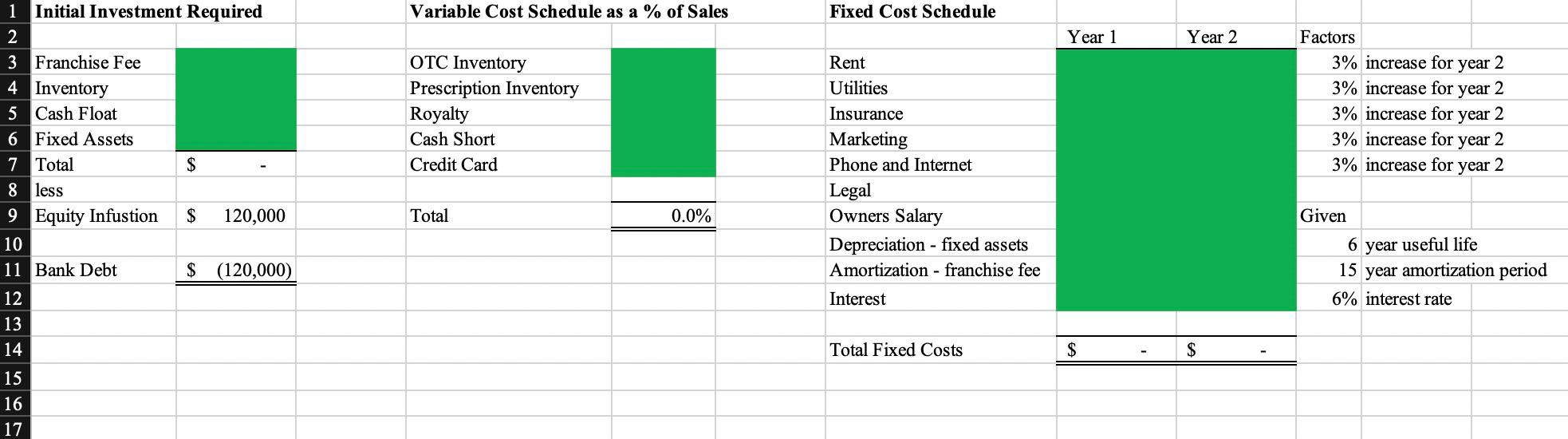

Question: Variable Cost Schedule as a % of Sales Fixed Cost Schedule Year 1 Year 2 1 Initial Investment Required 2 3 Franchise Fee 4 Inventory

Variable Cost Schedule as a % of Sales Fixed Cost Schedule Year 1 Year 2 1 Initial Investment Required 2 3 Franchise Fee 4 Inventory 5 Cash Float 6 Fixed Assets 7 Total $ 8 less 9 Equity Infustion $ 120,000 10 11 Bank Debt $ (120,000) OTC Inventory Prescription Inventory Royalty Cash Short Credit Card Factors 3% increase for year 2 3% increase for year 2 3% increase for year 2 3% increase for year 2 3% increase for year 2 Rent Utilities Insurance Marketing Phone and Internet Legal Owners Salary Depreciation - fixed assets Amortization - franchise fee $ Total 0.0% Given 6 year useful life 15 year amortization period 6% interest rate Interest 12 13 14 Total Fixed Costs $ $ 15 16 17 FARMACY INC.: HARBOURFRONT GUARDMEDICS PHARMACY Karim Mashnuk wrote this case under the supervision of Elizabeth M.A. Grasby solely to provide material for class discussion. The authors do not intend to illustrate either effective or ineffective handling of a managerial situation. The authors may have disguised certain names and other identifying information to protect confidentiality. This publication may not be transmitted, photocopied, digitized or otherwise reproduced in any form or by any means without the permission of the copyright holder. Reproduction of this material is not covered under authorization by any reproduction rights organization. To order copies or request permission to reproduce materials, contact Ivey Publishing, Ivey Business School, Western University, London, Ontario, Canada, N6G ON1; (t) 519.661.3208; (e) cases@ivey.ca; www.iveycases.com. Copyright 2013, Richard Ivey School of Business Foundation Version: 2014-04-29 Moira Lafort, entrepreneur and owner of Farmacy Inc., was investigating opening a GuardMedics franchise in Toronto, Ontario, Canada. In the summer of 2012, Lafort had spoken to Luke Amrit, the franchiser, about the financial investment required and the return that she could expect from her investment. In an effort to accurately estimate projected revenues and expenses, Lafort had also spoken with other friends who currently owned a GuardMedics or another brand-name pharmacy in the vicinity. Lafort wanted to project the cash flow and profitability of opening the franchise before deciding on whether to purchase the franchise. Authorized for use only by Sagar Sagar in BUS-2010 at University of Winnipeg from 1/10/2022 to 4/6/2022. Use outside these parameters is a copyright violation. THE PHARMACY INDUSTRY (IN ONTARIO) The pharmacy industry in Ontario was a very large and saturated industry containing two main types of businesses. The first was the pharmaceutical companies. These were businesses such as GlaxoSmithKline Inc., AstraZeneca and Novo Nordisk, companies that primarily manufactured and distributed their various medications. The second type of business in the industry was the pharmacies themselves. A few major players, including Shoppers Drug Mart and Rexall Pharmacy, dominated this side of the industry, which was responsible for the retail side of the business. These retail stores provided the public with basic over- the-counter (OTC) medical needs (e.g., medications like Advil) and with prescription medications written by their doctors. Pharmacies were very heavily regulated by the government, and, as such, standard business practices applied to each pharmacy. MOIRA LAFORT Moira Lafort was a 50-year-old mother of two who had worked in the pharmaceutical industry her entire adult life. Having received her bachelor of pharmacy degree in 1989, she chose to begin her career in the corporate world. Her first job was at a major pharmaceutical firm, where she spent 10 years furthering her career goals. After 10 years, she moved to another major firm in a managerial capacity. By 2008, Lafort grew tired of the corporate world and decided to work as a pharmacist. In order to do so, she first had to pass her Ontario pharmacy exams. Having successfully completed her exams by mid-2009, she created and incorporated Farmacy Inc. for the sole purpose of offering her services as a relief pharmacist Page 2 9B13B010 throughout Southwestern Ontario. By 2012, and after speaking with friends, Lafort had decided that she wanted to own and operate her own pharmacy. She believed she would be capable of doing so due to her extensive experience in the industry. GUARDMEDICS FRANCHISE Overview GuardMedics was a full-service pharmacy, offering prescription services as well as OTC products. OTC products ranged from Advil, toiletries and first aid products to candy bars and batteries. GuardMedics was a highly successful and well-known brand. To date, there was at least one GuardMedics in every neighbourhood in Canada, ranking it among the premier pharmacy brand names in the country. The prescription and OTC revenue varied with each franchise; however, the overwhelming opinion was that a pharmacy could be a highly successful and profitable venture. Investment Details Amrit listed all the investments required to open Lafort's GuardMedics franchise. The first would be a franchise fee of $300,000 to be paid on the first day of operations. Lafort would also need to make a $210,000 investment in various fixed assets for the business. An ongoing inventory of prescription and OTC goods would also have to be maintained in order to meet minimum operational levels. This inventory would amount to $60,000. Amrit recommended that Lafort keep an additional $7,000 cash float to meet any short-term emergency needs for cash. Authorized for use only by Sagar Sagar in BUS-2010 at University of Winnipeg from 1/10/2022 to 4/6/2022. Use outside these parameters is a copyright violation THE HARBOURFRONT PHARMACY Location The 4,800-square-foot space available to Lafort was located on the lakeshore in Toronto. Lafort could rent the main floor building space for $25 per square foot for the first year, with a three per cent increase in the price per square foot in every successive year. The lease would be signed for a 10-year period. No rental deposit would be required, and payment would be due at the beginning of each month. Projected Sales If Lafort decided to go ahead with the venture, she planned to begin operations on September 1, 2012. A pharmacy's sales revenue was generated primarily from three sources. The first source was revenue generated from the sale of all OTC goods. Based on historical numbers of pharmacies of similar size in the surrounding area, OTC sales were projected to be $1.2 million in the first year of operations. The second source of revenue was generated from dispensing fees on all prescriptions. The current prescription dispensing fee was $4.66 per prescription per customer, (i.e., if a customer had six prescriptions to fill at once, the customer would be charged $27.96). Lafort estimated that there would be 4,500 prescriptions in The fee was amortized over 15 years. 2 The fixed assets were depreciated using the straight line method over six years with no residual value. Cash put into the register to maintain sufficient cash needs for operations. Page 3 9B13B010 the first year of operations. The third source of revenue was from prescription sales. Lafort estimated these to be $1 million in the first year of operations. For the second year of operations, Lafort projected a 3 per cent increase in OTC revenue, an increase to 5,200 prescriptions and a 5 per cent increase in prescription sales. While prescription sales and dispensary fees were split equally over the 12-month period, OTC sales were seasonal. Twenty-five per cent of all OTC sales would be made in each of June and July. Fifteen per cent of all OTC sales would be made in each of May and August. The remaining 20 per cent of sales would be split equally amongst the remaining months of the year. Sales to customers were paid with cash, debit cards or credit cards. Any sales made with credit cards (such as Visa and MasterCard) would be treated like a cash sale since the credit card drafts could be deposited directly into the company's bank account. The credit card fee was estimated at 2.3 per cent of total sales. All OTC sales and dispensary fees would be collected immediately; however, from previous experience, and after talking to her colleagues, Lafort deduced that prescription collections would be received from various insurance companies (many customers' prescription costs, or a portion of the prescription costs, were covered under an employee benefit plan or a personal benefit plan) approximately one month after the store's sales. Projected Costs All OTC product costs would average 30 per cent of total sales, and all prescription inventory costs would average 37 per cent of total sales. These costs included the cost of the product, labour costs and cleaning costs for the store. In addition, franchise owners were required to pay a royalty fee of 1.5 per cent of sales to GuardMedics and to budget for a cash short of 0.5 per cent of sales. Authorized for use only by Sagar Sagar in BUS-2010 at University of Winnipeg from 1/10/2022 to 4/6/2022 Use outside these parameters is a copyright violation While unable to provide exact costs of the business, Amrit did provide Lafort with some direction. Amrit knew that other franchise owners experienced utility costs of around 80 per cent of their annual rent. Utilities would be paid in two lump sums during the months of September and March. Due to the nature of the business, insurance costs would be quite high, at $48,000 in the first year with a three per cent increase in the second year of operations. Insurance was due in September, and legal fees would be due in October. Marketing costs and phone and Internet expenses were estimated at $8,000 and $1,320, respectively, each with a three per cent increase in the second year of operations. Marketing would occur evenly throughout the year and would be paid in the month after the expense was incurred. Phone and Internet expenses were expected to be incurred evenly throughout the year. At an additional cost of $5,100 per year, Lafort would continue to use her current legal-services firm for all activities relating to the GuardMedics franchise. Income taxes were calculated at 25 per cent of net income before tax, payable six months after the end of the fiscal year. Under the agreement outlined by Amrit, Lafort, as manager and owner, would be able to pay herself a $60,000 salary in the first year of operations and a $70,000 salary in the second year. Salary payments would be made monthly, on the last day of each month. In addition, Lafort could pay out all cash in excess of the $7,000 float as a dividend. The dividend would be declared on the last day of the year's annual operations, to be paid on the first day of the following fiscal year. If she wanted to, Lafort could also give employees raises in the second year. Amount by which cash was short due to incorrect change being returned to customers and due to unexplained circumstances. Page 4 9B13B010 FINANCING Since Lafort had only $120,000 of her own money to invest in the pharmacy, she was going to need additional financing. She hoped to obtain a bank loan to supplement the balance of the financing requirements. Lafort believed this would be the major hurdle to starting her business, and she wondered whether the bank would approve her request for the loan. For her projections, Lafort decided to calculate interest, estimated at a rate of prime plus three per cent, on the opening balance of the bank loan each year. All funds would be borrowed as of September 1, 2012, and the projected annual interest payments would be made in equal amounts on a monthly basis. Lafort hoped to pay off $150,000 of the bank loan at the end of the year in each of the first and second years of operations. If the bank rejected her loan request, Lafort wondered what other sources of financing might be available to her. SUMMARY Lafort sat down to project a cash budget, income statement, and statement of financial position for the first two years of operations, based on her assumptions and estimates. After projecting the statements, Lafort would analyze the results and assess the risk of the venture, based on her return on investment and the margin of safety. Once these projections were completed, Lafort believed that she would have enough information to comfortably make a decision from a financial point of view. Authorized for use only by Sagar Sagar in BUS-2010 at University of Winnipeg from 1/10/2022 to 4/6/2022. Use outside these parameters is a copyright violation Variable Cost Schedule as a % of Sales Fixed Cost Schedule Year 1 Year 2 1 Initial Investment Required 2 3 Franchise Fee 4 Inventory 5 Cash Float 6 Fixed Assets 7 Total $ 8 less 9 Equity Infustion $ 120,000 10 11 Bank Debt $ (120,000) OTC Inventory Prescription Inventory Royalty Cash Short Credit Card Factors 3% increase for year 2 3% increase for year 2 3% increase for year 2 3% increase for year 2 3% increase for year 2 Rent Utilities Insurance Marketing Phone and Internet Legal Owners Salary Depreciation - fixed assets Amortization - franchise fee $ Total 0.0% Given 6 year useful life 15 year amortization period 6% interest rate Interest 12 13 14 Total Fixed Costs $ $ 15 16 17 FARMACY INC.: HARBOURFRONT GUARDMEDICS PHARMACY Karim Mashnuk wrote this case under the supervision of Elizabeth M.A. Grasby solely to provide material for class discussion. The authors do not intend to illustrate either effective or ineffective handling of a managerial situation. The authors may have disguised certain names and other identifying information to protect confidentiality. This publication may not be transmitted, photocopied, digitized or otherwise reproduced in any form or by any means without the permission of the copyright holder. Reproduction of this material is not covered under authorization by any reproduction rights organization. To order copies or request permission to reproduce materials, contact Ivey Publishing, Ivey Business School, Western University, London, Ontario, Canada, N6G ON1; (t) 519.661.3208; (e) cases@ivey.ca; www.iveycases.com. Copyright 2013, Richard Ivey School of Business Foundation Version: 2014-04-29 Moira Lafort, entrepreneur and owner of Farmacy Inc., was investigating opening a GuardMedics franchise in Toronto, Ontario, Canada. In the summer of 2012, Lafort had spoken to Luke Amrit, the franchiser, about the financial investment required and the return that she could expect from her investment. In an effort to accurately estimate projected revenues and expenses, Lafort had also spoken with other friends who currently owned a GuardMedics or another brand-name pharmacy in the vicinity. Lafort wanted to project the cash flow and profitability of opening the franchise before deciding on whether to purchase the franchise. Authorized for use only by Sagar Sagar in BUS-2010 at University of Winnipeg from 1/10/2022 to 4/6/2022. Use outside these parameters is a copyright violation. THE PHARMACY INDUSTRY (IN ONTARIO) The pharmacy industry in Ontario was a very large and saturated industry containing two main types of businesses. The first was the pharmaceutical companies. These were businesses such as GlaxoSmithKline Inc., AstraZeneca and Novo Nordisk, companies that primarily manufactured and distributed their various medications. The second type of business in the industry was the pharmacies themselves. A few major players, including Shoppers Drug Mart and Rexall Pharmacy, dominated this side of the industry, which was responsible for the retail side of the business. These retail stores provided the public with basic over- the-counter (OTC) medical needs (e.g., medications like Advil) and with prescription medications written by their doctors. Pharmacies were very heavily regulated by the government, and, as such, standard business practices applied to each pharmacy. MOIRA LAFORT Moira Lafort was a 50-year-old mother of two who had worked in the pharmaceutical industry her entire adult life. Having received her bachelor of pharmacy degree in 1989, she chose to begin her career in the corporate world. Her first job was at a major pharmaceutical firm, where she spent 10 years furthering her career goals. After 10 years, she moved to another major firm in a managerial capacity. By 2008, Lafort grew tired of the corporate world and decided to work as a pharmacist. In order to do so, she first had to pass her Ontario pharmacy exams. Having successfully completed her exams by mid-2009, she created and incorporated Farmacy Inc. for the sole purpose of offering her services as a relief pharmacist Page 2 9B13B010 throughout Southwestern Ontario. By 2012, and after speaking with friends, Lafort had decided that she wanted to own and operate her own pharmacy. She believed she would be capable of doing so due to her extensive experience in the industry. GUARDMEDICS FRANCHISE Overview GuardMedics was a full-service pharmacy, offering prescription services as well as OTC products. OTC products ranged from Advil, toiletries and first aid products to candy bars and batteries. GuardMedics was a highly successful and well-known brand. To date, there was at least one GuardMedics in every neighbourhood in Canada, ranking it among the premier pharmacy brand names in the country. The prescription and OTC revenue varied with each franchise; however, the overwhelming opinion was that a pharmacy could be a highly successful and profitable venture. Investment Details Amrit listed all the investments required to open Lafort's GuardMedics franchise. The first would be a franchise fee of $300,000 to be paid on the first day of operations. Lafort would also need to make a $210,000 investment in various fixed assets for the business. An ongoing inventory of prescription and OTC goods would also have to be maintained in order to meet minimum operational levels. This inventory would amount to $60,000. Amrit recommended that Lafort keep an additional $7,000 cash float to meet any short-term emergency needs for cash. Authorized for use only by Sagar Sagar in BUS-2010 at University of Winnipeg from 1/10/2022 to 4/6/2022. Use outside these parameters is a copyright violation THE HARBOURFRONT PHARMACY Location The 4,800-square-foot space available to Lafort was located on the lakeshore in Toronto. Lafort could rent the main floor building space for $25 per square foot for the first year, with a three per cent increase in the price per square foot in every successive year. The lease would be signed for a 10-year period. No rental deposit would be required, and payment would be due at the beginning of each month. Projected Sales If Lafort decided to go ahead with the venture, she planned to begin operations on September 1, 2012. A pharmacy's sales revenue was generated primarily from three sources. The first source was revenue generated from the sale of all OTC goods. Based on historical numbers of pharmacies of similar size in the surrounding area, OTC sales were projected to be $1.2 million in the first year of operations. The second source of revenue was generated from dispensing fees on all prescriptions. The current prescription dispensing fee was $4.66 per prescription per customer, (i.e., if a customer had six prescriptions to fill at once, the customer would be charged $27.96). Lafort estimated that there would be 4,500 prescriptions in The fee was amortized over 15 years. 2 The fixed assets were depreciated using the straight line method over six years with no residual value. Cash put into the register to maintain sufficient cash needs for operations. Page 3 9B13B010 the first year of operations. The third source of revenue was from prescription sales. Lafort estimated these to be $1 million in the first year of operations. For the second year of operations, Lafort projected a 3 per cent increase in OTC revenue, an increase to 5,200 prescriptions and a 5 per cent increase in prescription sales. While prescription sales and dispensary fees were split equally over the 12-month period, OTC sales were seasonal. Twenty-five per cent of all OTC sales would be made in each of June and July. Fifteen per cent of all OTC sales would be made in each of May and August. The remaining 20 per cent of sales would be split equally amongst the remaining months of the year. Sales to customers were paid with cash, debit cards or credit cards. Any sales made with credit cards (such as Visa and MasterCard) would be treated like a cash sale since the credit card drafts could be deposited directly into the company's bank account. The credit card fee was estimated at 2.3 per cent of total sales. All OTC sales and dispensary fees would be collected immediately; however, from previous experience, and after talking to her colleagues, Lafort deduced that prescription collections would be received from various insurance companies (many customers' prescription costs, or a portion of the prescription costs, were covered under an employee benefit plan or a personal benefit plan) approximately one month after the store's sales. Projected Costs All OTC product costs would average 30 per cent of total sales, and all prescription inventory costs would average 37 per cent of total sales. These costs included the cost of the product, labour costs and cleaning costs for the store. In addition, franchise owners were required to pay a royalty fee of 1.5 per cent of sales to GuardMedics and to budget for a cash short of 0.5 per cent of sales. Authorized for use only by Sagar Sagar in BUS-2010 at University of Winnipeg from 1/10/2022 to 4/6/2022 Use outside these parameters is a copyright violation While unable to provide exact costs of the business, Amrit did provide Lafort with some direction. Amrit knew that other franchise owners experienced utility costs of around 80 per cent of their annual rent. Utilities would be paid in two lump sums during the months of September and March. Due to the nature of the business, insurance costs would be quite high, at $48,000 in the first year with a three per cent increase in the second year of operations. Insurance was due in September, and legal fees would be due in October. Marketing costs and phone and Internet expenses were estimated at $8,000 and $1,320, respectively, each with a three per cent increase in the second year of operations. Marketing would occur evenly throughout the year and would be paid in the month after the expense was incurred. Phone and Internet expenses were expected to be incurred evenly throughout the year. At an additional cost of $5,100 per year, Lafort would continue to use her current legal-services firm for all activities relating to the GuardMedics franchise. Income taxes were calculated at 25 per cent of net income before tax, payable six months after the end of the fiscal year. Under the agreement outlined by Amrit, Lafort, as manager and owner, would be able to pay herself a $60,000 salary in the first year of operations and a $70,000 salary in the second year. Salary payments would be made monthly, on the last day of each month. In addition, Lafort could pay out all cash in excess of the $7,000 float as a dividend. The dividend would be declared on the last day of the year's annual operations, to be paid on the first day of the following fiscal year. If she wanted to, Lafort could also give employees raises in the second year. Amount by which cash was short due to incorrect change being returned to customers and due to unexplained circumstances. Page 4 9B13B010 FINANCING Since Lafort had only $120,000 of her own money to invest in the pharmacy, she was going to need additional financing. She hoped to obtain a bank loan to supplement the balance of the financing requirements. Lafort believed this would be the major hurdle to starting her business, and she wondered whether the bank would approve her request for the loan. For her projections, Lafort decided to calculate interest, estimated at a rate of prime plus three per cent, on the opening balance of the bank loan each year. All funds would be borrowed as of September 1, 2012, and the projected annual interest payments would be made in equal amounts on a monthly basis. Lafort hoped to pay off $150,000 of the bank loan at the end of the year in each of the first and second years of operations. If the bank rejected her loan request, Lafort wondered what other sources of financing might be available to her. SUMMARY Lafort sat down to project a cash budget, income statement, and statement of financial position for the first two years of operations, based on her assumptions and estimates. After projecting the statements, Lafort would analyze the results and assess the risk of the venture, based on her return on investment and the margin of safety. Once these projections were completed, Lafort believed that she would have enough information to comfortably make a decision from a financial point of view. Authorized for use only by Sagar Sagar in BUS-2010 at University of Winnipeg from 1/10/2022 to 4/6/2022. Use outside these parameters is a copyright violation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts