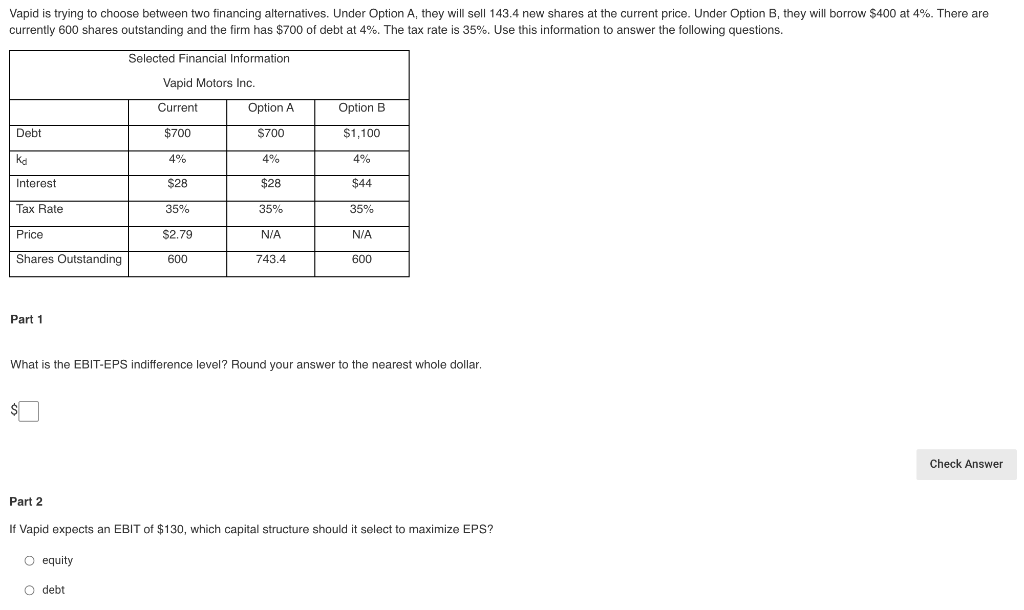

Question: Vapid is trying to choose between two financing alternatives. Under Option A, they will sell 143.4 new shares at the current price. Under Option B,

Vapid is trying to choose between two financing alternatives. Under Option A, they will sell 143.4 new shares at the current price. Under Option B, they will borrow $400 at 4%. There are currently 600 shares outstanding and the firm has $700 of debt at 4%. The tax rate is 35%. Use this information to answer the following questions. Selected Financial Information Vapid Motors Inc. Current Option A Option B Debt $700 $700 $1,100 ka 4% 4% 4% Interest $28 $28 $44 Tax Rate 35% 35% 35% Price $2.79 N/A N/A Shares Outstanding 600 743.4 600 Part 1 What is the EBIT-EPS indifference level? Round your answer to the nearest whole dollar. $ Check Answer Part 2 If Vapid expects an EBIT of $130, which capital structure should it select maximize EPS? O equity O debt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts