Question: VERSION *BACK NEXT Testbank Multiple Choice Question 82 Sheridan Co. leased equipment to Riggs Company on May 1, 2021. At that time the collectibility of

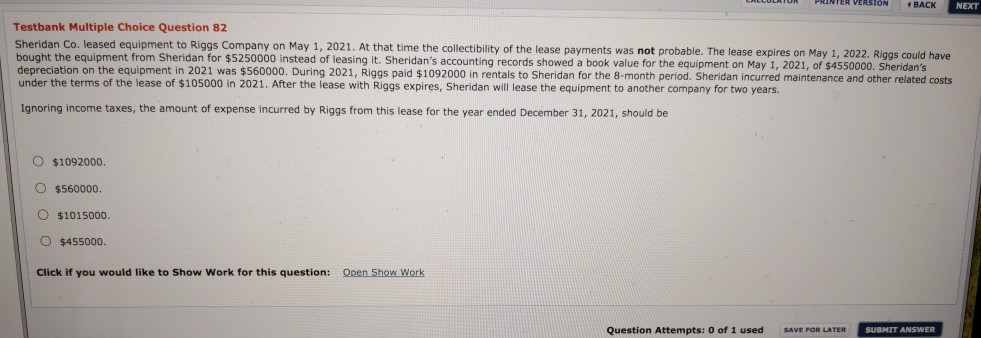

VERSION *BACK NEXT Testbank Multiple Choice Question 82 Sheridan Co. leased equipment to Riggs Company on May 1, 2021. At that time the collectibility of the lease payments was not probable. The lease expires on May 1, 2022. Riggs could have bought the equipment from Sheridan for $5250000 instead of leasing it. Sheridan's accounting records showed a book value for the equipment on May 1, 2021, of $4550000. Sheridan's depreciation on the equipment in 2021 was $560000. During 2021, Riggs paid $1092000 in rentals to Sheridan for the 8-month period. Sheridan incurred maintenance and other related costs under the terms of the lease of $105000 in 2021. After the lease with Riggs expires, Sheridan will lease the equipment to another company for two years. Ignoring income taxes, the amount of expense incurred by Riggs from this lease for the year ended December 31, 2021, should be O $1092000. O $560000 O $1015000 O $455000. Click if you would like to Show Work for this question: Qren Show Work Question Attempts: 0 of 1 used

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts