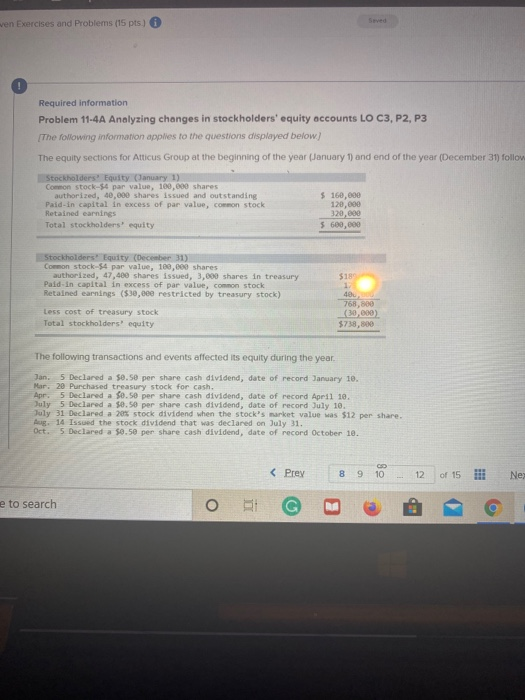

Question: ven Exercises and Problems (15 pts.) Seved Required information Problem 11-4A Analyzing changes in stockholders' equity accounts LO C3, P2, P3 The following information applies

ven Exercises and Problems (15 pts.) Seved Required information Problem 11-4A Analyzing changes in stockholders' equity accounts LO C3, P2, P3 The following information applies to the questions displayed below) The equity sections for Atticus Group at the beginning of the year (January 1) and end of the year (December 31) follow Stockholders' Equity (January 1) Common stock-$4 par value, 100,000 shares authorized, 40,000 shares issued and outstanding $ 160,000 Paid-in capital in excess of par value, common stock 120,000 Retained earnings 320,000 Total stockholders equity $ 600,000 Stockholders' Equity (December 31) Common stock-$4 par value, 180,000 shares authorized, 47, 480 shares issued, 3,000 shares in treasury Pald-in capital in excess of par value, common stock Retained earnings ($30,eee restricted by treasury stock) $18 1 404 768,800 (30.000 $738,800 Less cost of treasury stock Total stockholders' equity The following transactions and events affected its equity during the year Jan. 5 Declared a 50.50 per share cash dividend, date of record January 10. Mar. 20 Purchased treasury stock for cash. Apr 5 Declared a $0.50 per share cash dividend, date of record April 10. July 5 Declared a 50.50 per share cash dividend, date of record July 10. July 31 Declared a 20% stock dividend when the stock's market value was $12 per share. Aug 14 Issued the stock dividend that was declared on July 31. Oct. 5 Declared a 50.50 per share cash dividend, date of record October 10.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts