Question: Version A 3 1 . What is this individual's average tax rate? a , 2 5 . 0 0 % b . 1 8 .

Version A

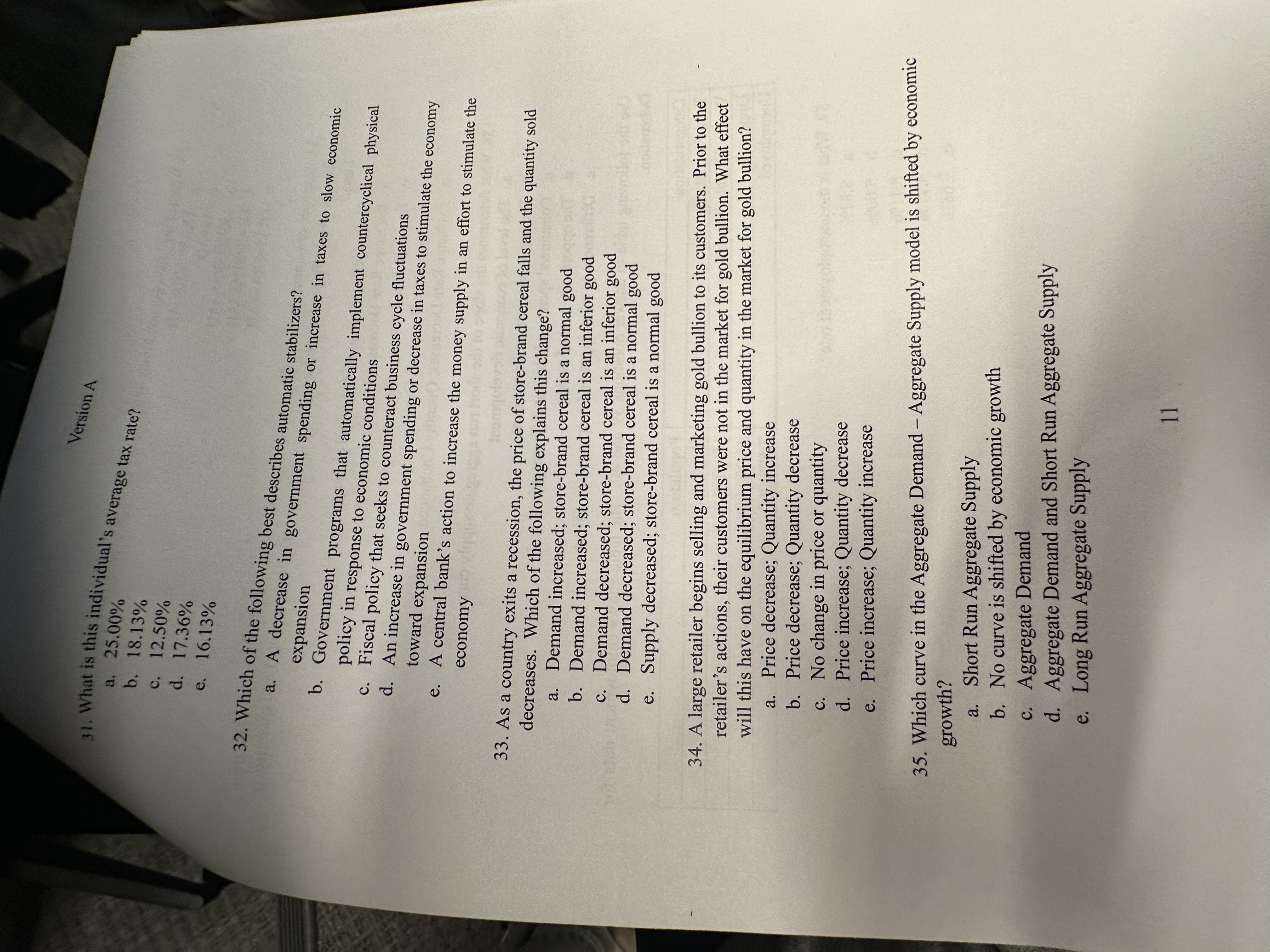

What is this individual's average tax rate?

a

b

c

d

e

Which of the following best describes automatic stabilizers?

a A decrease in government spending or increase in taxes to slow economic expansion

b Government programs that automatically implement countercyclical physical policy in response to economic conditions

c Fiscal policy that seeks to counteract business cycle fluctuations

d An increase in government spending or decrease in taxes to stimulate the economy toward expansion

e A central bank's action to increase the money supply in an effort to stimulate the economy

As a country exits a recession, the price of storebrand cereal falls and the quantity sold decreases. Which of the following explains this change?

a Demand increased; storebrand cereal is a normal good

b Demand increased; storebrand cereal is an inferior good

c Demand decreased; storebrand cereal is an inferior good

d Demand decreased; storebrand cereal is a normal good

e Supply decreased; storebrand cereal is a normal good

A large retailer begins selling and marketing gold bullion to its customers. Prior to the retailer's actions, their customers were not in the market for gold bullion. What effect will this have on the equilibrium price and quantity in the market for gold bullion?

a Price decrease; Quantity increase

b Price decrease; Quantity decrease

c No change in price or quantity

d Price increase; Quantity decrease

e Price increase; Quantity increase

Which curve in the Aggregate Demand Aggregate Supply model is shifted by economic growth?

a Short Run Aggregate Supply

b No curve is shifted by economic growth

c Aggregate Demand

d Aggregate Demand and Short Run Aggregate Supply

e Long Run Aggregate Supply

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock