Question: View Ltd has received its bank statement for the month of June from Citibank. There were neither outstanding checks nor deposits in transit at

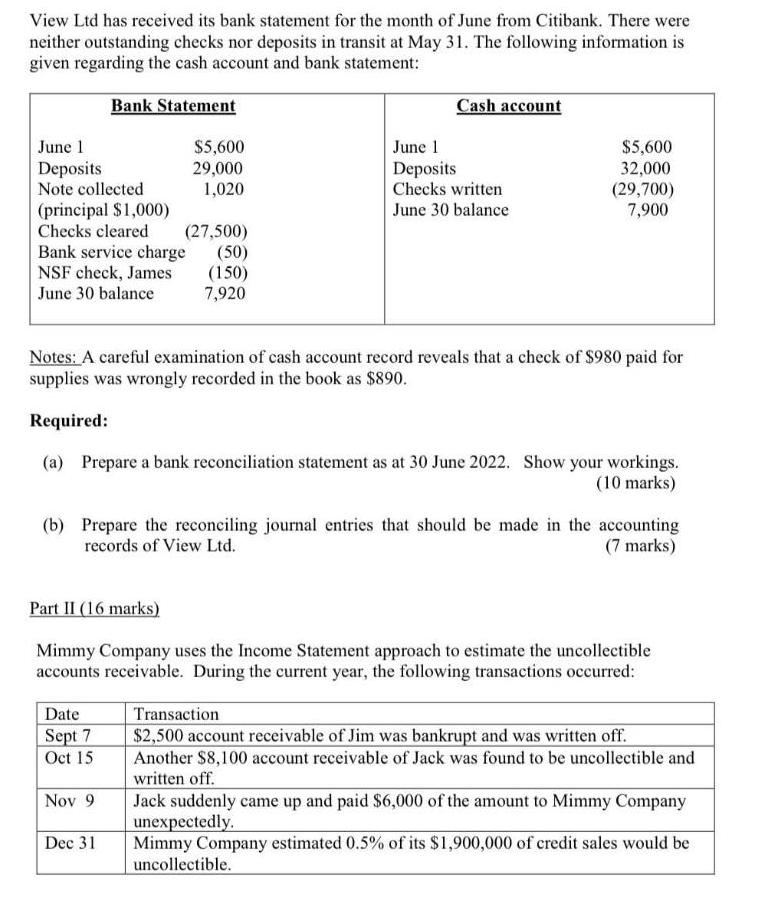

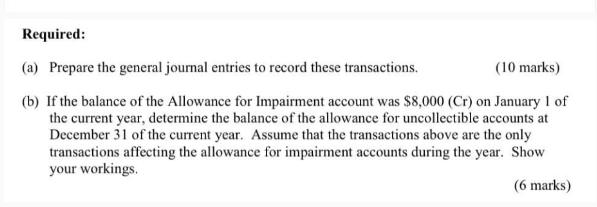

View Ltd has received its bank statement for the month of June from Citibank. There were neither outstanding checks nor deposits in transit at May 31. The following information is given regarding the cash account and bank statement: June 1 Deposits Note collected (principal $1,000) Checks cleared Bank service charge NSF check, James June 30 balance Bank Statement Date Sept 7 Oct 15 $5,600 29,000 1,020 Nov 9 (27,500) (50) (150) 7,920 Dec 31 Cash account June 1 Deposits Checks written June 30 balance Notes: A careful examination of cash account record reveals that a check of $980 paid for supplies was wrongly recorded in the book as $890. Required: (a) Prepare a bank reconciliation statement as at 30 June 2022. Show your workings. (10 marks) $5,600 32,000 (b) Prepare the reconciling journal entries that should be made in the accounting records of View Ltd. (7 marks) (29,700) 7,900 Part II (16 marks) Mimmy Company uses the Income Statement approach to estimate the uncollectible accounts receivable. During the current year, the following transactions occurred: Transaction $2,500 account receivable of Jim was bankrupt and was written off. Another $8,100 account receivable of Jack was found to be uncollectible and written off. Jack suddenly came up and paid $6,000 of the amount to Mimmy Company unexpectedly. Mimmy Company estimated 0.5% of its $1,900,000 of credit sales would be uncollectible. Required: (a) Prepare the general journal entries to record these transactions. (10 marks) (b) If the balance of the Allowance for Impairment account was $8,000 (Cr) on January 1 of the current year, determine the balance of the allowance for uncollectible accounts at December 31 of the current year. Assume that the transactions above are the only transactions affecting the allowance for impairment accounts during the year. Show your workings. (6 marks)

Step by Step Solution

3.40 Rating (153 Votes )

There are 3 Steps involved in it

a Prepare a bank reconciliation statement as at 30 June 2022 Bank Reconciliation Statement for View ... View full answer

Get step-by-step solutions from verified subject matter experts