Question: Version A 11. If your required return is 17%, what price will you pay for a stock that of S4 and is expected to grow

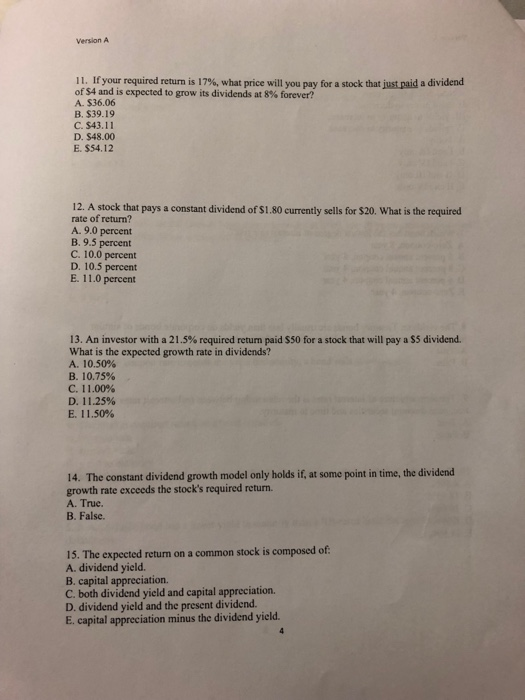

Version A 11. If your required return is 17%, what price will you pay for a stock that of S4 and is expected to grow its dividends at 8% forever? A. $36.06 B. $39.19 C. $43.11 D. $48.00 E. $54.12 stpnd a dividend 12. A stock that pays a constant dividend of $1.80 currently sells for $20. What is the required rate of return? A. 9.0 percent B. 9.5 percent C. 10.0 percent D. 10.5 percent E. 11.0 percent 13. An investor with a 2 1.5% required return paid S50 for a stock that will pay a SS dividend. What is the expected growth rate in dividends? A. 10.50% B. 10.75% C. 11.00% D. 11.25% E. 11.50% 14. The constant dividend growth model only holds if, at some point in time, the dividend growth rate exceeds the stock's required return. A. True. B. False. 15. The expected return on a common stock is composed of A. dividend yield. B. capital appreciation. C. both dividend yield and capital appreciation. D. dividend yield and the present dividend. E. capital appreciation minus the dividend yield

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts