Question: Video Instructions Excel File E Step One: Go to Nasdaq.com and pick a stock that has a symbol that starts with the first letter of

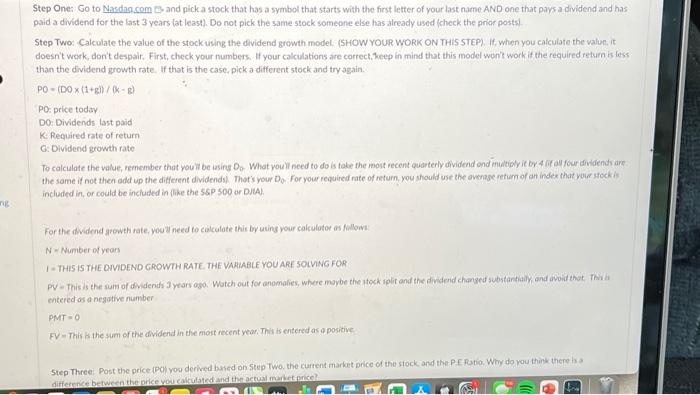

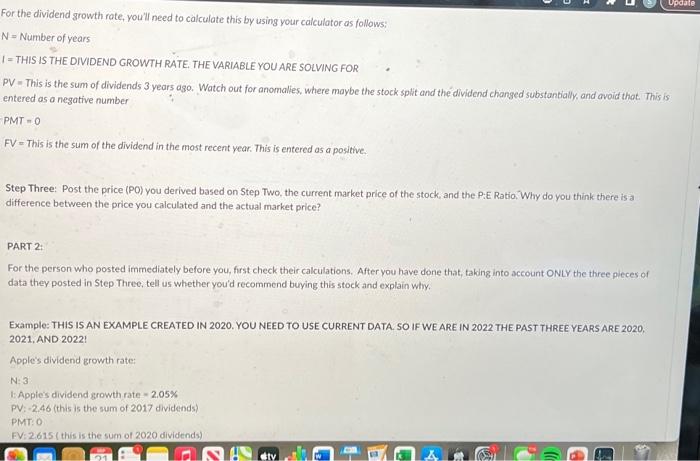

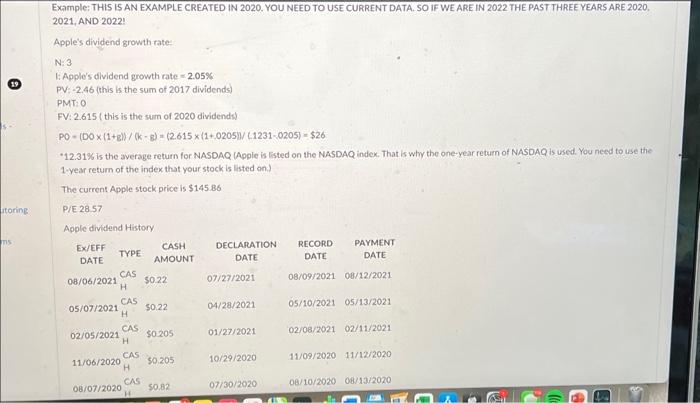

Step One: Go to Naredna.com B and pick a stock that has a symbol that starts with the first letter of your last name AND one that pays a dividend and has paid a dividend for the last 3 years (at least). Do not pick the same stock someone else has already used (check the pricr posts) Step Two: Calculate the value of the stock using the dividend growth model (SHOW YOUR WORK ON THIS STEP). If, when you calculate the value, it doesn't work, don't despair. First, check your numbers. If your calculations are correct, keep in mind that this model won't work if the required return is less than the dividend growth rate. If that is the case, pick a different stock and try again. PO=(DO(1+g))/0xg) PO: price today D0: Dividends last paid K. Reguired rate of return G: Dividend growth rate the same if not then add up the different dividends). That's your D0. For your required rate of return, you should use the ovenase retium of an inder that yoir stockis included in, or could be included in (like the SSP 500 or DJUA). For the dwidend growth rate, you ar need to colculate this by using vour calculotor as follows: N=Numberofyean I = THIS IS THE ONVIDED GROWTH RATE, THE VAALALE YOU ARE SOIVNG FOE PV - This is the sum of dvidends 3 years ogo. Wotch out for anomolies, where moybe the stock relit and the dividend changed substancialy, and avoid that Thi a entered os a negotive number PMT=0 FV = This k the sum of the dividend in the most recent year. This is entered as o positive. For the dividend growth rote, you'll need to calculate this by using your calculator as follows: N= Number of years I= THIS IS THE DIVIDEND GROWTH RATE. THE VARIABLE YOU ARE SOLVING FOR PV = This is the sum of dividends 3 years ago. Watch out for anomalies, where maybe the stock split and the dividend changed substantially, and avoid that. This is entered as a negative number PMT =0 FV= This is the sum of the dividend in the most recent year. This is entered as a positive. Step Three: Post the price (PO) you derived based on Step Two, the current market price of the stock, and the P:E Ratia. Why do you think there is a difference between the price you calculated and the actual market price? PART 2: For the person who posted immediately before you, first check their calculations. After you have done that, taking into account ONLY the three pieces of data they posted in Step Three, tell us whether you'd recommend buying this stock and explain why. EXample: THIS IS AN EXAMPLE CREATED IN 2020. YOU NEED TO USE CURRENT DATA. SO IF WE ARE IN 2022 THE PAST THREE YEARS ARE 2020, 2021, AND 2022! Apple's dividend growth rate: N:3 1: Apple's dividend growth rate =2.05% PV: -2.46 (this is the sum of 2017 dividends? PMT: 0 EXample: THIS IS AN EXAMPLE CREATED IN 2020. YOU NEED TO USE CURRENT DATA. SO IF WE ARE IN 2022 THE PAST THREE YEARS ARE 2020. 2021, AND 2022! Apple's dividend growth rate: N:3 I: Apple's dividend growth rate =2.05% PV: -2.46 (this is the sum of 2017 dividends) PMT: 0 FV: 2.615 ( this is the sum of 2020 dividends) PO=(DO(1+g))/(kg)=(2.615(1+.0205))/(12310205)=$26 *12.31\% is the average return for NASDAQ (Apple is listed on the NASDAQ index. That is why the one-year return of NASDAQ is used. You need to use the 1.year retum of the index that your stock is listed an.) The current Apple stock price is $145.86 P/E 28.57

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts