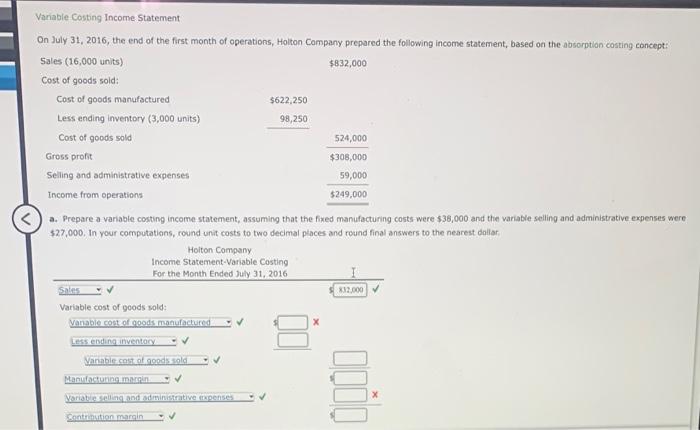

Question: variable costing income statement Variable Costing Income Statement On July 31, 2016, the end of the first month of operations, Holton Company prepared the following

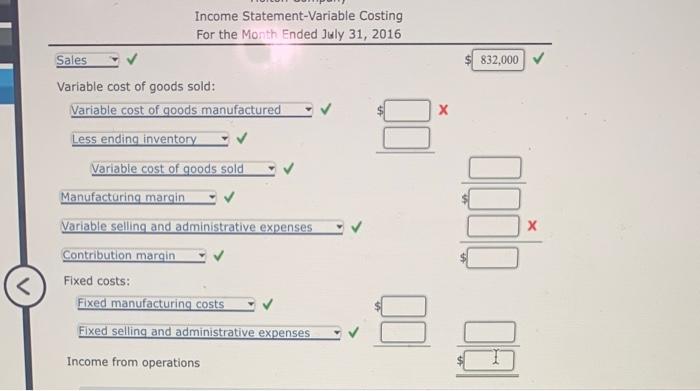

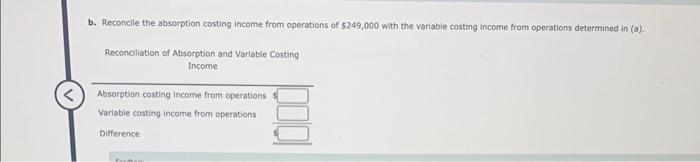

Variable Costing Income Statement On July 31, 2016, the end of the first month of operations, Holton Company prepared the following income statement, based on the absorptian costing concept: a. Prepare a variable costing income statement, assuming that the fixed manufacturing costs were $36,000 and the variable selling and administrative expenses were $27,000, In your computations, round unit costs to two decimal places and round final answers to the nearest doilar. Income Statement-Variable Costing For the Month Ended July 31, 2016 Sales r Variable cost of goods sold: Variable cost of goods manufactured X Less ending inventory Variable cost of goods sold Manufactaring margin Variable selling and administrative expenses X Contribution marqin Fixed costs: Fixed manufacturing costs Fixed selling and administrative expenses Income from operations Reconcile the absorption costing income from operations of $249,000 with the variable costing income from operations determined in (a): Reconciliation of Absorption and Variable Costing Income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts