Question: Variable Costing Using Excel for Variable Costing Tiger Mountain Gelato incurs the following costs for its premium ice cream in May 2018: Direct materials cost

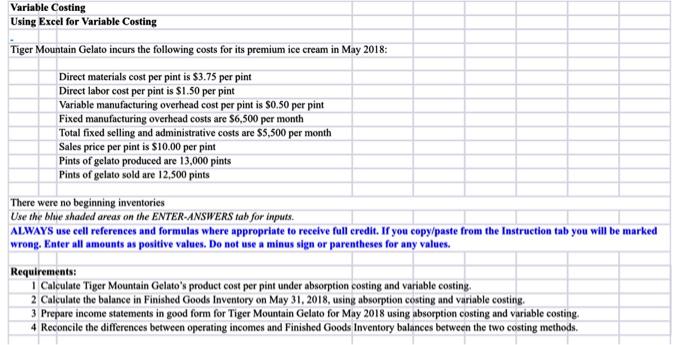

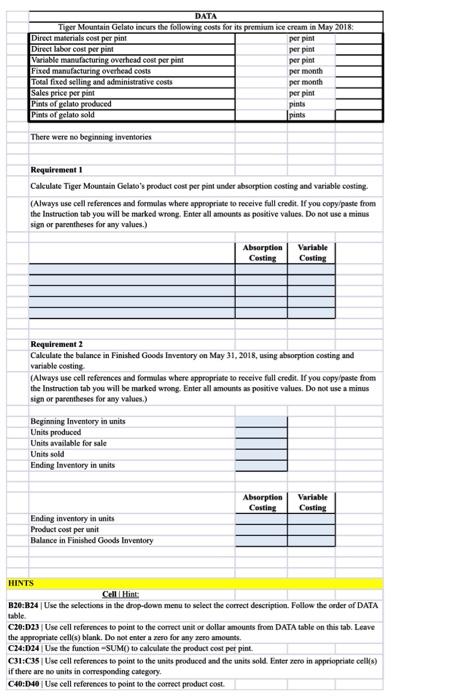

Variable Costing Using Excel for Variable Costing Tiger Mountain Gelato incurs the following costs for its premium ice cream in May 2018: Direct materials cost per pint is $3.75 per pint Direct labor cost per pint is $1.50 per pint Variable manufacturing overhead cost per pint is $0.50 per pint Fixed manufacturing overhead costs are $6,500 per month Total fixed selling and administrative costs are $5,500 per month Sales price per pint is $10.00 per pint Pints of gelato produced are 13,000 pints Pints of gelato sold are 12,500 pints There were no beginning inventories Use the Wue shaded areas on the ENTER-ANSWERS tab for inputs. ALWAYS use cell references and formulas where appropriate to receive full credit. If you copy/paste from the Instruction tab you will be marked wrong. Enter all amounts as positive values. Do not use a minus sign or parentheses for any values. Requirements: 1 Calculate Tiger Mountain Gelato's product cost per pint under absorption costing and variable costing 2 Calculate the balance in Finished Goods Inventory on May 31, 2018, using absorption costing and variable costing. 3 Prepare income statements in good form for Tiger Mountain Gelato for May 2018 using absorption costing and variable costing, 4 Reconcile the differences between operating incomes and Finished Goods Inventory balances between the two costing methods DATA Tiger Mountain Gelato incurs the following costs for its premium ice cream in May 2018: Direct materials cost per pint por pint Direet labor cost per pint per pint Variable manufacturing overhead cost per pint per pint Fixed manufacturing overhead costs per month Total fixed selling and administrative costs per month Sales price per pint per pint Pints of gelato produced pints Pints of gelato sold pints There were no beginning inventories Requirement Calculate Tiger Mountain Gelato's product cost per pint under absorptice costing and variable costing. (Always use cell references and formulas where appropriate to receive full credit. If you copy paste from the Instruction tab you will be marked wrong. Enter all amounts as positive values. Do not use a minus signor parentheses for any values.) Absorption Costing Variable Costing Requirement 2 Calculate the balance in Finished Goods Inventory on May 31, 2018, using absorption costing and variable costing (Always use cell references and formulas where appropriate to receive full credit. If you copy paste from the Instruction tab you will be marked wrong. Enter all amounts as positive values. Do not use a minus sign or parentheses for any values.) Beginning Inventory in units Units produced Units available for sale Units sold Ending Inventory in units Absorption Casting Variable Casting Ending inventory in units Product cost per unit Balance in Finished Goods Inventory HINTS Call Hint B20:324 Use the selections in the drop-down menu to select the correct description. Follow the order of DATA table C20:D23 Use cell references to point to the correct unit or dollar amounts from DATA table on this tab. Leave the appropriate cell(s) blank. Do not enter a zero for any zero amounts. C24:D24 Use the function -SUM) to calculate the product cost per pint. C31:C35 Use cell references to point to the units produced and the units sold. Enter zero in appropriate cells) if there are no units in corresponding category. C40:40 | Use cell references to point to the correct product cost Variable Costing Using Excel for Variable Costing Tiger Mountain Gelato incurs the following costs for its premium ice cream in May 2018: Direct materials cost per pint is $3.75 per pint Direct labor cost per pint is $1.50 per pint Variable manufacturing overhead cost per pint is $0.50 per pint Fixed manufacturing overhead costs are $6,500 per month Total fixed selling and administrative costs are $5,500 per month Sales price per pint is $10.00 per pint Pints of gelato produced are 13,000 pints Pints of gelato sold are 12,500 pints There were no beginning inventories Use the Wue shaded areas on the ENTER-ANSWERS tab for inputs. ALWAYS use cell references and formulas where appropriate to receive full credit. If you copy/paste from the Instruction tab you will be marked wrong. Enter all amounts as positive values. Do not use a minus sign or parentheses for any values. Requirements: 1 Calculate Tiger Mountain Gelato's product cost per pint under absorption costing and variable costing 2 Calculate the balance in Finished Goods Inventory on May 31, 2018, using absorption costing and variable costing. 3 Prepare income statements in good form for Tiger Mountain Gelato for May 2018 using absorption costing and variable costing, 4 Reconcile the differences between operating incomes and Finished Goods Inventory balances between the two costing methods

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts