Question: Version:0.9 StartHTML:0000000105 EndHTML:0000009137 StartFragment:0000000141 EndFragment:0000009097 PART I [40 marks] The Case (Part I) We are in January 2029. ArtiFood plc produce equipment that enables the

Version:0.9 StartHTML:0000000105 EndHTML:0000009137 StartFragment:0000000141 EndFragment:0000009097

PART I [40 marks]

The Case (Part I)

We are in January 2029. ArtiFood plc produce equipment that enables the artificial growth of plants in

controlled environments. The firm is in the news. Your analysts expect ArtiFood's earnings and dividends to

grow at 3% per year, indefinitely. These forecasts are treated as reliable. The end-of-year dividends

(December 2029) are safely expected to be 20 million pounds. Dividends are discounted by the bank rate,

which is 7% (identically for loans and for deposits). There are 1 million shares outstanding. The company has

been in the news and there has been a lot of interest from retail investors pushing up the price. The share

price today is 620 pounds per share.

You are convinced that ArtiFood, though a sound business, is overpriced. You also believe that each year,

there is a 90% chance that an existing excessively positive investor sentiment carries over into the next year.

If that happens, then ArtiFood stock will continue to be overpriced. Alternatively, with a 10% chance the share

price will go back to fundamentals. You are risk-neutral and your criterion for trading is that a trade is good if

its expected profits are positive.

Question (Part I):

Use the given case to explain what is meant by a "rational bubble" (Blanchard/Watson).

QI.1 If the high ArtiFood sentiment continues, the stock's market price at the end of the period (date 1) will

remain above the stock's fundamental value (as derived from the stock's dividends). Discuss a short-selling

trading strategy that tries to exploit the initial over-pricing in order to make a profit when the price returns to

fundamentals. For the first period, identify ArtiFood's end-of-period share price (in a continued bubble) that

would give you zero expected end-of-period profits (ignoring fees). Using this idea, determine how the share

price would evolve in a continued bubble that lasts for 2 years, for 3 years, and for 4 years.

QI.2 You expect the bubble to evolve as in Q1, but at each date, if the bubble bursts (with a 10% chance),

you expect the new market price to fall to zero; the company collapses. Describe a short-selling strategy for

this situation. Discuss the difficulties of maintaining your strategy if the bubble continues over several years.

Reading (Part I)

The article by Blanchard/Watson, plus lecture notes.

PART II [50 marks]

The Case (Part II)

SecuBank produces securitised fixed-income products. One of these is SafeHaven, a higher-level

Collateralised Debt Obligation (CDO Squared) that offers re-packaged payoff streams based on the US

mortgage market.

On the input side, SafeHaven combines holdings in various mezzanine tranches from 10 primary mortgage

based CDOs. From each of these primary CDOs, SafeHaven holds a mezzanine share whose no-default

value is 50 million dollars, so overall SafeHaven holds assets with a no-default value of 500 million dollars.

These holdings serve as the source of cash flows and as collaterals for SafeHaven's own "bond" offering.

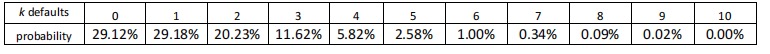

We label the ten shares C1, C2, C3, ... , C10 and simply call them "collaterals". SecuBank's valuation team

assume an individual default probability of 15% for each of the ten collaterals. The team assume that default

events for the ten collaterals are uncorrelated. The resulting probability distribution is binomial, with the

likelihood of k defaults among the 10 collaterals as follows:

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts