Question: Vanik Barseghyan File Home Insert Page Layout Formulas Data Review View Help Tell me what you w Calibri 11 ab Wrap Text General Paste BIU

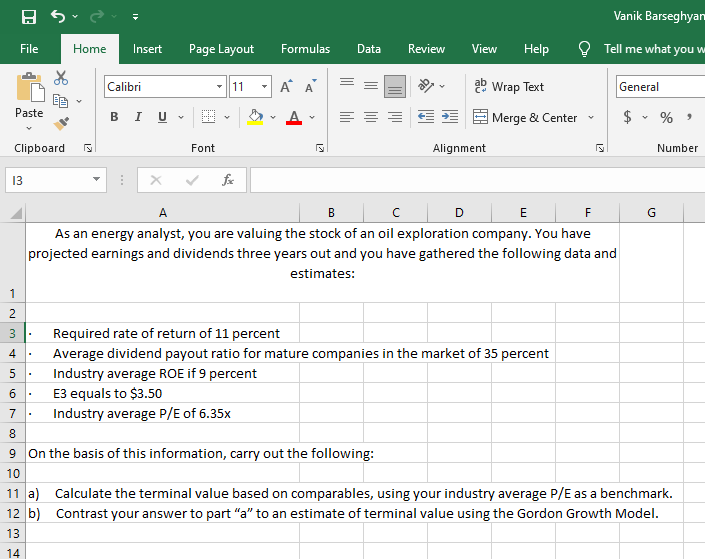

Vanik Barseghyan File Home Insert Page Layout Formulas Data Review View Help Tell me what you w Calibri 11 ab Wrap Text General Paste BIU Merge & Center $ % Clipboard Font Alignment Number 13 E F G As an energy analyst, you are valuing the stock of an oil exploration company. You have projected earnings and dividends three years out and you have gathered the following data and estimates: 1 2 3 4 5 Required rate of return of 11 percent Average dividend payout ratio for mature companies in the market of 35 percent Industry average ROE if 9 percent E3 equals to $3.50 Industry average P/E of 6.35x 6 7 8 9 On the basis of this information, carry out the following: 10 11 a) Calculate the terminal value based on comparables, using your industry average P/E as a benchmark. 12 b) Contrast your answer to part "a" to an estimate of terminal value using the Gordon Growth Model. 13 14

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts