Question: Video Excel Online Structured Activity: Bond valuation You are considering a 15-year, $1,000 par value bond. Its coupon rate is 10%, and interest is paid

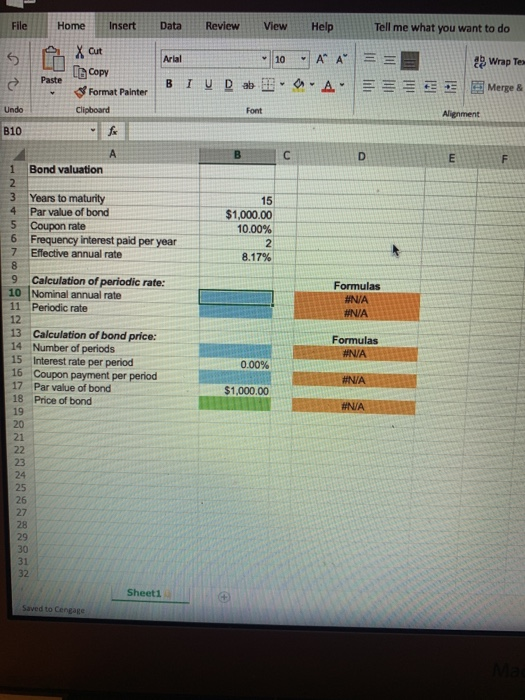

Video Excel Online Structured Activity: Bond valuation You are considering a 15-year, $1,000 par value bond. Its coupon rate is 10%, and interest is paid semiannually. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. X Open spreadsheet If you require an effective annual Interest rate (not a nominal rate) of 8.17%, how much should you be willing to pay for the bond? Do not round Intermediate steps. Round your answer to the nearest cent. $ 1156.60 Check My Work Reset Problem File Home Insert Data Review View H elp Tell me what you want to do = = X Cut Copy Format Painter Clipboard Arial 10 A A BI U Daba. A Paste 2 Wrap Tes Merge & Font Alignment B10 1 Bond valuation 15 3 4 5 6 7 Years to maturity Par value of bond Coupon rate Frequency interest paid per year Effective annual rate $1,000.00 10.00% 8.17% 9 Calculation of periodic rate: 10 Nominal annual rate 11 Periodic rate Formulas #N/A #NA Formulas #NA 13 Calculation of bond price: 14 Number of periods 15 Interest rate per period 16 Coupon payment per period 17 Par value of bond 18 Price of bond 0.00% #N/A $1,000.00 #N/A 19 Sheet1 Saved to Cente

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts