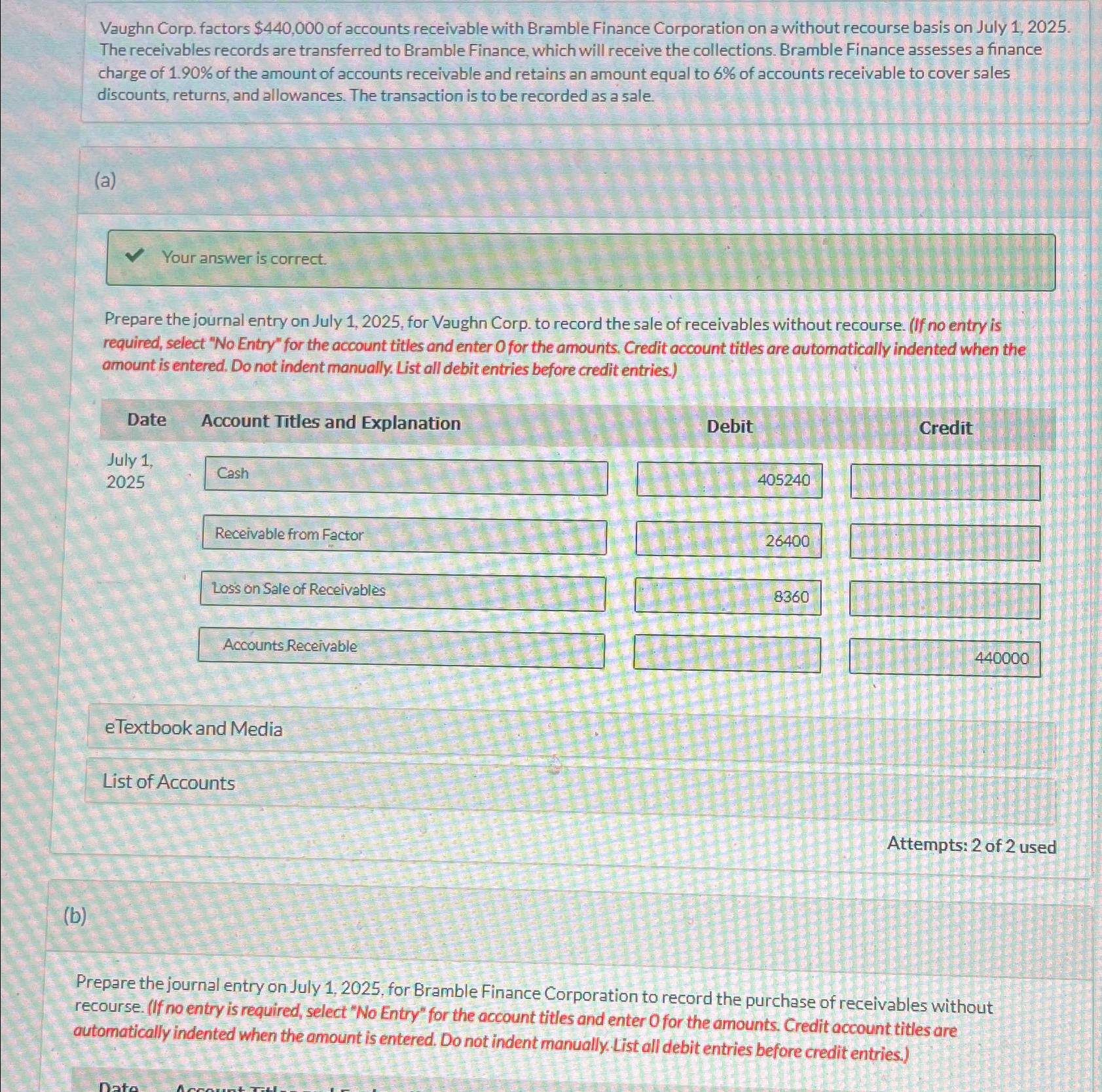

Question: Vaughn Corp. factors $ 4 4 0 , 0 0 0 of accounts receivable with Bramble Finance Corporation on a without recourse basis on July

Vaughn Corp. factors $ of accounts receivable with Bramble Finance Corporation on a without recourse basis on July The receivables records are transferred to Bramble Finance, which will receive the collections. Bramble Finance assesses a finance charge of of the amount of accounts receivable and retains an amount equal to of accounts receivable to cover sales discounts, returns, and allowances. The transaction is to be recorded as a sale.

a

Your answer is correct.

Prepare the journal entry on July for Vaughn Corp. to record the sale of receivables without recourse. If no entry is required, select No Entry" for the account titles and enter for the amounts. Credit account titles are automatically indented when the omount is entered. Do not indent manually. List all debit entries before credit entries.

Date Account Titles and Explanation

Debit

Credit

July

Cash

Receivable from Factor

Loss on Sale of Receivables

Accounts Receivable

eTextbook and Media

List of Accounts

Attempts: of used

b

Prepare the journal entry on July for Bramble Finance Corporation to record the purchase of receivables without recourse. If no entry is required, select No Entry" for the account titles and enter for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. Part b

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock