Question: VI. The Capital Asset Pricing Model - a) Explain the CAPM equation E(rj) = r + j[E(rm) r]. b) Assume two stocks, Ford and

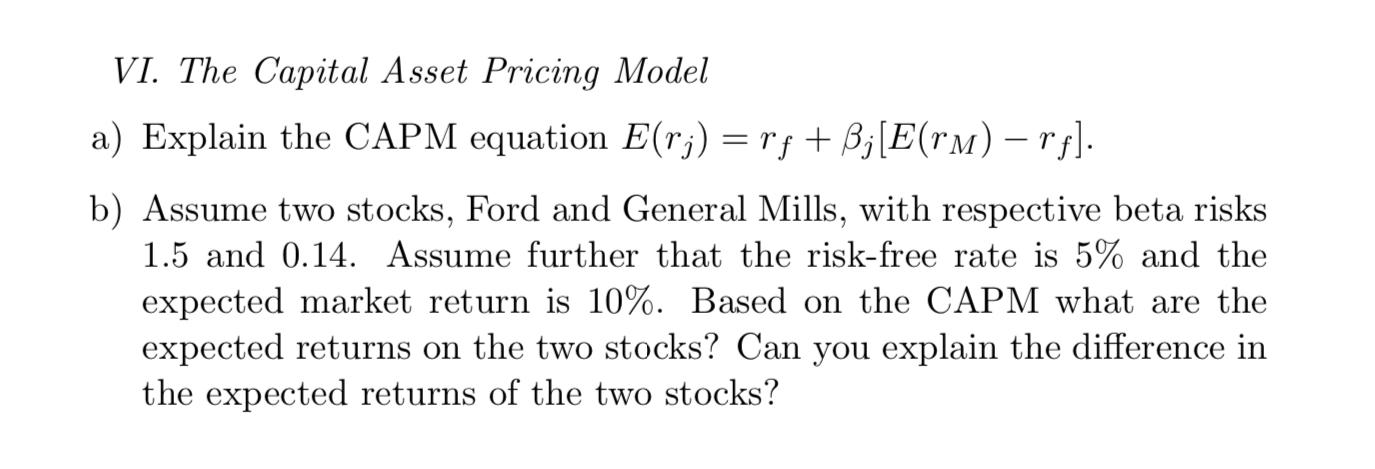

VI. The Capital Asset Pricing Model - a) Explain the CAPM equation E(rj) = r + j[E(rm) r]. b) Assume two stocks, Ford and General Mills, with respective beta risks 1.5 and 0.14. Assume further that the risk-free rate is 5% and the expected market return is 10%. Based on the CAPM what are the expected returns on the two stocks? Can you explain the difference in the expected returns of the two stocks?

Step by Step Solution

There are 3 Steps involved in it

I can analyze and solve the text in the image for you The text describes the Capital Asset Pricing Model CAPM and its equation CAPM is a financial model used to estimate the expected return on an inve... View full answer

Get step-by-step solutions from verified subject matter experts