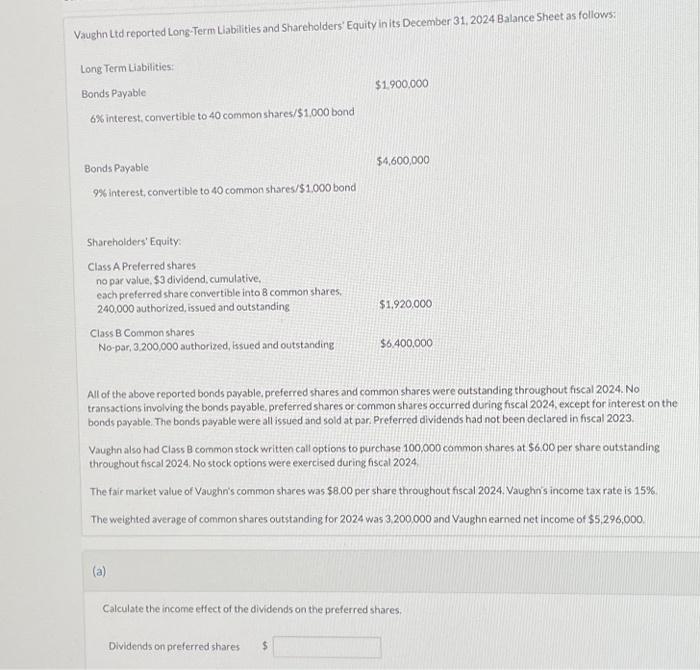

Question: Vaughn Ltd reported Long-Term Liabilities and Shareholders' Equity in its December 31.2024 Balance Sheet as follow5: Long Term Liabilities: Bonds Payable $1,900,000 6% interest, convertible

Vaughn Ltd reported Long-Term Liabilities and Shareholders' Equity in its December 31.2024 Balance Sheet as follow5: Long Term Liabilities: Bonds Payable $1,900,000 6% interest, convertible to 40 common shares/ $1,000 bond Bonds Payable $4,600,000 9% interest, convertible to 40 common shares/\$1.000 bond All of the above reported bonds payable, preferred shares and common shares were outstanding throughout fiscal 2024. No transactions involving the bonds payable. preferred shares or common shares occurred during fiscal 2024, except for interest on the bonds payable. The bonds payable were all issued and sold at par. Preferred dividends had not been declared in fiscal 2023. Vaughn also had Class B common stock written call options to purchase 100,000 common shares at $6,00 per share outstanding throughout fiscal 2024. No stock optionswere exercised during fiscal 2024 The fair market value of Vaughn's common shares was $8.00 per share throughout fiscal 2024 . Vaughn's income tax rate is 15%. The weighted average of common shares outstanding for 2024 was 3,200,000 and Vaughn earned net income of $5,296,000. (a) Calculate the income effect of the dividends on the preferred shares. Dividends on preferred shares

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts