Question: Vaughn Co . sels ( $ 4 4 0 , 0 0 0 ) of ( 1 2 %

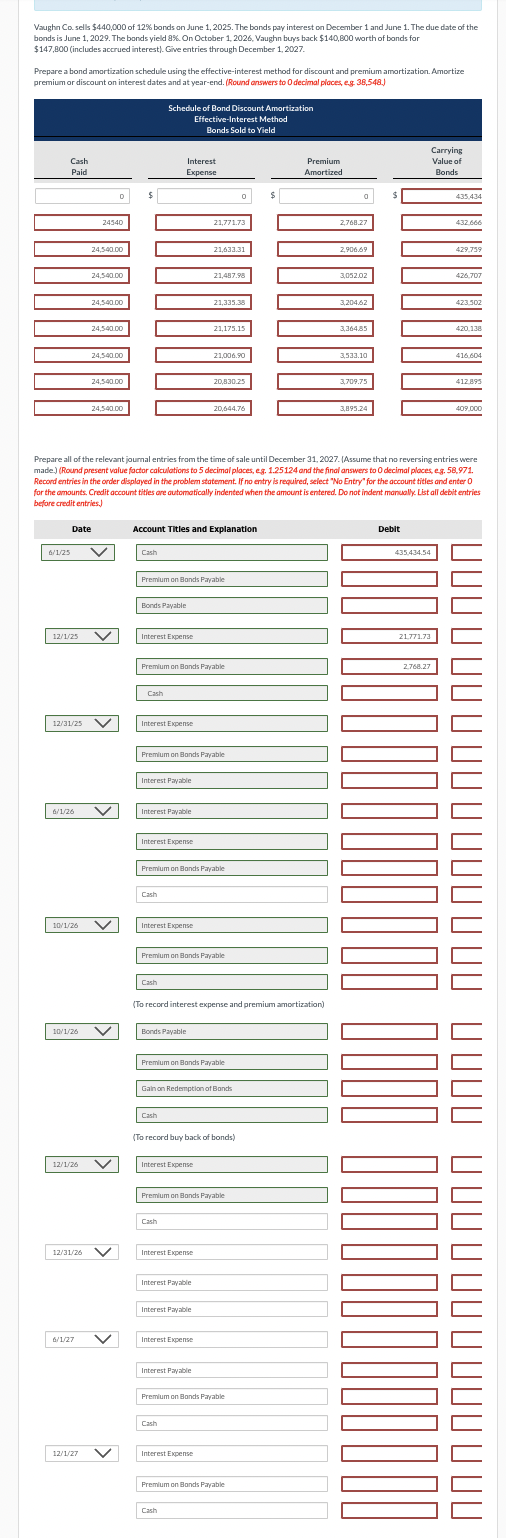

Vaughn Co sels $ of bonds on June The bonds pay interest on December and June The due date of the bonds is June The bonds yield On October Vaughn buys back $ worth of bonds for

$ includes accrued interest Give entries through December

Prepare a bond amortization schedule using the effectiveinterest method for discount and premium amortization. Amortize premium or discount on interest dates and at yearend. Round onswers to decimal ploces, eg

Prepare all of the relevant journal entries from the time of sale until December Assume that no reversing entries were madeRound present value factor calculations to decimal places, eg and the final answers to decimal ploces eg

Record entries in the order displayed in the problem statement. If no entry is required, select No Entr" for the account beginarrayltext ities ond enter endarray Record entries in the order displayed in the problem statement. If no entry is requived, select No Entry" for the account tities and enter for the amounts. Credit account tities ore outomatically indented when the amount is entered. Do not indent manually. List all debit entries re credit entries.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock