Question: Variable Costing Income Statement On July 31, 2016, the end of the first month of operations, Rhys Company prepared the following income statement, based on

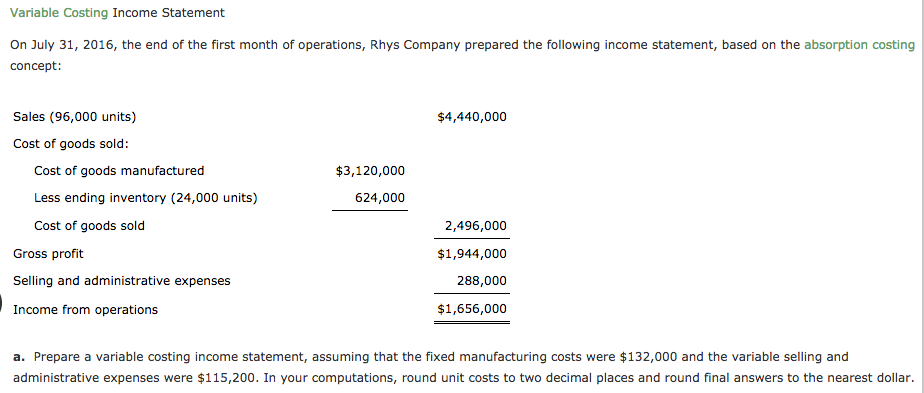

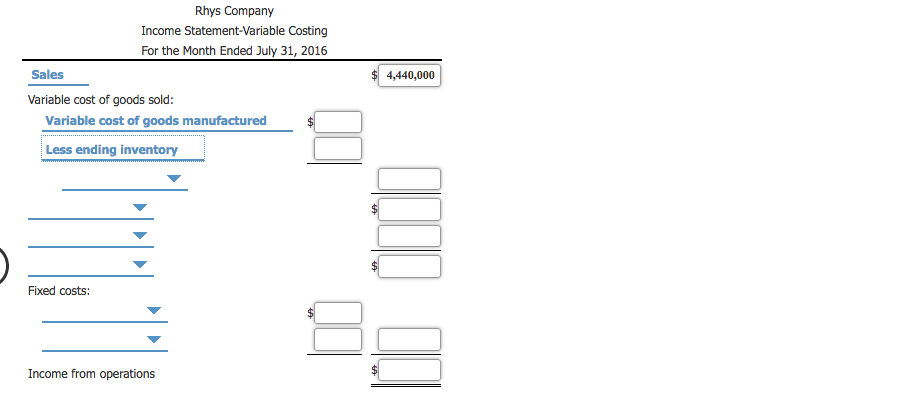

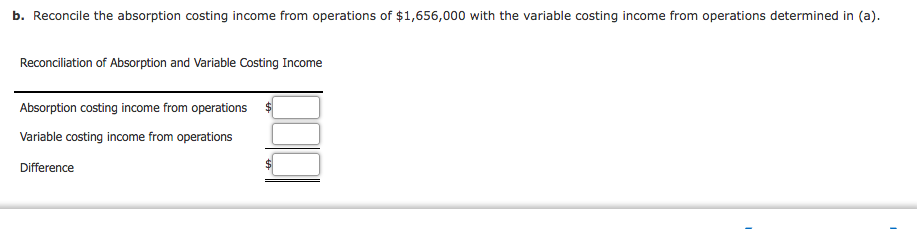

Variable Costing Income Statement On July 31, 2016, the end of the first month of operations, Rhys Company prepared the following income statement, based on the absorption costing concept: Sales (96,000 units) $4,440,000 Cost of goods sold: Cost of goods manufactured $3,120,000 Less ending inventory (24,000 units) 624,000 Cost of goods sold 2,496,000 Gross profit $1,944,000 Selling and administrative expenses 288,000 Income from operations $1,656,000 a. Prepare a variable costing income statement, assuming that the fixed manufacturing costs were $132,0000 and the variable selling and administrative expenses were $115,200. In your computations, round unit costs to two decimal places and round final answers to the nearest dollar. Rhys Company Income Statement-Variable Costing For the Month Ended July 31, 2016 Sales $4,440,000 Variable cost of goods sold: Variable cost of goods manufactured Less ending inventory Fixed costs: Income from operations b. Reconcile the absorption costing income from operations of $1,656,000 with the variable costing income from operations determined in (a) Reconciliation of Absorption and Variable Costing Income Absorption costing income from operations Variable costing income from operations Difference

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts