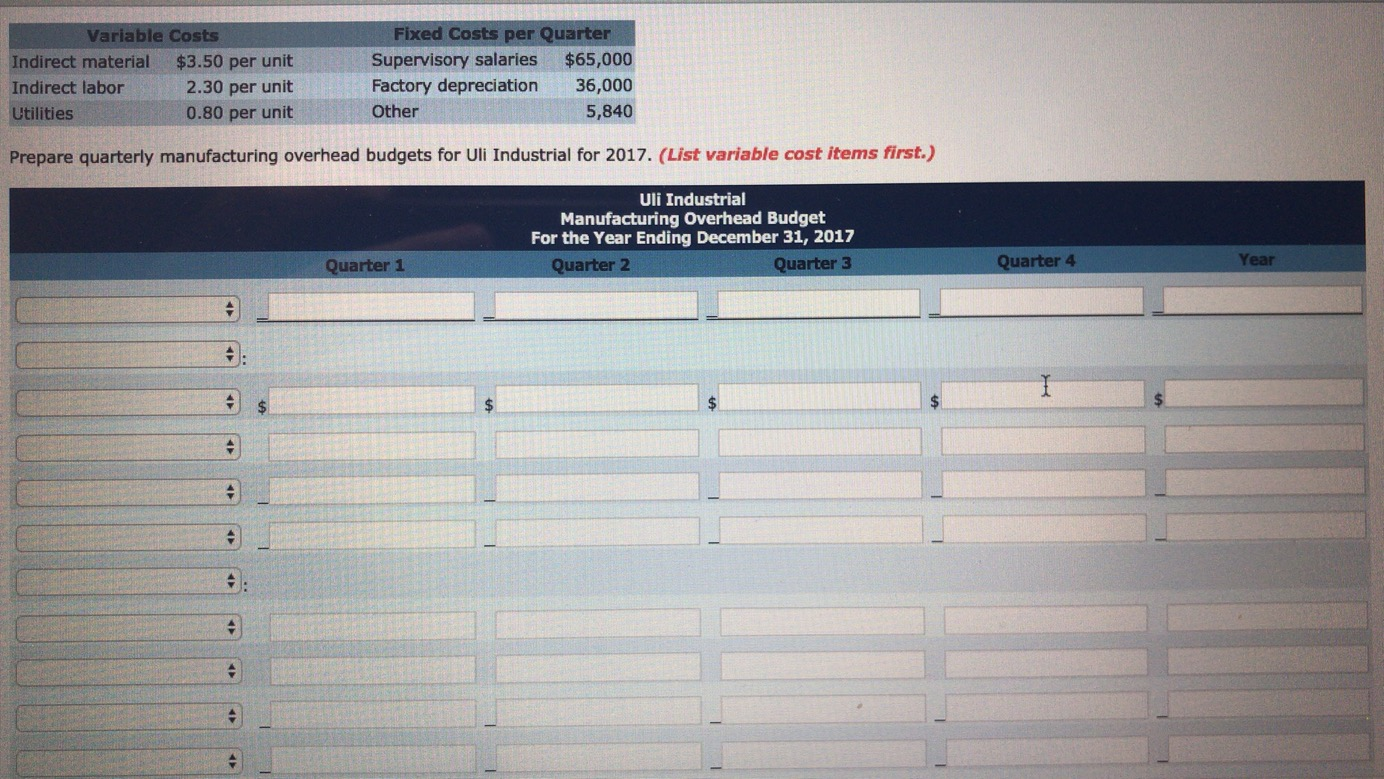

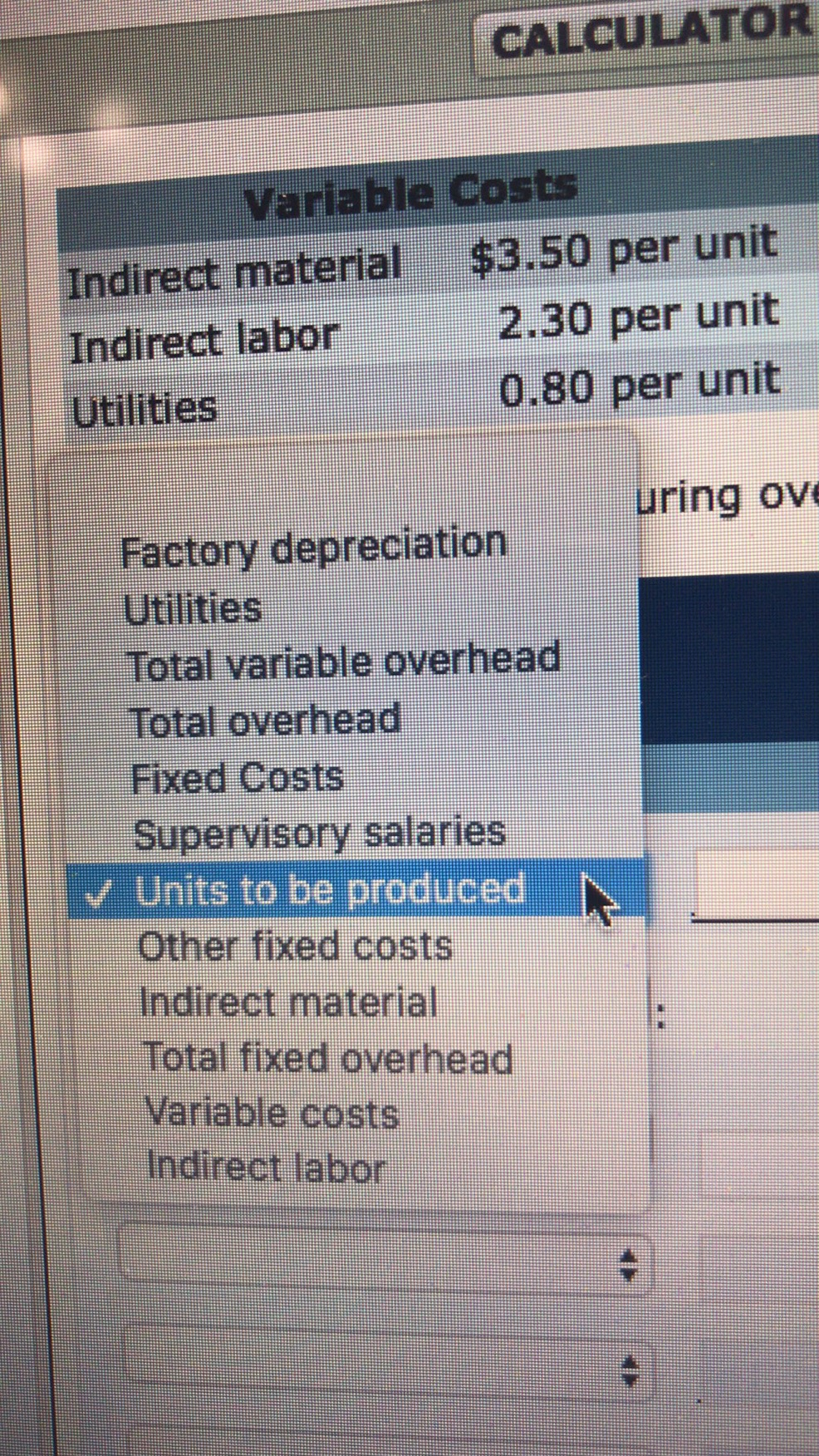

Question: Variable Costs Indirect material $3.50 per unit Indirect labor 2.30 per unit Utilities 0.80 per unit Fixed Costs per Quarter Supervisory salaries $65,000 Factory depreciation

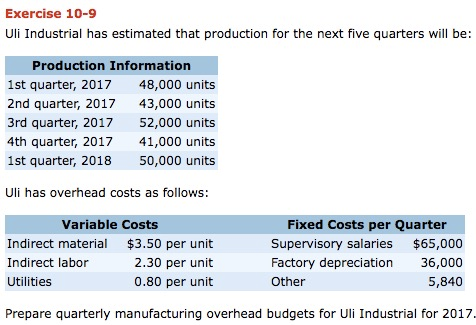

Variable Costs Indirect material $3.50 per unit Indirect labor 2.30 per unit Utilities 0.80 per unit Fixed Costs per Quarter Supervisory salaries $65,000 Factory depreciation 36,000 Other 5,840 Prepare quarterly manufacturing overhead budgets for Uli Industrial for 2017. (List variable cost items first.) Uli Industrial Manufacturing Overhead Budget For the Year Ending December 31, 2017 Quarter 2 Quarter 3 Quarter 1 Quarter 4 Year - 47) PE E B le Exercise 10-9 Uli Industrial has estimated that production for the next five quarters will be: Production Information 1st quarter, 2017 48,000 units 2nd quarter, 2017 43,000 units 3rd quarter, 2017 52,000 units 4th quarter, 2017 41,000 units 1st quarter, 2018 50,000 units Uli has overhead costs as follows: Variable Costs Indirect material $3.50 per unit Indirect labor 2.30 per unit Utilities 0.80 per unit Fixed Costs per Quarter Supervisory salaries $65,000 Factory depreciation 36,000 Other 5,840 Prepare quarterly manufacturing overhead budgets for Uli Industrial for 2017

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts