Question: Victor, now age 61, and Maria, age 59, plan to retire at the end of the year. Since his employer changed from a defined-benefit retirement

Victor, now age 61, and Maria, age 59, plan to retire at the end of the year. Since his employer changed from a defined-benefit retirement plan to a defined-contribution plan ten years ago, Victor has been contributing the maxi- mum amount of his salary to several different mutual funds offered through the plan, although his employer never matched any of his contributions. Victors tax-sheltered account, which now has a balance of $300,000, has been growing at a rate of 7 percent through the years. Under the previous defined-benefit plan, today Victor is entitled to a single-life pension of $360 per month ($4,320 annually) or a joint and survivor option paying $240 per month ($2,880 annually). The value of Victors investment of $20,000 in Pharmacia stock some years ago has now grown to $56,000. Marias earlier career as a medical records assistant provided no retirement program, although she did save $10,000 through her credit union, which was later used to purchase zero-coupon bonds now worth $28,000. Marias second career as a pharmaceutical representative for Pharmacia allowed her to contribute to her retirement account over the past nine years, which is now worth $98,000. Pharmacia matched a portion of her contributions, and that match is now worth $70,000; its growth rate has ranged from 6 to 10 percent each year. When Marias mother died last year, Maria inherited her home, which is rented for $1,800 per month; the house has a market value of $300,000. The Hernandezes personal residence is worth $260,000. They pay combined federal and state income taxes at a 30 percent rate.

(a) Sum up the present values of the Hernandezes assets, excluding their personal residence, and identify which assets derive from tax-sheltered accounts.

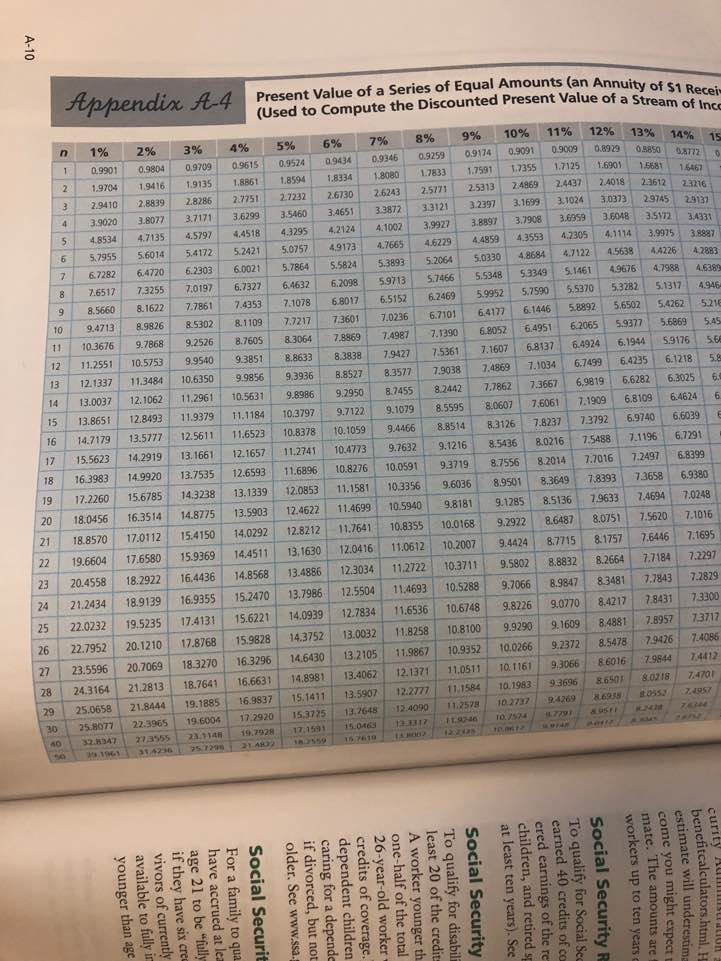

(b) Assume that the Hernandezes sold their stocks, bonds, and rental property, realizing a gain of $34,000 after income taxes and commissions. If that sum plus their tax-sheltered accounts earned a 7 percent rate of return over the Hernandezes anticipated 20 years of retirement, how large an amount could be withdrawn each month? How large an amount could be withdrawn each month if they needed the money over 30 years? How large an amount could be withdrawn each month if the proceeds earned 6 percent for 20 years? For 30 years? Hint: Use Appendix A4.

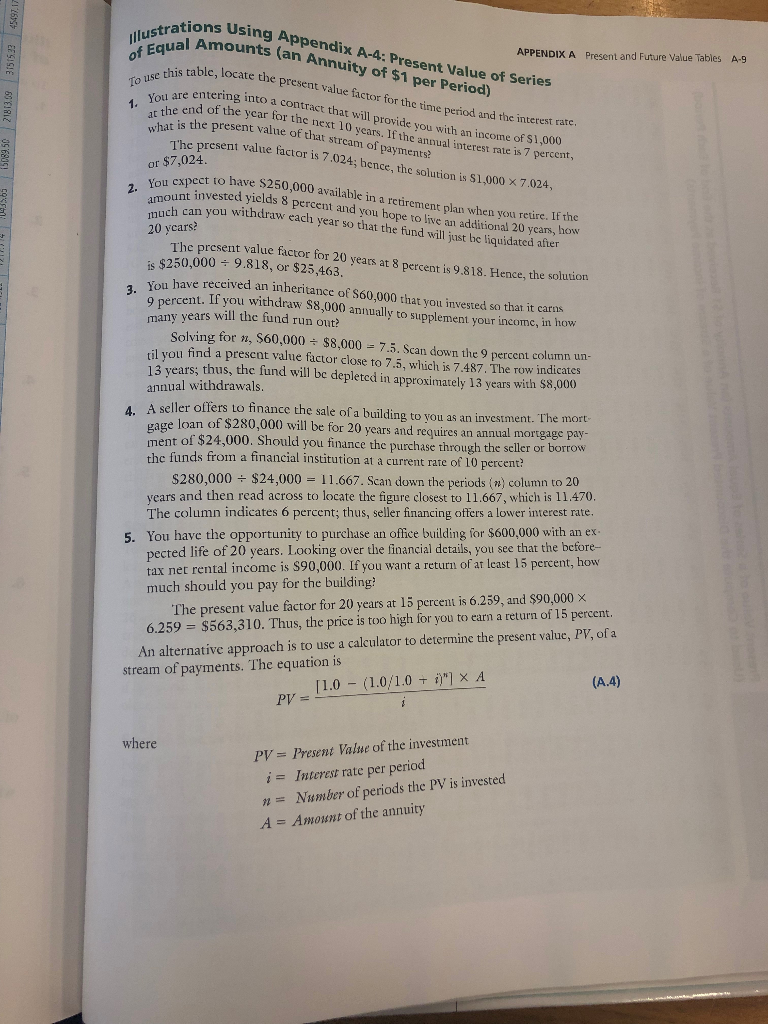

tions Using Appendix A-4: Present Value of Series ustral Amounts (an Annuity of $1 per Period) APPENDIX A Present and Future Value Tables A-9 of Equal is table, locate the present value factor for the time period and the interest entering into a contract that will provide you with an income o You are at the end the what is the present value of that strca of the ycar for the next 10 years. If the annual nterest rate ncome of S1,000 The present value factor is 7.024; hence, the solution is S 1,000 x 7 m of payments? interest rate is 7 percent, or $7,024. nct to have $250,000 available in a retirement plan when uninveted yields 8 percent and you hope to live an additional 20 ycars, how ch can you withdraw each year so that the fund will just be liquidated after 20 ycars? The present value factor for 20 years at 8 percent is 9.818. Hence, the solution is $250,000 9.818, or $25,463. have received an inheritance of S60,000 that you invested so that it carns nt. If you withdraw $8,000anniually to supplement your income, in how many years will the fund run out? r n, S60.000 $8,000-7.5. Scan down the 9 percent column un. Solving fo til you find a present value factor close to 7.5, which is 7.487. The row indicates 13 years; thus, the fund will be depletcd in approximately 13 years with $8,000 annual withdrawals. seller offers to finance the sale of a building to you as an investment. The mort wage loan of $280,000 will be for 20 years and requires an annual mortgage pay 4. A nt of $24,000. Should you finance the purchase through the seller or borrow men the funds from a financial institution at a current rate of 10 percent? 11.667. Scan down the periods (n) column to 20 S280,000$24,000 years and then read across to locate the figure closest to 11.667, which is 11.470 The column indicates 6 percent; thus, seller financing offers a lower interest rate pected life of 20 years. Looking over the financial details, you see that the bcfore- tax net rental income is $90,000. If you want a return of ar least 15 percent, how much should you pay for the building? 5. You have the opportunity to purchase an office building for $600,000 with an ex The present value factor for 20 years at 15 percent is 6.259, and $90,000 x 6.259 $563,310. Thus, the price is too high for you to earn a return of 15 percent. An alternative approach is to use a calculator to determine the present value, PV, of a stream of payments. The equation is (A.4) 1.0 Present Value of the investment iInterest rate per period nNumber of periods the PV is invested AAmount of the annuity where PV Present Value of a Series of Equal Amounts (an Annuity s (Used to Compute the Discounted Present Value of a Stream ofecei of $1 Recei % 14%.15 n 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 13 || 09901. 0.9804: 0.9709| 0.9615 | 09524| 9434| 0.9346 0.9259. 0.91 741 0.9091 : 0.9009108929. o 50 2 1.9704 19416 1.9135 1.8861 1.8594 18334 180801.7833 1.7591 17355 1.7125 1690 1568 3 2.9410 28839 2.8286 2.775t 2.7232 2.6130 2.6243 2577 2.53132.4692.4437 2.4018 23612 4 39020 3.8077 3.7171 3.6299 35460 3.4651 3.3872 33121 32397 3.169931024 30373 29745 2111 5 48534 4.7135 4.5797 44518 432954.2124 4.1002 3.9973.8897 3.9083.659 3.6048 3.5172 34331 6 5.7955 5.6014 5,4172 5242 5.0757 49173 4.7665 4.62294.4859 4.3553 4.7305 4.1114 3.9975) 3 8887 7 6.7282 6.4720 6.2303 6002157864 5824 53893 5.2064 5.0330 48684 4.7122 4.5638 44226 883 8 7.6517 7,3255 70197 6.7327 64632 6.209859713 5.74665.5348 53349 5 1461 49676 479884638 9 8.5660 8.1622 7.7861 7.4353 7.10786.8017 651526.2469 59952 5.7590 55370 53782 5.1317 4946 : 10 I 9.4713| 8.9826 85302| 8.1109| 7.7217| 73601| 7.0236| 6.7101| 6.4177| 6.14461 58892 56502 5,4262| 521 | 11 : 10.3676| 9.7868 92526| 8.7605| 83064| 7.8869| 7.4987| 7J390| 68052| 64951| 62065| 5.9377| 5.6869; 5AS 12 11.2551 10.5753 9.9540 9.3851 8.8633 8.3838 7.9427 7.5361 7.1607 6.81376.4924 6.1944 59176 566 13 12.1337 11.3484 10.6350 99856 9.3936 8.827 8.3577 7.9038 7.4869 7.1034 6.7499 6.4235 61218 58 14 13.0037 12.1062 11.2961 10.5631 9.8986 9.2950 8.45524427.78627.3667 6,9819 6.6282 6.3025 15 13.865 128493 11.9379 11.1184 10.3797 9.7122 9.1079 8.5595 80607 7,6061 7.1909 6.8109 646246 16 14.7179 13.5777125611 11.6523 10.8378 10.1059 94466 8.851483126 7.8237 73792 6.9740 6096 17 15.5623 14.2919 13.1661 12.1657 11.2741 10.4773 9.7632 9.12168.5436 8.0216 7.5488 7.1196 6.7291 18 16.3983 14.9920 13.7535 12.6593 11.6896 10.8276 10.0591 9.37198.75568.20147.7016724976.8399 19 17:2260 15.6785 14.3238 13.1339 12.0853 .8 10.33569.6036 8.9501 8.36497.8393 73658 6.9380 201 18.0456 16.3514| 14.8775| 13.5903| 12.46221 11.4699| 10.5940| 9.8181 9.1285| 8.5136| 7.9633| 7.4694| 7.0248| 21 18.8570 17.0112 15.4150 14.0292 12.81211.7641 10.8355 10.01689.2922 8.6487 80751 7.5620 7.1016 22 19.6604 17.6580 5.9369 44 13,1630 12.0416 11.0612 10.2007 9.4424 8.771581757 7.6446 7.1695 23 20.4558 18.2922 16.4436 14.8568 1.4886 12.3034 11.2722 10.3711 9.5802 8.8832 8.2664 7.7184 7.2297 24 21.2434 18.9139 16.9355 15.2470 13.7986 12.5504114693105288 9.7066 8.9847 8.3481 7.7843 72829 | 25 | 22.0232| 19.5235| 17.4131 | 15.6221 | 14.0939| 12.7834| 11.6536| 10.6748| 9.8226| 9.0770| 8.4217| 8431| 7.3300 26 22.7952 20.1210 17.8768 15.9828 14.3752 13.0032 11.8258 108100 9.9290 9.1609 8488 7.8957 1377 27 23.5596069 18.3270 16.3296 14.6430 13.2105 1.9867 10.9352 10.0266 9.2372 8.5478 9426 74086 28 24.3164 21.2813 18.7641 16.6631 148981 13.4062 12.1371 11.0511 10.1161 9.3066 6016 79844 74412 29 25.0658 21.8444 19.1885 6.9837 15.1411 13.590712.2777 11,1584 10.1983 93696 650 80218 7470 02737.4269 8693880552 74857 30 258077 22.3965 196 04 112920 '53775 13.7648 124090 11,25% am 4269-aass toss 40 32.8347 27-35551-23.114 19,7928-17.1591 15.046313.3317 tions Using Appendix A-4: Present Value of Series ustral Amounts (an Annuity of $1 per Period) APPENDIX A Present and Future Value Tables A-9 of Equal is table, locate the present value factor for the time period and the interest entering into a contract that will provide you with an income o You are at the end the what is the present value of that strca of the ycar for the next 10 years. If the annual nterest rate ncome of S1,000 The present value factor is 7.024; hence, the solution is S 1,000 x 7 m of payments? interest rate is 7 percent, or $7,024. nct to have $250,000 available in a retirement plan when uninveted yields 8 percent and you hope to live an additional 20 ycars, how ch can you withdraw each year so that the fund will just be liquidated after 20 ycars? The present value factor for 20 years at 8 percent is 9.818. Hence, the solution is $250,000 9.818, or $25,463. have received an inheritance of S60,000 that you invested so that it carns nt. If you withdraw $8,000anniually to supplement your income, in how many years will the fund run out? r n, S60.000 $8,000-7.5. Scan down the 9 percent column un. Solving fo til you find a present value factor close to 7.5, which is 7.487. The row indicates 13 years; thus, the fund will be depletcd in approximately 13 years with $8,000 annual withdrawals. seller offers to finance the sale of a building to you as an investment. The mort wage loan of $280,000 will be for 20 years and requires an annual mortgage pay 4. A nt of $24,000. Should you finance the purchase through the seller or borrow men the funds from a financial institution at a current rate of 10 percent? 11.667. Scan down the periods (n) column to 20 S280,000$24,000 years and then read across to locate the figure closest to 11.667, which is 11.470 The column indicates 6 percent; thus, seller financing offers a lower interest rate pected life of 20 years. Looking over the financial details, you see that the bcfore- tax net rental income is $90,000. If you want a return of ar least 15 percent, how much should you pay for the building? 5. You have the opportunity to purchase an office building for $600,000 with an ex The present value factor for 20 years at 15 percent is 6.259, and $90,000 x 6.259 $563,310. Thus, the price is too high for you to earn a return of 15 percent. An alternative approach is to use a calculator to determine the present value, PV, of a stream of payments. The equation is (A.4) 1.0 Present Value of the investment iInterest rate per period nNumber of periods the PV is invested AAmount of the annuity where PV Present Value of a Series of Equal Amounts (an Annuity s (Used to Compute the Discounted Present Value of a Stream ofecei of $1 Recei % 14%.15 n 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 13 || 09901. 0.9804: 0.9709| 0.9615 | 09524| 9434| 0.9346 0.9259. 0.91 741 0.9091 : 0.9009108929. o 50 2 1.9704 19416 1.9135 1.8861 1.8594 18334 180801.7833 1.7591 17355 1.7125 1690 1568 3 2.9410 28839 2.8286 2.775t 2.7232 2.6130 2.6243 2577 2.53132.4692.4437 2.4018 23612 4 39020 3.8077 3.7171 3.6299 35460 3.4651 3.3872 33121 32397 3.169931024 30373 29745 2111 5 48534 4.7135 4.5797 44518 432954.2124 4.1002 3.9973.8897 3.9083.659 3.6048 3.5172 34331 6 5.7955 5.6014 5,4172 5242 5.0757 49173 4.7665 4.62294.4859 4.3553 4.7305 4.1114 3.9975) 3 8887 7 6.7282 6.4720 6.2303 6002157864 5824 53893 5.2064 5.0330 48684 4.7122 4.5638 44226 883 8 7.6517 7,3255 70197 6.7327 64632 6.209859713 5.74665.5348 53349 5 1461 49676 479884638 9 8.5660 8.1622 7.7861 7.4353 7.10786.8017 651526.2469 59952 5.7590 55370 53782 5.1317 4946 : 10 I 9.4713| 8.9826 85302| 8.1109| 7.7217| 73601| 7.0236| 6.7101| 6.4177| 6.14461 58892 56502 5,4262| 521 | 11 : 10.3676| 9.7868 92526| 8.7605| 83064| 7.8869| 7.4987| 7J390| 68052| 64951| 62065| 5.9377| 5.6869; 5AS 12 11.2551 10.5753 9.9540 9.3851 8.8633 8.3838 7.9427 7.5361 7.1607 6.81376.4924 6.1944 59176 566 13 12.1337 11.3484 10.6350 99856 9.3936 8.827 8.3577 7.9038 7.4869 7.1034 6.7499 6.4235 61218 58 14 13.0037 12.1062 11.2961 10.5631 9.8986 9.2950 8.45524427.78627.3667 6,9819 6.6282 6.3025 15 13.865 128493 11.9379 11.1184 10.3797 9.7122 9.1079 8.5595 80607 7,6061 7.1909 6.8109 646246 16 14.7179 13.5777125611 11.6523 10.8378 10.1059 94466 8.851483126 7.8237 73792 6.9740 6096 17 15.5623 14.2919 13.1661 12.1657 11.2741 10.4773 9.7632 9.12168.5436 8.0216 7.5488 7.1196 6.7291 18 16.3983 14.9920 13.7535 12.6593 11.6896 10.8276 10.0591 9.37198.75568.20147.7016724976.8399 19 17:2260 15.6785 14.3238 13.1339 12.0853 .8 10.33569.6036 8.9501 8.36497.8393 73658 6.9380 201 18.0456 16.3514| 14.8775| 13.5903| 12.46221 11.4699| 10.5940| 9.8181 9.1285| 8.5136| 7.9633| 7.4694| 7.0248| 21 18.8570 17.0112 15.4150 14.0292 12.81211.7641 10.8355 10.01689.2922 8.6487 80751 7.5620 7.1016 22 19.6604 17.6580 5.9369 44 13,1630 12.0416 11.0612 10.2007 9.4424 8.771581757 7.6446 7.1695 23 20.4558 18.2922 16.4436 14.8568 1.4886 12.3034 11.2722 10.3711 9.5802 8.8832 8.2664 7.7184 7.2297 24 21.2434 18.9139 16.9355 15.2470 13.7986 12.5504114693105288 9.7066 8.9847 8.3481 7.7843 72829 | 25 | 22.0232| 19.5235| 17.4131 | 15.6221 | 14.0939| 12.7834| 11.6536| 10.6748| 9.8226| 9.0770| 8.4217| 8431| 7.3300 26 22.7952 20.1210 17.8768 15.9828 14.3752 13.0032 11.8258 108100 9.9290 9.1609 8488 7.8957 1377 27 23.5596069 18.3270 16.3296 14.6430 13.2105 1.9867 10.9352 10.0266 9.2372 8.5478 9426 74086 28 24.3164 21.2813 18.7641 16.6631 148981 13.4062 12.1371 11.0511 10.1161 9.3066 6016 79844 74412 29 25.0658 21.8444 19.1885 6.9837 15.1411 13.590712.2777 11,1584 10.1983 93696 650 80218 7470 02737.4269 8693880552 74857 30 258077 22.3965 196 04 112920 '53775 13.7648 124090 11,25% am 4269-aass toss 40 32.8347 27-35551-23.114 19,7928-17.1591 15.046313.3317

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts