Question: Vertical Analysis Problem 14-1A a, bi (Part Level Submission) Here are comparative statement data for Duke Company and Lord Company, two competitors. All balance sheet

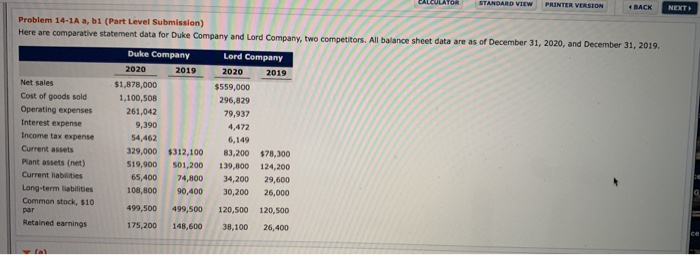

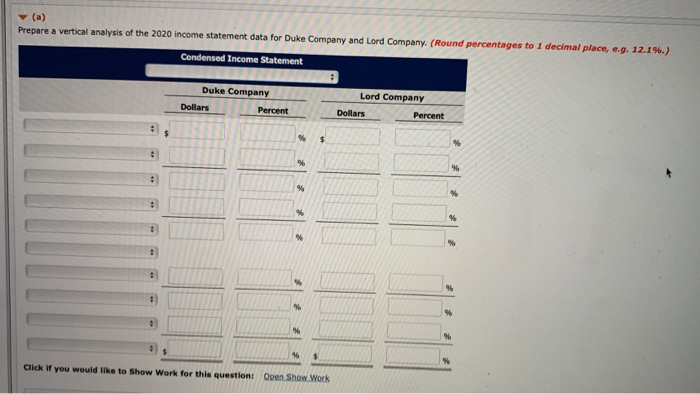

Problem 14-1A a, bi (Part Level Submission) Here are comparative statement data for Duke Company and Lord Company, two competitors. All balance sheet data are as of December 31, 2020, and December 31, 2019. Duke Company 2020 2019 Net sales Cost of goods sold Operating expenses Interest expense Income tax expense Current assets Plant assets (net) Current liabetes Long-term liabilities Common stock, 510 $1,878,000 1,100,508 261,042 9,390 54,462 329,000 519,900 65,400 108,800 499,500 175,200 Lord Company 2020 2019 $559,000 296,829 79,937 4,472 6,149 85,200 $78,300 139,800 124,200 34,200 29,600 30,200 26,000 120,500 120,500 38,100 26,400 $312,100 501,200 74,800 90,400 499,500 148,600 Retained earnings Prepare a vertical analysis of the 2020 income statement data for Duke Company and Lord Company (Round percentages to 1 decimal place, e.g. 12.1%.) Condensed Income Statement Duke Company Lord Company Dollars Dollars Percent Click if you would like to show Work for this question Open Show. Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts