Question: Video Excel Online Structured Activity: Constant growth You are considering an investment in Justus Corporation's stock, which is expected to pay a dividend of $2.00

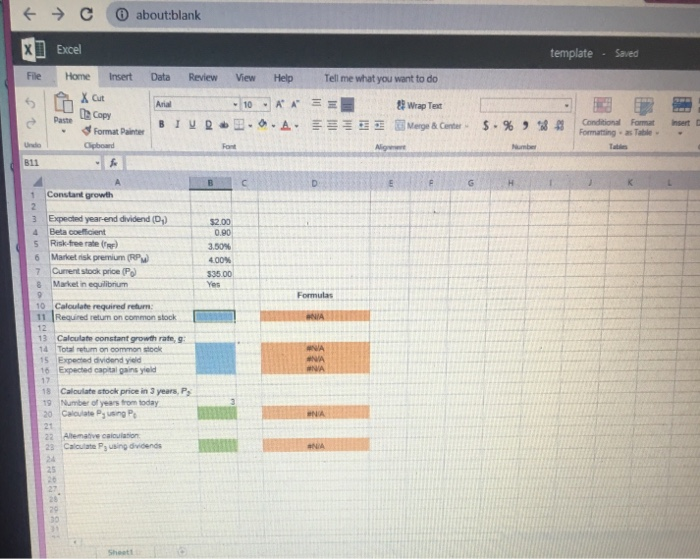

Video Excel Online Structured Activity: Constant growth You are considering an investment in Justus Corporation's stock, which is expected to pay a dividend of $2.00 a share at the end of the year (D - $2.00) and has beta of 0.9. The risk-free rate is 3.5%, and the market risk premium is 4.0%. Justus currently sells for $35.00 a share, and its dividend is expected to grow at som constant rate, 9. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. X Open spreadsheet Assuming the market is in equilibrium, what does the market believe will be the stock price at the end of 3 years? (That is what is Po?) Round your answer to two decimal places. Do not round your intermediate calculations. about:blank + X] File C Excel Home template - Saved Insert Help XO Data Review Ariel BIUR View - 10 .. Tell me what you want to do == Wrap Test Merge Center Copy Format Painter beard .A. $ . % ) insert Conditional Formatting Famet Table Constant growth 3 5 6 7 Expected year-end dividend (D) Beta coefficient Risk-free rate Market risk premium (RPW Current stock price (P) Market in equilibrium $2.00 090 3.50% 400 335.00 10 Calculate required return 11 Required return on common stock 13 Calculate constant growth rates 14 Toumon common 15 Expedividend yod 16 Expected capital gains yold 18 Calculate stock price in 3 years, Ps 19 Number of years from today 20 Calate Pang A 23 vec Calculate Powaing avconds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts