Question: Variable and Absorption Costing During its first year. Walnut, Inc., showed an $18 per-unit profit under absorption costing but would have reported a total profit

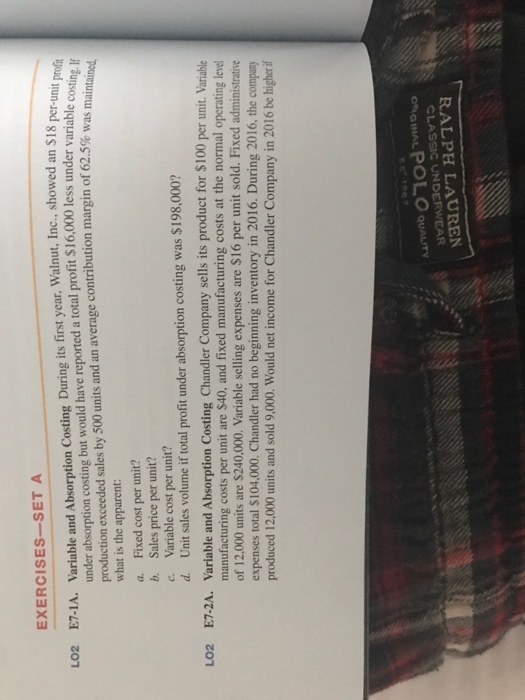

Variable and Absorption Costing During its first year. Walnut, Inc., showed an $18 per-unit profit under absorption costing but would have reported a total profit $16,000 less under variable costing. If production exceeded sales by 500 units and an average contribution margin of 62.5% was maintained, what is the apparent: a. Fixed cost per unit? b. Sales price per unit? c. Variable cost per unit? d. Unit sales volume if total profit under absorption costing was $198,000? Variable and Absorption Costing Chandler Company sells its product for $100 per unit. Variable manufacturing costs per unit are $40, and fixed manufacturing costs at the normal operating level of 12,000 units are $240,000. Variable selling expenses are $16 per unit sold. Fixed administrative expenses total $104,000. Chandler had no beginning inventory in 2016. During 2016, the company produced 12,000 units and sold 9,000. Would net income for Chandler Company in 2016 be higher if

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts