Question: Vides A-Z. Excel Online Structured Activity: New project analysis You must evaluate the purchase of a propesed spectrometer for the R&D department. The base prices

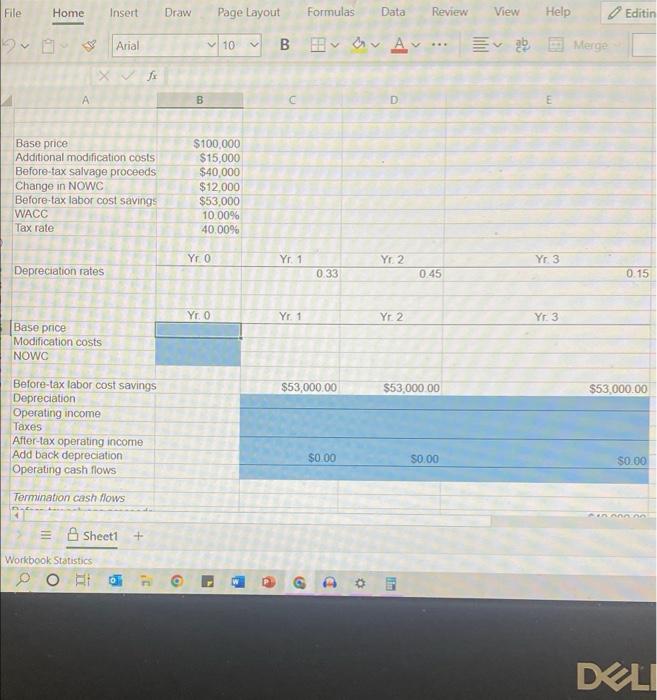

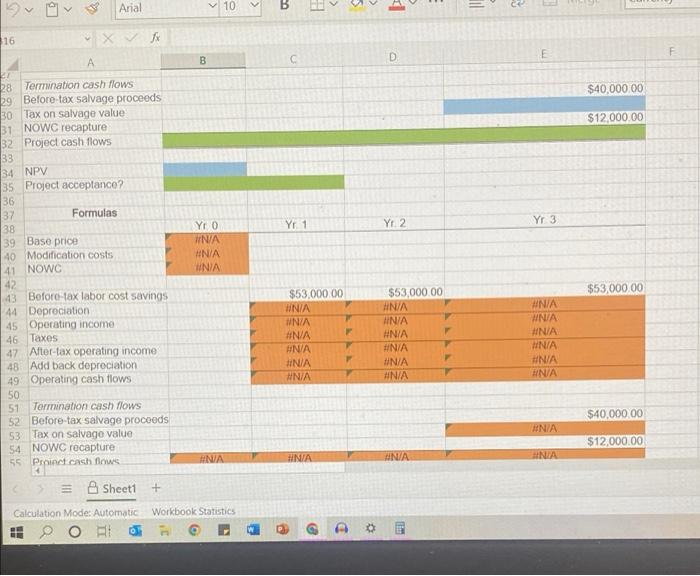

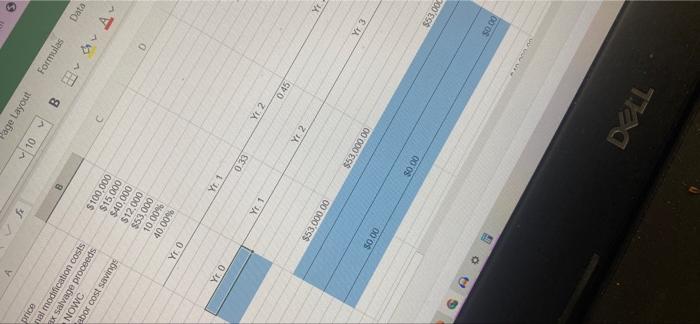

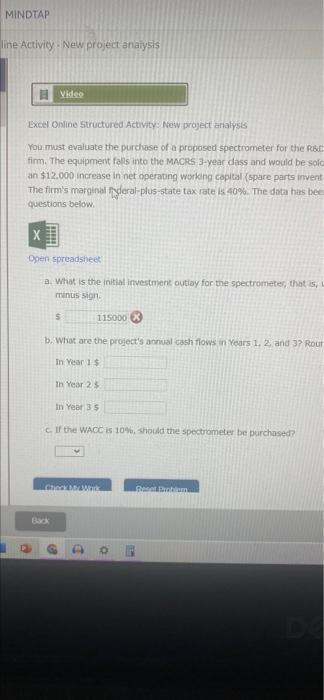

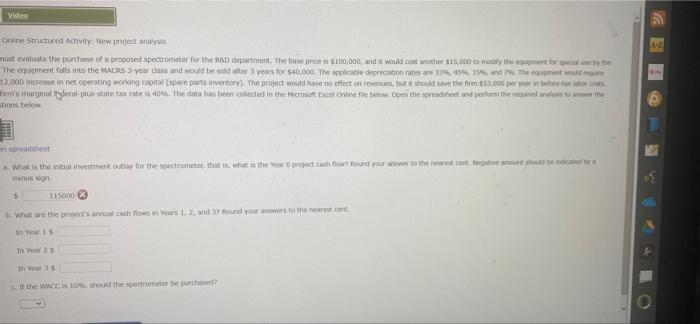

Vides A-Z. Excel Online Structured Activity: New project analysis You must evaluate the purchase of a propesed spectrometer for the R&D department. The base prices $100,000, and it would cost another $15,000 to modify the equipment for special use by the firm. The equipment falls into the MACRS 3-year class and would be sold after 3 years for $40,000. The applicable depreciation rates are 33%, 45%, 15%, and 7%. The equipment would reare an $12,000 increase on net operating working capital (spare parts inventory). The project would have no effect on revenues, but it should save the firm $53,000 per year in before tax labor costs The firm's marginal federal-plus-state tax rate is 40%. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. SA Open spreadsheet a. What is the initial investment outlay for the spectrometer, that is, what is the Year 0 project cash flow? Round your answer to the nearest cent. Negative amount should be indicated by a minus sign. $ 115000 b. What are the project's annual cash flows in Years 1, 2, and 37 Round your answers to the nearest cent In Year 15 In Year 25 In Year 3$ If the WACC is 10%, should the spectrometer be purchased? ir 10 - + File Home Insert Arial X fx A Base price Additional modification costs Before-tax salvage proceeds Change in NOWC Before-tax labor cost savings WACC Tax rate Depreciation rates Base price Modification costs NOWC Before-tax labor cost savings Depreciation Operating income Taxes After-tax operating income Add back depreciation Operating cash flows Termination cash flows Workbook Statistics Sheet1 + Od Draw Page Layout 10 B $100,000 $15,000 $40,000 $12,000 $53,000 10.00% 40.00% Yr 0 Yr. 0 Formulas Data Review B Av D Yr 2 Yr. 2 $53,000.00 $0.00 Yr. 1 Yr. 1 $53,000.00 $0.00 0.33 @ C Fin 0.45 View Help Eva Merge Yr. 3 Yr. 3 Editin 0.15 $53,000.00 $0.00 410.000 DELI Arial X fx A er 28 Termination cash flows 29 Before-tax salvage proceeds 30 Tax on salvage value 31 NOWC recapture 32 Project cash flows 33 34 NPV 35 Project acceptance? 36 37 Formulas 38 39 Base price 40 Modification costs 41 NOWC 42 43 Before-tax labor cost savings 44 Depreciation 45 Operating income 46 Taxes 47 After-tax operating income 48 Add back depreciation 49 Operating cash flows 50 51 Termination cash flows 52 Before-tax salvage proceeds 53 Tax on salvage value 54 NOWC recapture 55 Proinct cash flows. #N/A 4 E Sheet1 + Calculation Mode: Automatic Workbook Statistics O 16 III 10 B Yr 0 #N/A #N/A #N/A B S 4 C Yr. 1 $53,000.00 #N/A #N/A #N/A #N/A #N/A #N/A P M P D Yr. 2 $53,000.00 #N/A #N/A #N/A #N/A #N/A #N/A #N/A |||| E Yr 3 #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A $40,000.00 $12,000.00 $53,000.00 $40,000.00 $12,000.00 ut Formulas Data BEA C D Yr. 1 Yr, 2 $53,000.00 #N/A #N/A #N/A #N/A #NA #N/A N/A #N/A #N/A F #N/A 5 #N/A P UNIA NA INIA D Review View www $53,000.00 Help Ev & Merge E P M Yr. 3. #N/A NA INIA #N/A #N/A ANIA #N/A INA Editing Curren $40,000.00 $12,000.00 $53,000.00 $40,000.00 $12,000.00 DELL price nal modification costs x salvage proceeds NOWC abor cost savings Yr. 0 D Yr. 0 O 15 B $100,000 $15,000 $40,000 $12,000 $53,000 10.00% 40.00% Yr 1 Yr. 1 $53,000.00 $0.00 0.33 Page Layout 10 Formulas Data BA- CA D Yr. 2 Yr. 2 $53,000.00 80.00 0.45 Yr Yr. 3 $53,000 $0.00 40 000 on DELL MINDTAP line Activity - New project analysis Video Excel Online Structured Activity: New project analysis You must evaluate the purchase of a proposed spectrometer for the R&C firm. The equipment falls into the MACRS 3-year dass and would be solo an $12.000 increase in net operating working capital (spare parts invent The firm's marginal deral-plus-state tax rate is 40%. The data has bee questions below. Open spreadsheet a. What is the initial investment outlay for the spectrometer, that is, L minus sign. S 115000 b. What are the project's annual cash flows in Years 1, 2, and 37 Rour In Year 1 $ In Year 2 $ In Year 3 S If the WACC is 10%, should the spectrometer be purchased? Check My Work Reset Broblum 10 Back 0011545115642282198 58N-978035711453786d-14791821356snapshotid-29240 Christian Songs solpassoigheshisto Everyday things Microso trometer for the R&D department. The base price is $100,000, and it would cost another $15,0 ass and would be sold after 3 years for $40,000. The applicable depreciation rates are 13%, 45 al (spare parts inventory). The project would have no effect on revenues, but it should save the The data has been collected in the Microsoft Excel Online file below, Open the spreadsheet spectrometer, that is, what is the Year O project cash flow? Round your answer to the nearest ca ears 1, 2, and 37 Round your answers to the nearest cent be purchased? A Q Search this The base pro $100,000, and would com ter $15,000 to modify the apment for special use by the for $40,000. The applicable diprition rates are 37%, 4%, 15% and 7% The equipment w we have no effect on revenues, but it should save the firm $51.000 per year in before the labor c the Monut Excel Online bes. Open the spadeet and perform the required analysis to amwer the project cash flow? Round your awer to the nearest cet. Negative amount should be indicated by a vers to the news cent STF Partly 1030 PrtScr Video Online Structured Activity: New project analysis A-2 HIN must evaluate the purchase of a proposed spectrometer for the R&D department. The base price is $100,000, and it would cost another $15,000 to modify the equaposent for special use by the The equipment falls into the MACRS 3-year dass and would be sold after 3 years for $40,000. The applicable depreciation rates are 33%, 45% 15% and 7% The equipment would maure 12,000 increase in net operating working capital (spare parts inventory). The project would have no effect on revenues, but it should save the firm $53,000 per year in before tas labor coots firm's marginal eral-plus-state tax rate is 40%. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to the stions below. en spreadsheet a. What is the initial investment outlay for the spectrometer, that is what is the Year o project cash flow? Round your answer to the nearest cent. Negative amoure should be noted by a minus sign S 115000 b. What are the project's annual cash flows in Years 1, 2, and 37 Round your answers to the nearest cent In year 15 In Year 25 A In Year 3-5 If the WACC is 10%, should the spectrometer be purchased? G

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts