Question: Vanguard applies the full replication method to construct the investment portfolio for its Vanguard Australian Shares Index Fund (hereafter the Fund), which seeks to track

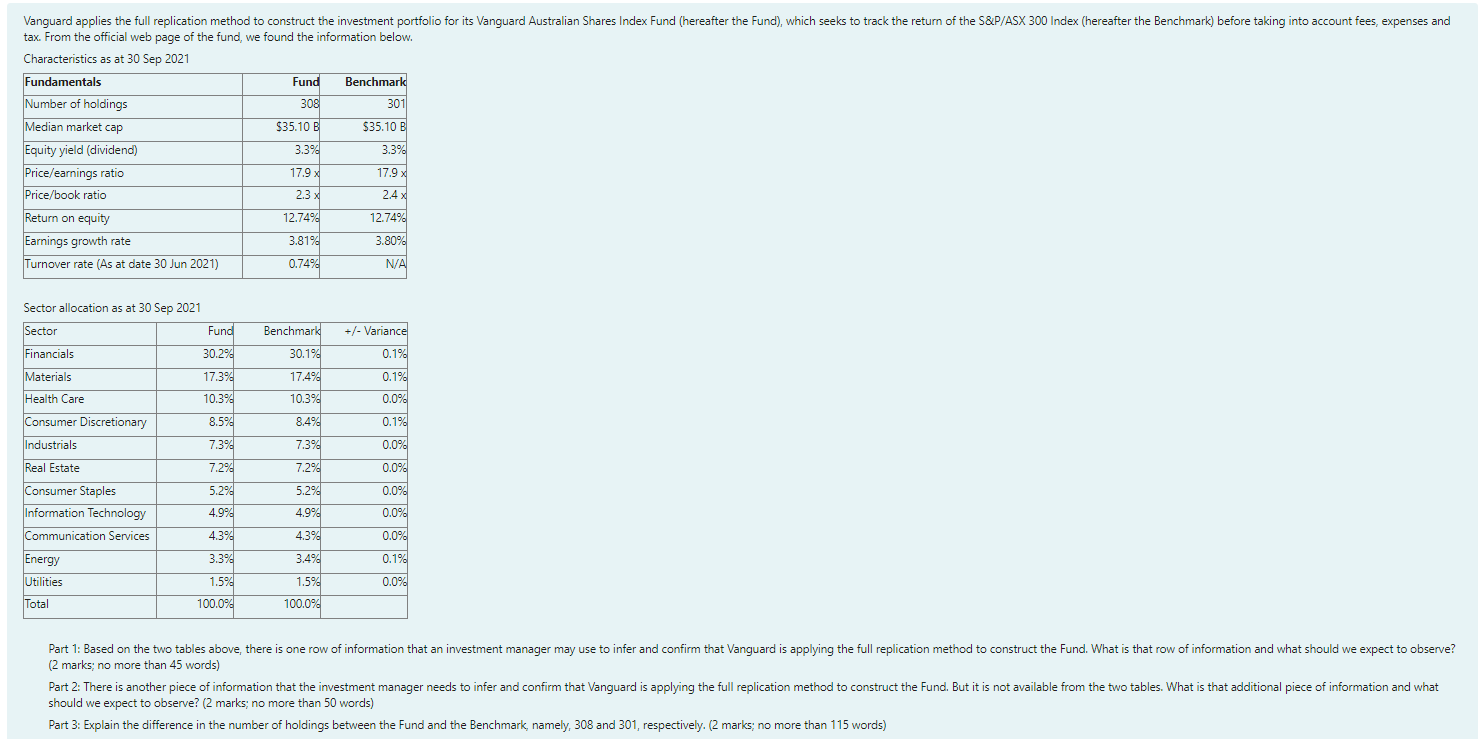

Vanguard applies the full replication method to construct the investment portfolio for its Vanguard Australian Shares Index Fund (hereafter the Fund), which seeks to track the return of the S&P/ASX 300 Index (hereafter the Benchmark) before taking into account fees, expenses and tax. From the official web page of the fund, we found the information below. Characteristics as at 30 Sep 2021 Fundamentals Fund Benchmark Number of holdings 308 301 Median market cap $35.10 B $35.10 B Equity yield (dividend) 3.394 3.3% Price/earnings ratio 17.9 x 17.9 x Price/book ratio 2.3 x 2.4 Return on equity 12.74% 12.74% Earnings growth rate 3.81% 3.80% Turnover rate (As at date 30 Jun 2021) 0.7494 N/A Sector allocation as at 30 Sep 2021 Sector Fund Financials 30.2% Benchmark +/- Variance 17.3% 10.39 0.1% 0.1% 0.0% 8.594 30.19 17.4% 10.394 8.494 7.39 7.29 5.294 4.99 Materials Health Care Consumer Discretionary Industrials Real Estate Consumer Staples Information Technology Communication Services Energy Utilities Total 0.1% 0.0% 7.394 7.294 5.294 4.9 0.0% 0.0% 0.0% 0.0% 4.394 3.394 0.1% 4.394 3.49 1.5% 100.0% 1.59 0.0% 100.0% Part 1: Based on the two tables above, there is one row of information that an investment manager may use to infer and confirm that Vanguard is applying the full replication method to construct the Fund. What is that row of information and what should we expect to observe? (2 marks; no more than 45 words) Part 2: There is another piece of information that the investment manager needs to infer and confirm that Vanguard is applying the full replication method to construct the Fund. But it is not available from the two tables. What is that additional piece of information and what should we expect to observe? (2 marks; no more than 50 words) Part 3: Explain the difference in the number of holdings between the Fund and the Benchmark, namely, 308 and 301, respectively. (2 marks; no more than 115 words) Vanguard applies the full replication method to construct the investment portfolio for its Vanguard Australian Shares Index Fund (hereafter the Fund), which seeks to track the return of the S&P/ASX 300 Index (hereafter the Benchmark) before taking into account fees, expenses and tax. From the official web page of the fund, we found the information below. Characteristics as at 30 Sep 2021 Fundamentals Fund Benchmark Number of holdings 308 301 Median market cap $35.10 B $35.10 B Equity yield (dividend) 3.394 3.3% Price/earnings ratio 17.9 x 17.9 x Price/book ratio 2.3 x 2.4 Return on equity 12.74% 12.74% Earnings growth rate 3.81% 3.80% Turnover rate (As at date 30 Jun 2021) 0.7494 N/A Sector allocation as at 30 Sep 2021 Sector Fund Financials 30.2% Benchmark +/- Variance 17.3% 10.39 0.1% 0.1% 0.0% 8.594 30.19 17.4% 10.394 8.494 7.39 7.29 5.294 4.99 Materials Health Care Consumer Discretionary Industrials Real Estate Consumer Staples Information Technology Communication Services Energy Utilities Total 0.1% 0.0% 7.394 7.294 5.294 4.9 0.0% 0.0% 0.0% 0.0% 4.394 3.394 0.1% 4.394 3.49 1.5% 100.0% 1.59 0.0% 100.0% Part 1: Based on the two tables above, there is one row of information that an investment manager may use to infer and confirm that Vanguard is applying the full replication method to construct the Fund. What is that row of information and what should we expect to observe? (2 marks; no more than 45 words) Part 2: There is another piece of information that the investment manager needs to infer and confirm that Vanguard is applying the full replication method to construct the Fund. But it is not available from the two tables. What is that additional piece of information and what should we expect to observe? (2 marks; no more than 50 words) Part 3: Explain the difference in the number of holdings between the Fund and the Benchmark, namely, 308 and 301, respectively. (2 marks; no more than 115 words)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts