Question: View Policies Current Attempt in Progress As an analyst for Marin Inc., you are responsible for many firms, including ADFC. Currently you have a hold

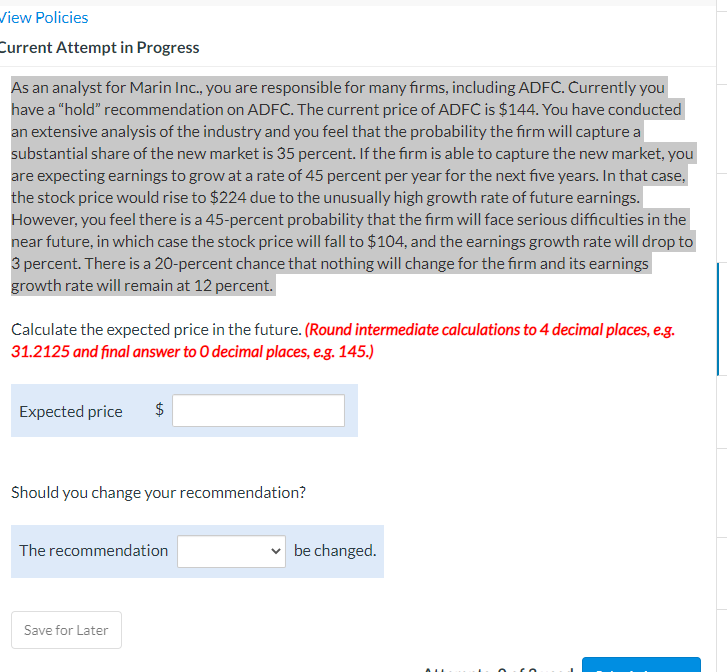

View Policies Current Attempt in Progress As an analyst for Marin Inc., you are responsible for many firms, including ADFC. Currently you have a hold recommendation on ADFC. The current price of ADFC is $144. You have conducted an extensive analysis of the industry and you feel that the probability the firm will capture a substantial share of the new market is 35 percent. If the firm is able to capture the new market, you are expecting earnings to grow at a rate of 45 percent per year for the next five years. In that case, the stock price would rise to $224 due to the unusually high growth rate of future earnings. However, you feel there is a 45-percent probability that the firm will face serious difficulties in the near future, in which case the stock price will fall to $104, and the earnings growth rate will drop to 3 percent. There is a 20-percent chance that nothing will change for the firm and its earnings growth rate will remain at 12 percent. Calculate the expected price in the future. (Round intermediate calculations to 4 decimal places, e.g. 31.2125 and final answer to 0 decimal places, e.g. 145.) Expected price $ Should you change your recommendation? The recommendation be changed. Save for Later

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts