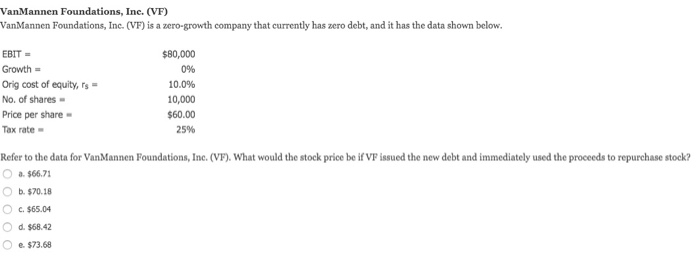

Question: VanMannen Foundations, Inc. (VF) VanMannen Foundations, Inc. (VF) is a zero-growth company that currently has zero debt, and it has the data shown below. EBIT

VanMannen Foundations, Inc. (VF) VanMannen Foundations, Inc. (VF) is a zero-growth company that currently has zero debt, and it has the data shown below. EBIT 2 Growth = Orig cost of equity, I's - No. of shares Price per share Tax rate $80,000 0% 10.0% 10,000 $60.00 25% Refer to the data for VanMannen Foundations, Inc. (VT). What would the stock price be if VF issued the new debt and immediately used the proceeds to repurchase stock? O a. $66.71 O b. $70.18 OC.$65.04 d. $68.42 e $73.68 VanMannen Foundations, Inc. (VF) VanMannen Foundations, Inc. (VF) is a zero-growth company that currently has zero debt, and it has the data shown below. EBIT 2 Growth = Orig cost of equity, I's - No. of shares Price per share Tax rate $80,000 0% 10.0% 10,000 $60.00 25% Refer to the data for VanMannen Foundations, Inc. (VT). What would the stock price be if VF issued the new debt and immediately used the proceeds to repurchase stock? O a. $66.71 O b. $70.18 OC.$65.04 d. $68.42 e $73.68

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts