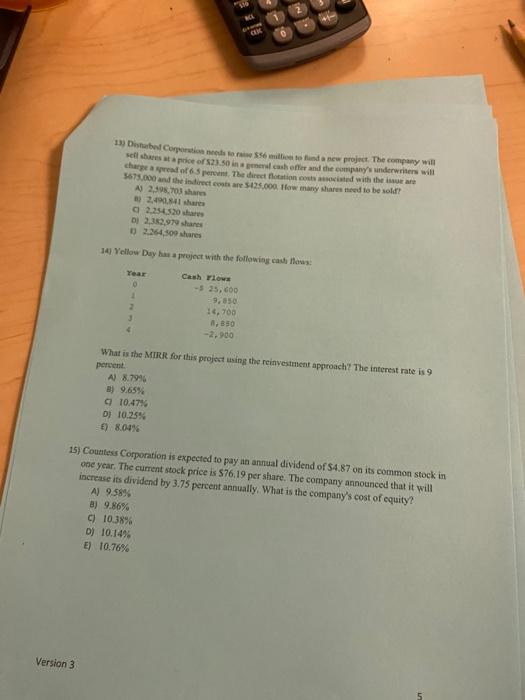

Question: Version 3 Year 0 1 2 3 4 STO RCL 13) Disturbed Corporation needs to raise $56 million to fund a new project. The company

seil shares at a noice of si2. so in a groenal casfi efler and the company's anderwriters aill chape a wpecal of 6 s pereme, Dee dicect flotation costs aboeisted with the isur ara A 2,408,709 iharen i.) 2,490.841 share (c) 2,254,520 ihatre b) 2,382,979 shares (1) 2.264,so9 shanes 14) Yeilow Dity has a froject with the following cast ilhas: What is the MIRR for this project using the reinyestaticat approach? The interest rate is 9 pertent. (A) 8.7986 B) 9.657 10.47\% D) 10.25% e) 8.047 15) Countesi Corporation is expected to pay an annual dividend of 54.87 on its common stock in ore year, The curnent stock price is 576,19 per shate. The company announced that it will increase its dividend by 3.75 percent annually. What is the company's cost of oquity? A) 958% b) 9.86% c) 10.38% D) 10,14% E) 10.76% seil shares at a noice of si2. so in a groenal casfi efler and the company's anderwriters aill chape a wpecal of 6 s pereme, Dee dicect flotation costs aboeisted with the isur ara A 2,408,709 iharen i.) 2,490.841 share (c) 2,254,520 ihatre b) 2,382,979 shares (1) 2.264,so9 shanes 14) Yeilow Dity has a froject with the following cast ilhas: What is the MIRR for this project using the reinyestaticat approach? The interest rate is 9 pertent. (A) 8.7986 B) 9.657 10.47\% D) 10.25% e) 8.047 15) Countesi Corporation is expected to pay an annual dividend of 54.87 on its common stock in ore year, The curnent stock price is 576,19 per shate. The company announced that it will increase its dividend by 3.75 percent annually. What is the company's cost of oquity? A) 958% b) 9.86% c) 10.38% D) 10,14% E) 10.76%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts