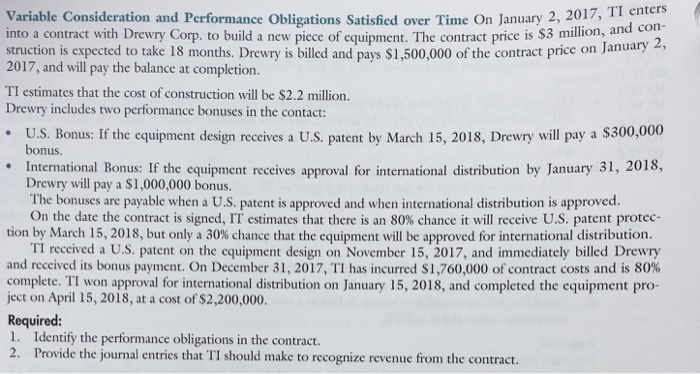

Question: Variable Consideration and Performance Obligations Satisfied over Time On January 2, 201 into a contract with Drewry Corp. to build a new piece of equipment.

Variable Consideration and Performance Obligations Satisfied over Time On January 2, 201 into a contract with Drewry Corp. to build a new piece of equipment. The contract price is $3 million, and c struction is expected to take 18 months. Drewry is billed and pays $1,500,000 of the contract price on January 2017, and will pay the balance at completion. TI estimates that the cost of construction will be $2.2 million. Drewry includes two performance bonuses in the contact: and con U.S. Bonus: If the equipment design receives a U.S patent by March 15, 2018, Drewr y will pay a $300,000 bonus. International Bonus: If the equipment receives approval for international distribution by January 31, 2018, Drewry will pay a $1,000,000 bonus. The bonuses are payable when a U.S. patent is approved and when international distribution is approved. On the date the contract is signed, IT estimates that there is an 80% chance it will receive US. patent protec- tion by March 15, 2018, but only a 30% chance that the equipment will be approved for international distribution. and received its bonus payment. On December 31, 2017, TI has incurred S 1,760,000 of contract costs and is 80% ject on April 15, 2018, at a cost of $2,200,000. Required: TI reccived a U.S. patent on the equipment design on November 15, 2017, and immediately billed Drewry distribution on January 15, 2018, and completed the cquipment pro 1. Identify the performance obligations in the contract. ide the journal entries that TI should make to recognize revenue from the contract

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts