Question: View Policies Current Attempt in Progress A new accountant at Marin Inc. is trying to identify which of the amounts shown below should be reported

View Policies

Current Attempt in Progress

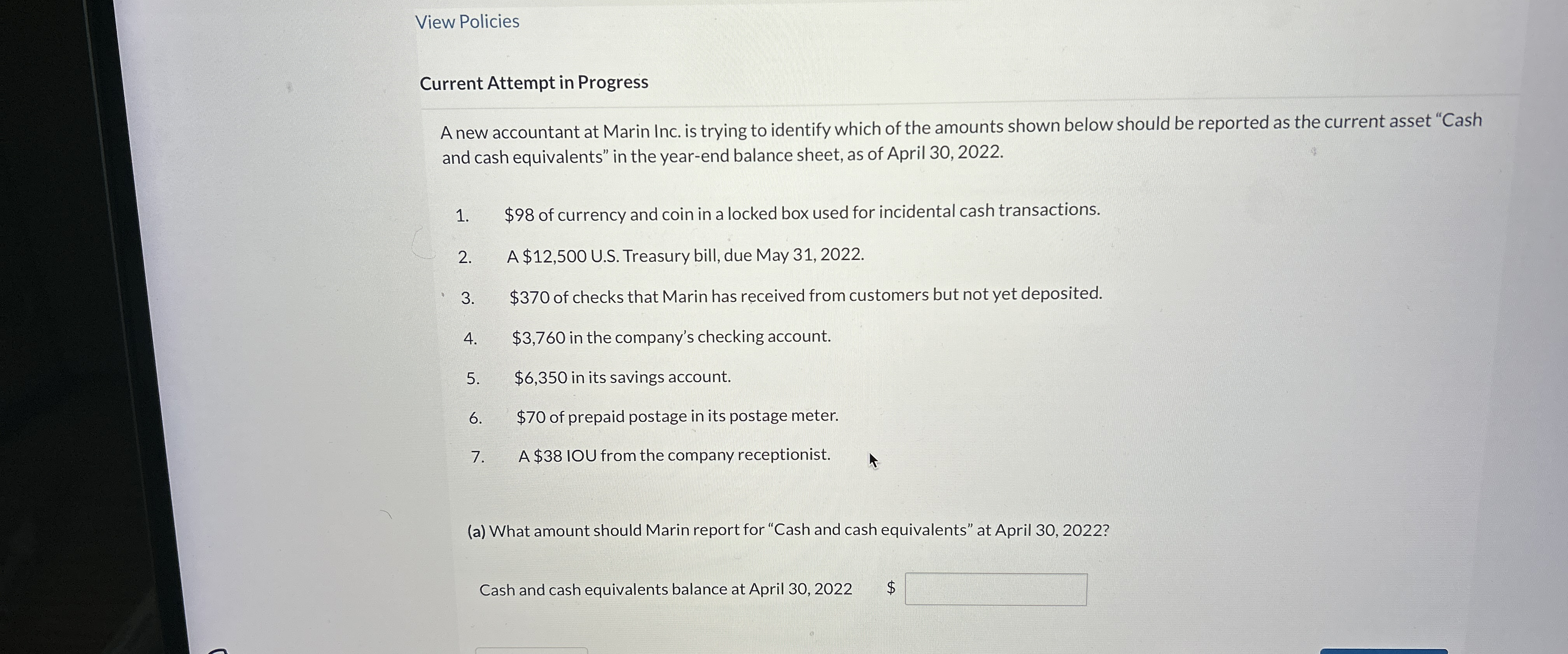

A new accountant at Marin Inc. is trying to identify which of the amounts shown below should be reported as the current asset "Cash and cash equivalents" in the yearend balance sheet, as of April

$ of currency and coin in a locked box used for incidental cash transactions.

A $ US Treasury bill, due May

$ of checks that Marin has received from customers but not yet deposited.

$ in the company's checking account.

$ in its savings account.

$ of prepaid postage in its postage meter.

$IOU from the company receptionist.

a What amount should Marin report for "Cash and cash equivalents" at April

Cash and cash equivalents balance at April

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock