Question: Vapid is trying to choose between two financing alternatives. Under Option A, they will sell 127.6 new shares at the current price. Under Option B,

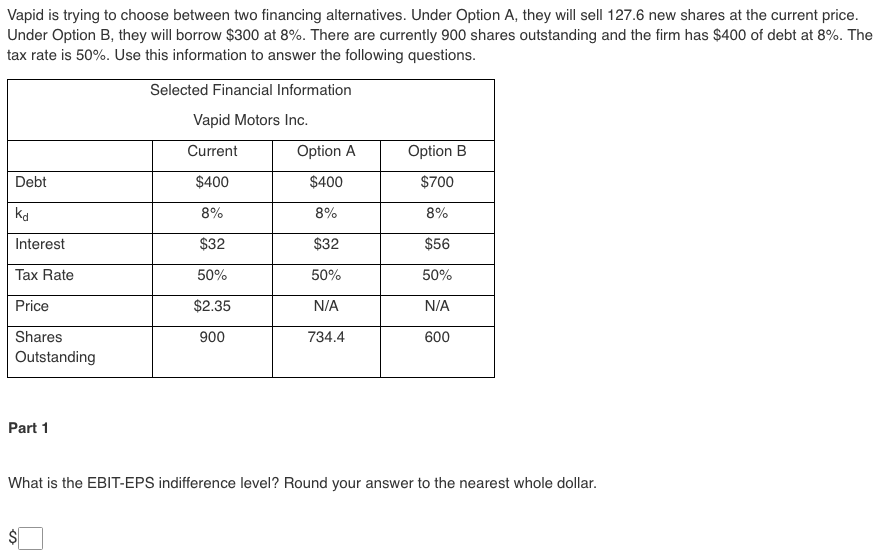

Vapid is trying to choose between two financing alternatives. Under Option A, they will sell 127.6 new shares at the current price. Under Option B, they will borrow $300 at 8%. There are currently 900 shares outstanding and the firm has $400 of debt at 8%. The tax rate is 50%. Use this information to answer the following questions. Selected Financial Information Vapid Motors Inc. Current Option A Option B Debt $400 $400 $700 ko 8% 8% 8% Interest $32 $32 $56 Tax Rate 50% 50% 50% Price $2.35 N/A N/A 900 734.4 600 Shares Outstanding Part 1 What is the EBIT-EPS indifference level? Round your answer to the nearest whole dollar. $ Analysts expect the Rumpel Felt Company to generate EBIT of $25 million annually in perpetuity (starting in one year). Rumpel is all equity financed and its stockholders require a return of 10%. If Rumple borrows $110 million (interest-only in perpetuity) with a cost of debt of 2%, what will the equity be worth? Assume Rumpel operates in Utopia where corporate taxes are zero. $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts