Question: Vertical & Horizontal Analysis 2018 & 2017 . Conduct the following vertical analyses and write a brief summary of findings related to the analysis. You

Vertical & Horizontal Analysis 2018 & 2017. Conduct the following vertical analyses and write a brief summary of findings related to the analysis. You may use EXCEL or a similar program for this question. That is, I would suggest you recreate the financial statements in an Excel tab or tabs, and make the computations directly on that file.

- First, describe the purposes of conducting a vertical analysis and how its computed (do this using one formula for a vertical analysis). Then conduct the following:

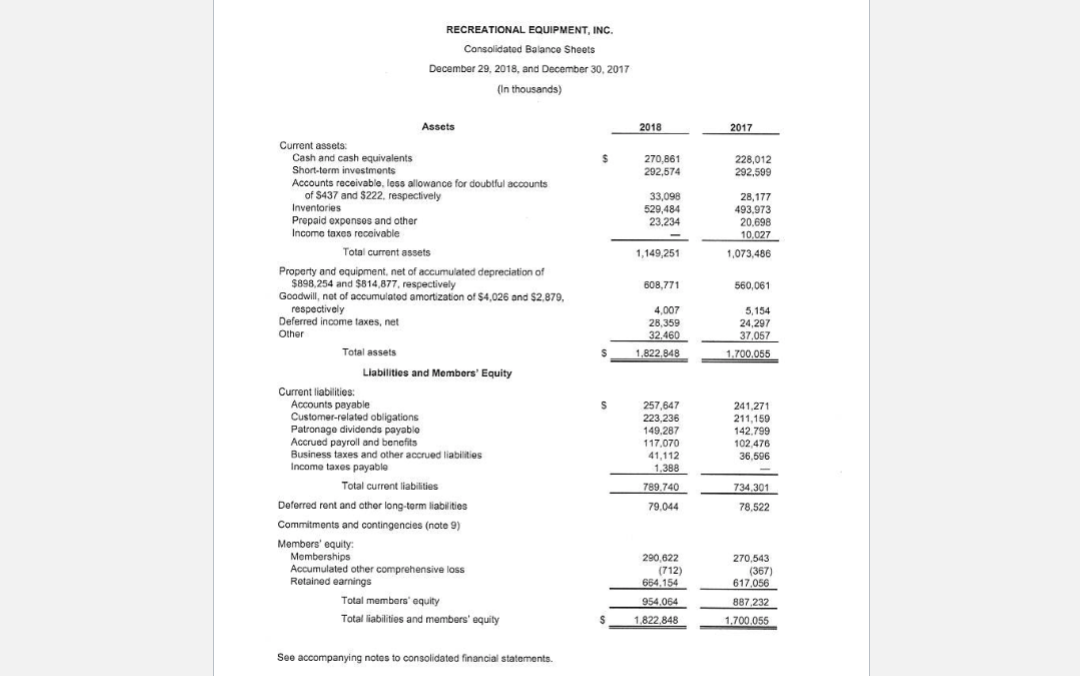

- Vertical analysis of the balance sheet using Total Assets as constant for 2018 and 2017.

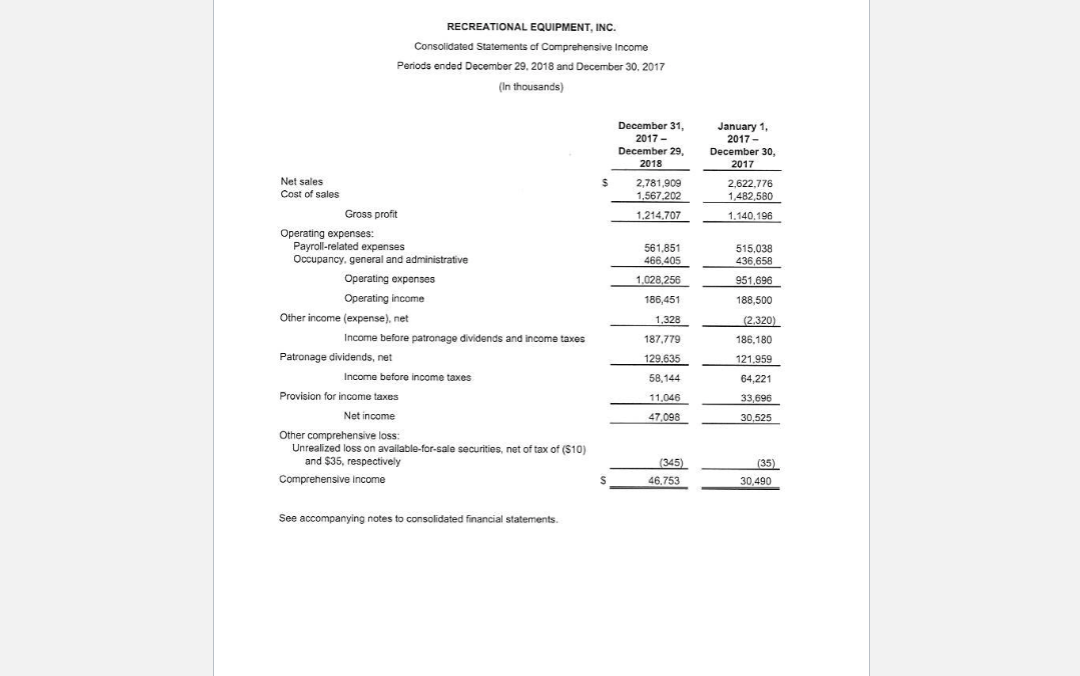

RECREATIONAL EQUIPMENT, INC. , Consolidated Balance Sheets December 29, 2018, and December 30, 2017 , (In thousands) 2018 2017 $ 270,861 292,574 228,012 292,599 33,098 529,484 23,234 1932 28,177 493,973 20.698 10,027 1,073,486 1,149,251 608,771 560,061 4,007 28,359 32,460 1.822.848 5,154 24,297 37,057 1.700,055 Assets Current assets: Cash and cash equivalents Short-term investments Accounts receivable less allowance for doubtful accounts of S437 and 5222, respectively Inventories Prepaid expenses and other Income taxes receivable Total current assets Property and equipment, net of accumulated depreciation of $898,254 and $814,877, respectively Goodwill, not of accumulated amortization of $4,026 and $2.879, respectively Deferred income taxes, net Other Total assets Liabilities and Members' Equity Current liabilities: Accounts payable Customer-related obligations Patronage dividends payablo Accrued payroll and benefits Business taxes and other accrued liabilities Income taxes payable Total current liabilities Deferred ront and other long term liabilities - Commitments and contingencies (note 9) Members' equity: ' Memberships Accumulated other comprehensive loss Retained earnings Total members' equity Total liabilities and members' equity S 257,647 223,236 149,287 117,070 41,112 1,388 789.740 79,044 241,271 211,150 142.799 102 476 36,506 734,301 78,522 1942 290 622 (712) 664.154 954,064 270,543 (367 617.056 887,232 1.700.055 1.822.848 See accompanying notes to consolidated financial statements. RECREATIONAL EQUIPMENT, INC. Consolidated Statements of Comprehensive Income Periods ended December 29, 2018 and December 30, 2017 (In thousands) December 31, 2017 - December 29, 2018 January 1. 2017- December 30, 2017 2.622.776 1,482,580 $ 2,781,909 1,567.202 1.214,707 1.140.196 561.851 466,405 1,028,256 515,038 436,658 951,696 186,451 188,500 1,328 Net sales Cost of sales Gross profit Operating expenses Payroll-related expenses Occupancy, general and administrative Operating expenses Operating income Other income (expense), net Income before patronage dividends and income taxes Patronage dividends, net Income before income taxes Provision for income taxes Net income Other comprehensive loss: Unrealized loss on available-for-sale securities, net of tax of (510) and $35, respectively Comprehensive income (2.320) 186,180 187.779 129.635 58,144 121,959 64,221 11,046 33,696 47,098 30,525 (345) 46.753 (35) 30,490 S See accompanying notes to consolidated financial statements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts