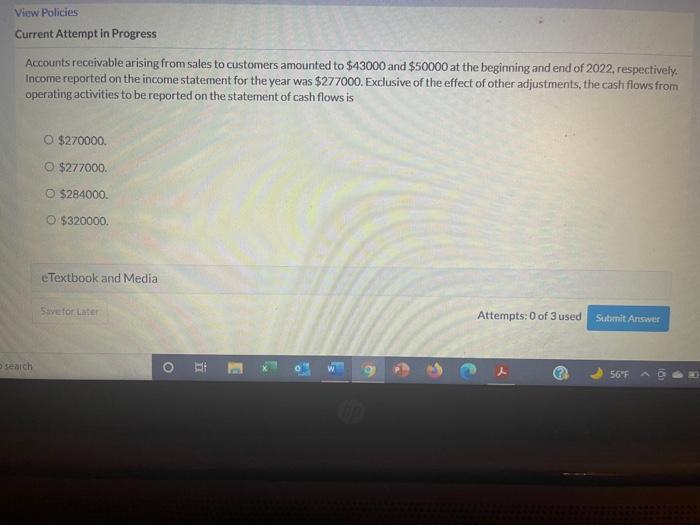

Question: ... View Policies Current Attempt in Progress Accounts receivable arising from sales to customers amounted to $43000 and $50000 at the beginning and end of

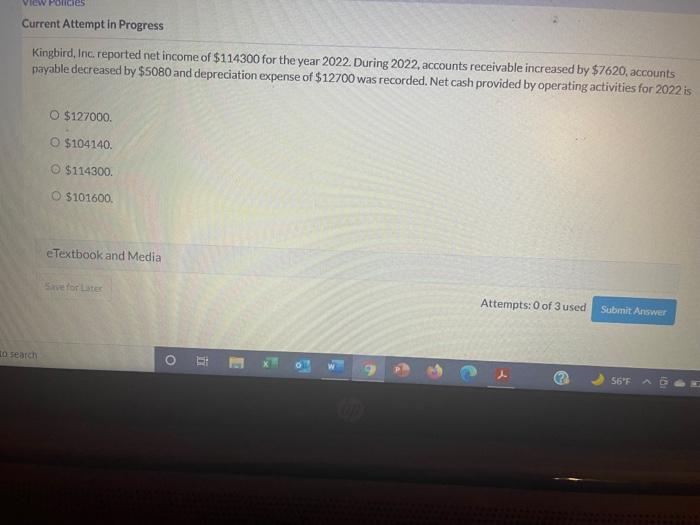

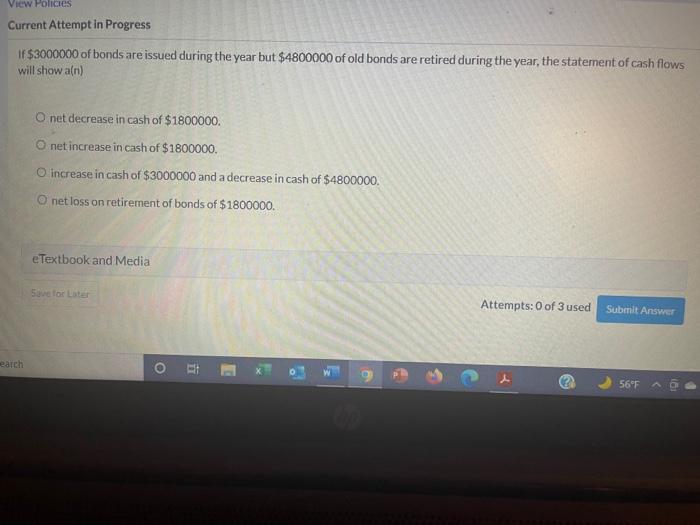

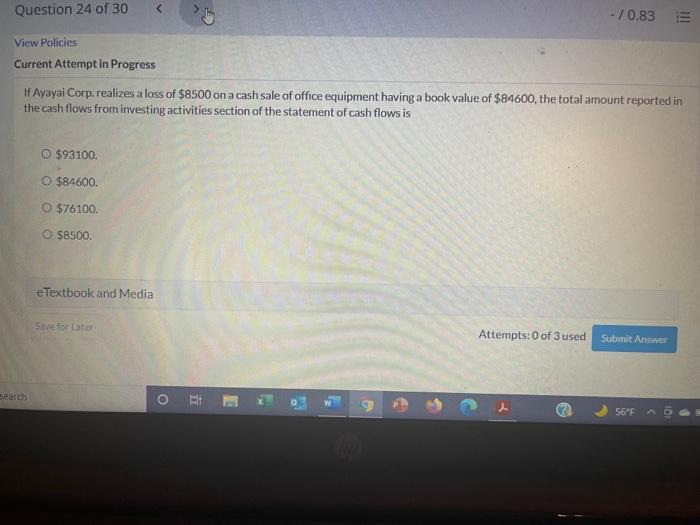

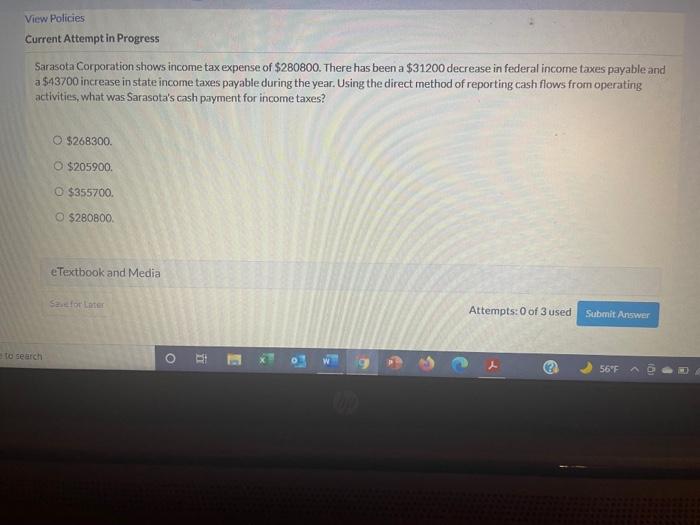

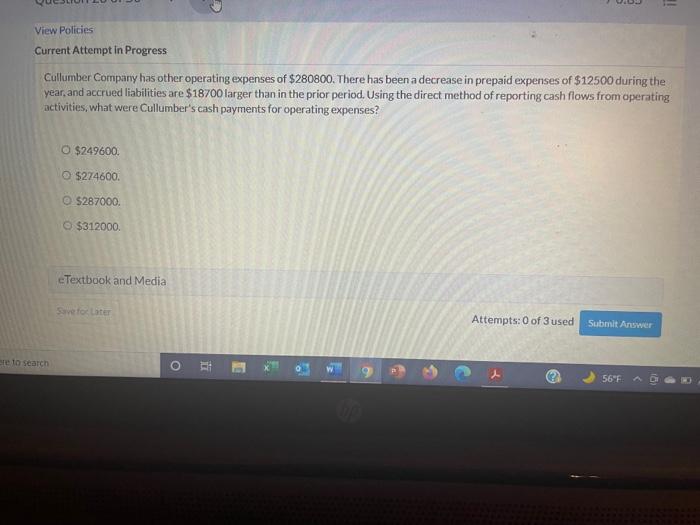

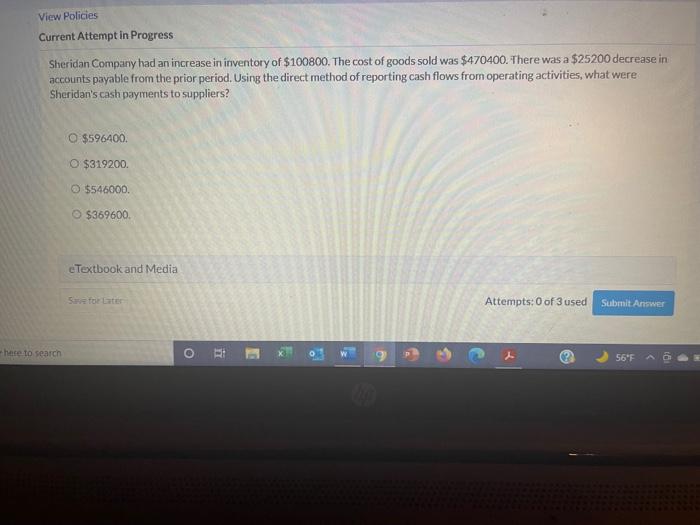

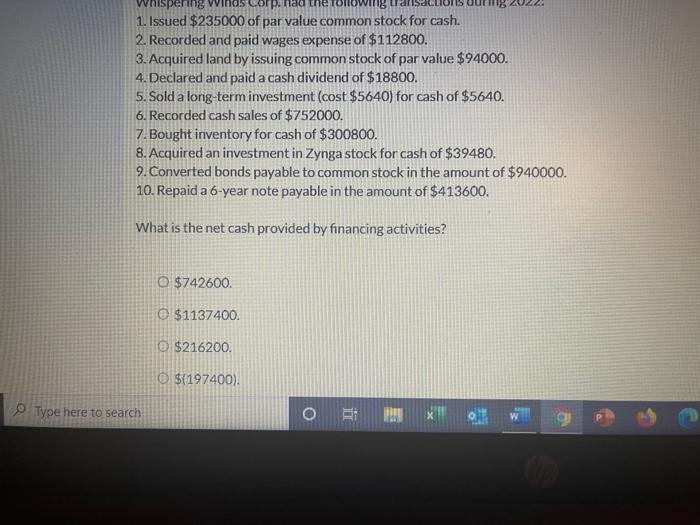

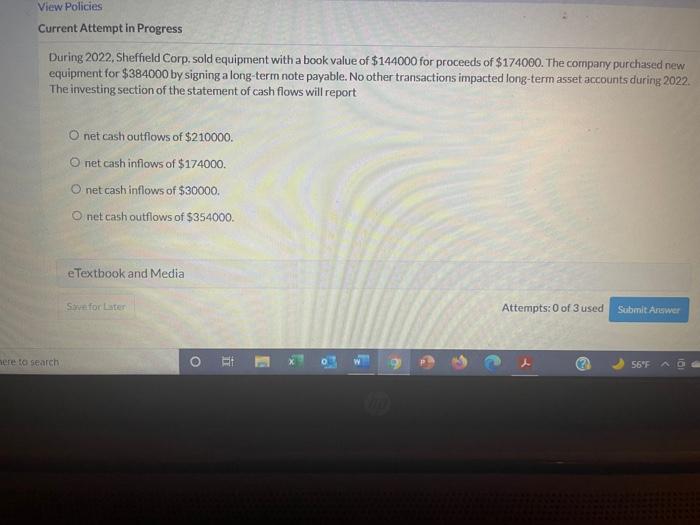

View Policies Current Attempt in Progress Accounts receivable arising from sales to customers amounted to $43000 and $50000 at the beginning and end of 2022, respectively. Income reported on the income statement for the year was $277000. Exclusive of the effect of other adjustments, the cash flows from operating activities to be reported on the statement of cash flows is O $270000. O $277000. $284000 $320000. eTextbook and Media Save for Later Attempts: 0 of 3 used Submit Answer search BE E 56" CW Policies Current Attempt in Progress Kingbird, Inc. reported net income of $114300 for the year 2022. During 2022, accounts receivable increased by $7620, accounts payable decreased by $5080 and depreciation expense of $12700 was recorded. Net cash provided by operating activities for 2022 is O $127000. O $104140. $114300 $101600 eTextbook and Media Srive for Liter Attempts: 0 of 3 used Submit Answer to search O W 56F View Policies Current Attempt in Progress If $3000000 of bonds are issued during the year but $4800000 of old bonds are retired during the year, the statement of cash flows will show a(n) Onet decrease in cash of $1800000. O net increase in cash of $1800000 O increase in cash of $3000000 and a decrease in cash of $4800000. Onet loss on retirement of bonds of $1800000 e Textbook and Media Sve for Later Attempts: 0 of 3 used Submit Answer earch O g 56F Question 24 of 30 - 70.83 View Policies Current Attempt in Progress If Ayayai Corp. realizes a loss of $8500 on a cash sale of office equipment having a book value of $84600, the total amount reported in the cash flows from investing activities section of the statement of cash flows is O $93100. O $84600. O $76100. O $8500 e Textbook and Media Save for later Attempts: 0 of 3 used Submit Answer search o 56F View Policies Current Attempt in Progress Sarasota Corporation shows income tax expense of $280800. There has been a $31200 decrease in federal income taxes payable and a $43700 increase in state income taxes payable during the year. Using the direct method of reporting cash flows from operating activities, what was Sarasota's cash payment for income taxes? O $268300. O $205900. O $355700 $280800 e Textbook and Media Sare for Later Attempts: 0 of 3 used Submit Answer to search o . 56F @ View Policies Current Attempt in Progress Cullumber Company has other operating expenses of $280800. There has been a decrease in prepaid expenses of $12500 during the year, and accrued liabilities are $18700 larger than in the prior period. Using the direct method of reporting cash flows from operating activities, what were Cullumber's cash payments for operating expenses? O $249600. $274600. $287000. $312000 eTextbook and Media Save to the Attempts:0 of 3 used Submit Answer ste to search o 56F View Policies Current Attempt in Progress Sheridan Company had an increase in inventory of $100800. The cost of goods sold was $470400. There was a $25200 decrease in accounts payable from the prior period. Using the direct method of reporting cash flows from operating activities, what were Sheridan's cash payments to suppliers? O $596400. O $319200 O $546000. $369600. eTextbook and Media Setor Later Attempts: 0 of 3 used Submit Answer here to search 0 RI 56" Whispering orp. lowing 1. Issued $235000 of par value common stock for cash. 2. Recorded and paid wages expense of $112800. 3. Acquired land by issuing common stock of par value $94000. 4. Declared and paid a cash dividend of $18800. 5. Sold a long-term investment (cost $5640) for cash of $5640. 6. Recorded cash sales of $752000. 7. Bought inventory for cash of $300800. 8. Acquired an investment in Zynga stock for cash of $39480. 9. Converted bonds payable to common stock in the amount of $940000. 10. Repaid a 6-year note payable in the amount of $413600. What is the net cash provided by financing activities? O $742600. O $1137400. $216200 $(197400). Type here to search o x View Policies Current Attempt in Progress During 2022, Sheffield Corp, sold equipment with a book value of $144000 for proceeds of $174000. The company purchased new equipment for $384000 by signing a long-term note payable. No other transactions impacted long-term asset accounts during 2022 The investing section of the statement of cash flows will report O net cash outflows of $210000. O net cash inflows of $174000. O net cash inflows of $30000. net cash outflows of $354000. e Textbook and Media Safor Later Attempts: 0 of 3 used Submit Answer here to search HI . 2 56F

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts