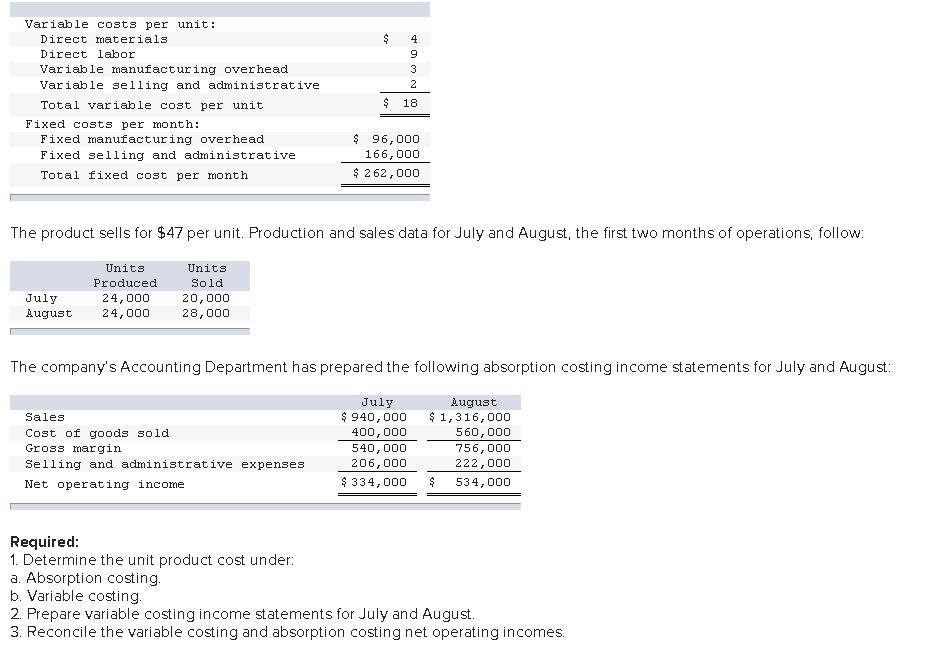

Question: Variable costs per unit: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative Total variable cost per unit Fixed costs per month:

Variable costs per unit: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative Total variable cost per unit Fixed costs per month: Fixed manufacturing overhead Fixed selling and administrative Total fixed cost per month $ 4 9 3 2 $ 18 $ 96,000 166,000 $ 262,000 The product sells for $47 per unit. Production and sales data for July and August, the first two months of operations, follow: Units Produced July 24,000 August 24,000 Units Sold 20,000 28,000 The company's Accounting Department has prepared the following absorption costing income statements for July and August: Sales Cost of goods sold Gross margin Selling and administrative expenses Net operating income July August $940,000 400,000 $ 1,316,000 560,000 540,000 756,000 206,000 222,000 $ 334,000 $ 534,000 Required: 1. Determine the unit product cost under: a. Absorption costing. b. Variable costing. 2. Prepare variable costing income statements for July and August. 3. Reconcile the variable costing and absorption costing net operating incomes.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts