest FL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts