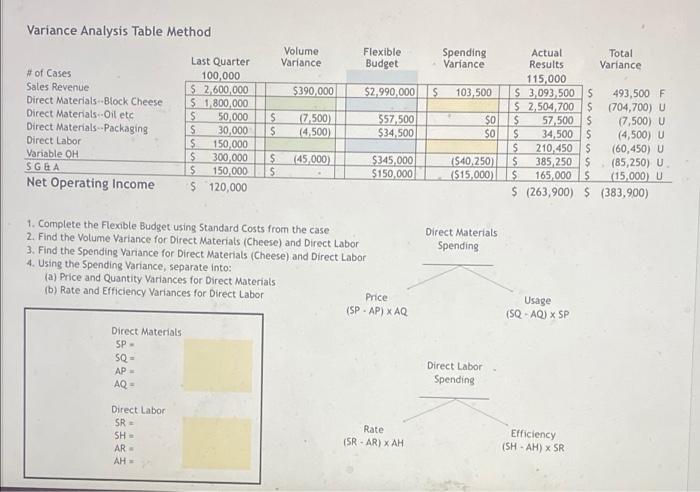

Question: Variance Analysis Table Method Volume Variance Flexible Budget Spending Variance $390,000 $2,990,000 S 103,500 # of Cases Sales Revenue Direct Materials-Block Cheese Direct Materials Oil

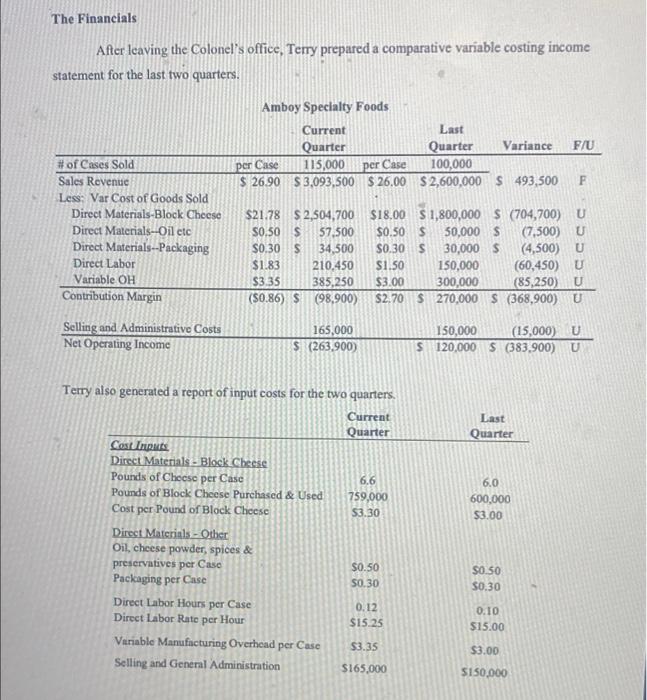

Variance Analysis Table Method Volume Variance Flexible Budget Spending Variance $390,000 $2,990,000 S 103,500 # of Cases Sales Revenue Direct Materials-Block Cheese Direct Materials Oil etc Direct Materials --Packaging Direct Labor Variable OH SGGA Net Operating Income Last Quarter 100,000 $ 2,600,000 $ 1,800,000 S 50,000 S 30,000 $ 150,000 $ 300,000 $ 150,000 $ 120,000 S $ 7.500) (4.500) $57,500 $34,500 $0 SO Actual Total Results Variance 115,000 $ 3,093,500 $ 493,500 F $ 2,504.700S (704,700) U $ 57,500S (7,500) U $ 34,500S (4,500) U $ 210,450 $ (60,450) U $ 385,250 $ (85,250) U S 165,000 s (15,000) U $ (263,900) $ (383.900) $ $ (45,000) $345.000 $150,000 $40,250) ($15,000) Direct Materials Spending 1. Complete the Flexible Budget using Standard Costs from the case 2. Find the Volume Variance for Direct Materials (Cheese) and Direct Labor 3. Find the Spending Variance for Direct Materials (Cheese) and Direct Labor 4. Using the Spending Variance, separate into: (a) Price and Quantity Variances for Direct Materials (b) Rate and Efficiency Variances for Direct Labor Price (SP.AP) XAQ Usage (SQ-AQ) X SP Direct Materials SP- SQ - AP AQ - Direct Labor Spending Direct Labor SR - SH AR AH Rate (SR - AR) XAH Efficiency (SHAH) x SR The Financials After leaving the Colonel's office. Terry prepared a comparative variable costing income statement for the last two quarters. Amboy Specialty Foods Current Last Quarter Quarter Variance 115,000 100,000 $ 26,90 S3,093,500 $26.00 $2,600,000 $493,500 F/U per Case per Case F #of Cases Sold Sales Revenue Less: Var Cost of Goods Sold Direct Materials-Block Cheese Direct Materials--Oil etc Direct Materials--Packaging Direct Labor Variable OH Contribution Margin $21.78 $ 2,504,700 S0.50 $ 57,500 $0.30 s 34,500 $1.83 210.450 $3.35 385,250 (50.86) $ (98,900) $18,00 $ 1,800,000 S (704,700) U $0.50 $ 50,000 $ (7,500) U $0.30 S 30,000 $ (4,500) U $1.50 150,000 (60,450) U $3.00 300,000 (85,250) U 52.70 S 270,000 $ (368,900) U Selling and Administrative Costs Net Operating Income 165,000 $ (263,900) 150,000 (15,000) U $ 120,000 S (383.900) U Terry also generated a report of input costs for the two quarters Current Quarter Last Quarter 6.6 759,000 $3.30 6.0 600,000 53.00 Cost Input Direct Materials - Block Cheese Pounds of Cheese per Case Pounds of Block Cheese Purchased & Used Cost per Pound of Block Cheese Direct Materials - Other Oil, cheese powder, spices & preservatives per Case Packaging per Case Direct Labor Hours per Case Direct Labor Rate per Hour Variable Manufacturing Overhead per Case Selling and General Administration $0.50 50.30 $0.50 50.30 0.12 $15.25 0.10 $15.00 $3.35 $3.00 $165,000 S150.000 Variance Analysis Table Method Volume Variance Flexible Budget Spending Variance $390,000 $2,990,000 S 103,500 # of Cases Sales Revenue Direct Materials-Block Cheese Direct Materials Oil etc Direct Materials --Packaging Direct Labor Variable OH SGGA Net Operating Income Last Quarter 100,000 $ 2,600,000 $ 1,800,000 S 50,000 S 30,000 $ 150,000 $ 300,000 $ 150,000 $ 120,000 S $ 7.500) (4.500) $57,500 $34,500 $0 SO Actual Total Results Variance 115,000 $ 3,093,500 $ 493,500 F $ 2,504.700S (704,700) U $ 57,500S (7,500) U $ 34,500S (4,500) U $ 210,450 $ (60,450) U $ 385,250 $ (85,250) U S 165,000 s (15,000) U $ (263,900) $ (383.900) $ $ (45,000) $345.000 $150,000 $40,250) ($15,000) Direct Materials Spending 1. Complete the Flexible Budget using Standard Costs from the case 2. Find the Volume Variance for Direct Materials (Cheese) and Direct Labor 3. Find the Spending Variance for Direct Materials (Cheese) and Direct Labor 4. Using the Spending Variance, separate into: (a) Price and Quantity Variances for Direct Materials (b) Rate and Efficiency Variances for Direct Labor Price (SP.AP) XAQ Usage (SQ-AQ) X SP Direct Materials SP- SQ - AP AQ - Direct Labor Spending Direct Labor SR - SH AR AH Rate (SR - AR) XAH Efficiency (SHAH) x SR The Financials After leaving the Colonel's office. Terry prepared a comparative variable costing income statement for the last two quarters. Amboy Specialty Foods Current Last Quarter Quarter Variance 115,000 100,000 $ 26,90 S3,093,500 $26.00 $2,600,000 $493,500 F/U per Case per Case F #of Cases Sold Sales Revenue Less: Var Cost of Goods Sold Direct Materials-Block Cheese Direct Materials--Oil etc Direct Materials--Packaging Direct Labor Variable OH Contribution Margin $21.78 $ 2,504,700 S0.50 $ 57,500 $0.30 s 34,500 $1.83 210.450 $3.35 385,250 (50.86) $ (98,900) $18,00 $ 1,800,000 S (704,700) U $0.50 $ 50,000 $ (7,500) U $0.30 S 30,000 $ (4,500) U $1.50 150,000 (60,450) U $3.00 300,000 (85,250) U 52.70 S 270,000 $ (368,900) U Selling and Administrative Costs Net Operating Income 165,000 $ (263,900) 150,000 (15,000) U $ 120,000 S (383.900) U Terry also generated a report of input costs for the two quarters Current Quarter Last Quarter 6.6 759,000 $3.30 6.0 600,000 53.00 Cost Input Direct Materials - Block Cheese Pounds of Cheese per Case Pounds of Block Cheese Purchased & Used Cost per Pound of Block Cheese Direct Materials - Other Oil, cheese powder, spices & preservatives per Case Packaging per Case Direct Labor Hours per Case Direct Labor Rate per Hour Variable Manufacturing Overhead per Case Selling and General Administration $0.50 50.30 $0.50 50.30 0.12 $15.25 0.10 $15.00 $3.35 $3.00 $165,000 S150.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts