Question: VERSION 2-001 Section II -Calculations (60 Points) 1. Benchmark Capital proposes to invest $30 million in RL Industries for 10 million shares of Series A

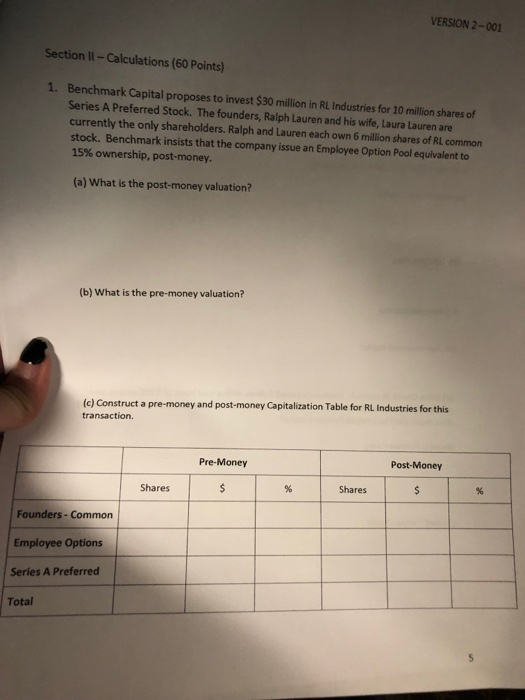

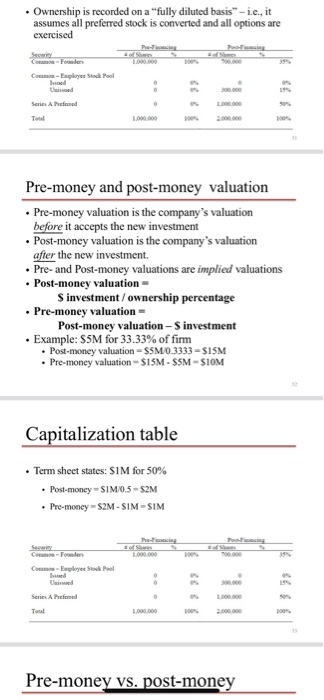

VERSION 2-001 Section II -Calculations (60 Points) 1. Benchmark Capital proposes to invest $30 million in RL Industries for 10 million shares of Series A Preferred Stock. The founders, Ralph Lauren and his wife, Laura Lauren are currently the only shareholders. Ralph and Lauren each own 6 million shares of RL commorn stock. Benchmark insists that the company issue an Employee Option Pool equivalent to 15% ownership, post-money (a) What is the post-money valuation? (b) What is the pre-money valuation? (c) Construct a pre-money and post-money Capitalization Table for RL Industries for this transaction. Pre-Money Post-Money Shares Shares Founders-Common Employee Options Series A Preferred Total . Ownership is recorded on a "fully diluted basis"-i.e., it assumes all preferred stock is converted and all options are Commos-Exployee Stock Paol Series A Preome Pre-money and post-money valuation . Pre-money valuation is the company's valuation before it accepts the new investment Post-money valuation is the company's valuation after the new investment. Pre-and Post-money valuations ane Post-money valuation S investment/ownership percentage . Pre-money valuation Post-money valuation S investment * Example: S5M for 33.33% of firm Post-money valuation SSM/0.3333 S1SM Pre-money valuation-S15M-SSM -SIOM Capitalization table * Term sheet states: Si M for 50% Post-money SIM.5-S2M Pre-money S2M-SIM-SIM Como-Engiloyee Stouk Poel Series A Total 1,000.000 Pre-money vs. post-mone

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts