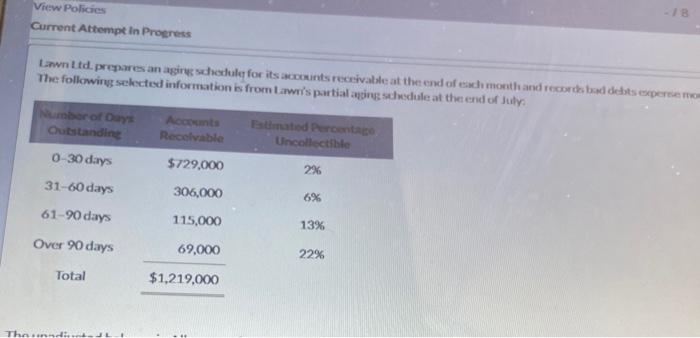

Question: View Policies Current Attempt in Progress B Lawn td prepares an aging schedule for its accounts receivable at the end of each month and record

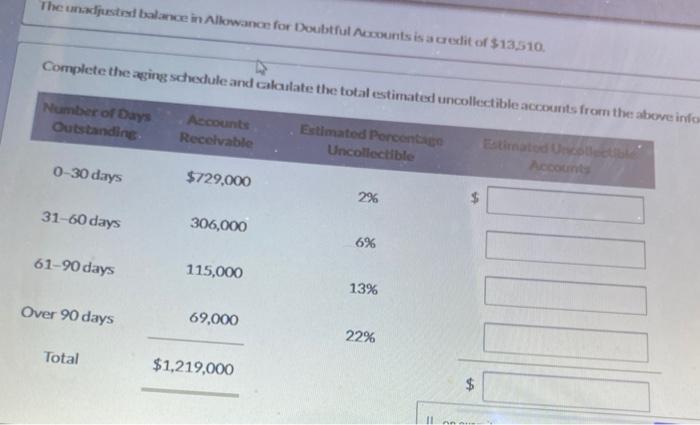

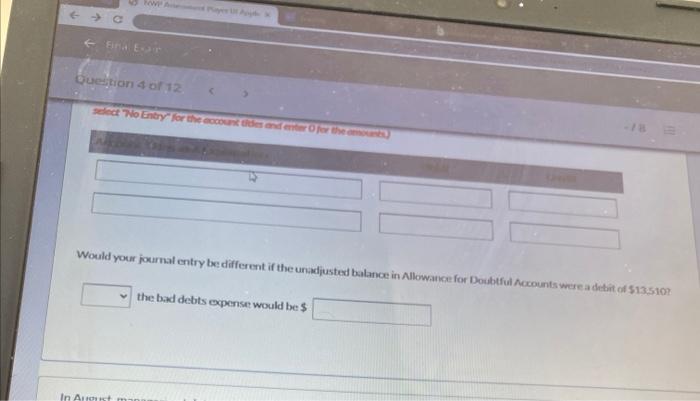

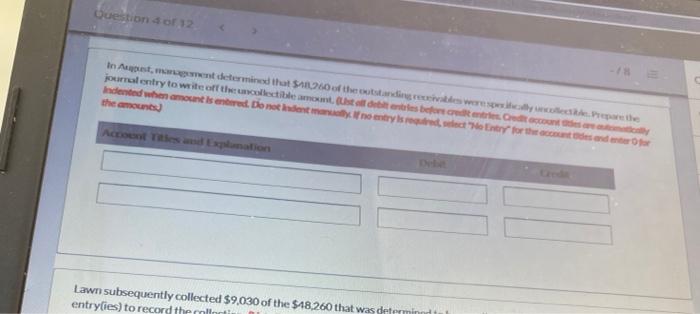

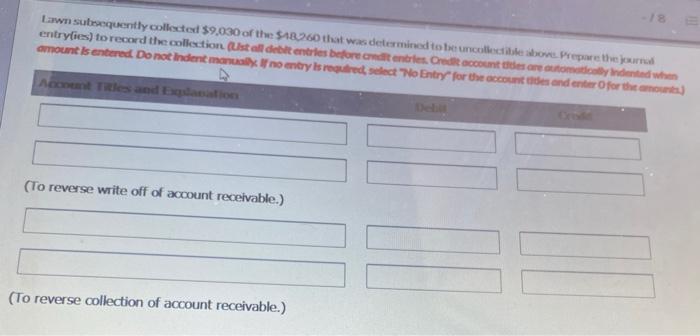

View Policies Current Attempt in Progress B Lawn td prepares an aging schedule for its accounts receivable at the end of each month and record bad debts esperemo The following selected information is from Lawr's partial apping schedule at the end of July Number of Days Outstandine 0-30 days Accounts Receivable Estimated Pronto Uncollectie $729,000 2% 306,000 31-60 days 61-90 days 6% 115,000 13% Over 90 days 69,000 22% Total $1,219,000 Than The unadjusted balance in Allowance for Doubtful Accounts is a credit of $13,510 Complete the aging schedule and calculate the total estimated uncollectible accounts from the above info Number of Days Outstanding Accounts Receivable Estimated Porcento Uncollectible Estimated collectibles Account 0-30 days $729,000 2% $ 31-60 days 306,000 6% 61-90 days 115,000 13% Over 90 days 69,000 22% Total $1,219,000 $ f binnen Question 4 of 12 decto Entry for the accounts and for the Would your journal entry be different if the uradjusted balance in Allowance for Doubtful Accounts were debit of $13.5107 the bad debts expense would be $ In Austm Question of Inst, men determined that $11.260 of the standing receives were prepare the journal entry to write of the collectie motustallaties before Indented when amount is en blandet mano entry sector for the code andere the amount Account is donation Lawn subsequently collected $9,030 of the $18,260 that was determinat entrylies) to record the main Lawn subsequently collected $9,030 of the S10.260 that was determined to be uncollectie bove. Prepare the jour entryies) to record the collection (Ustall debt entries before credit entries. Credit accounts are automondited when amount is entered Do notIndent manually. If no entry is required select "No Entry for the accounts and enter for the amount) Acount Tiles and Equation (To reverse write off of account receivable.) (To reverse collection of account receivable.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts