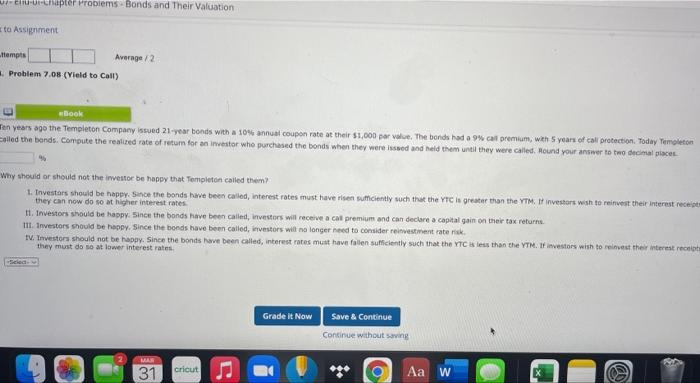

Question: vieur-chapter Problems - Bonds and Their Valuation to Assignment ttempts Average/2 Problem 7.08 (Yield to Call) book Ten years ago the Templeton Company issued 21-year

vieur-chapter Problems - Bonds and Their Valuation to Assignment ttempts Average/2 Problem 7.08 (Yield to Call) book Ten years ago the Templeton Company issued 21-year bonds with a 10% annual coupon rate at their $1,000 per value. The bonds had a cal premium, with 5 years of cal protection. Today Termoleton alled the bonds. Compute the realized rate of return for an investor who purchased the bonds when they were issued and held them until they were called Hound your answer to the decimal place Why should or should not the investor be happy that Templeton called them? 1. Investors should be happy. Since the bonds have been called, interest rates must have risen sumclently such that the YT is greater than the YTM. It investors wish to reinvest their interest receipt they can now do so at higher interest rates 11. Investors should be happy. Since the bonds have been called, investors will receive a cal premium and can declare a capital gain on their tax returns III. Investors should be happy. Since the bonds have been called, investors will no longer need to consideri ment ratek IV. Investors should not be happy. Since the bonds have been called interest rates must have fallen sufficiently such that the YTC is less than the YTM. If investors wish to reinvest their interestre they must do so at lower interest rates Scied Grade it Now Save & Continue Continue without saving 31 cricut OY Aa W

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts