Question: View Policies Current Attempt in Progress Crane SA began operations in 2 0 2 2 and reported pretax financial income of 2 4 4 ,

View Policies

Current Attempt in Progress

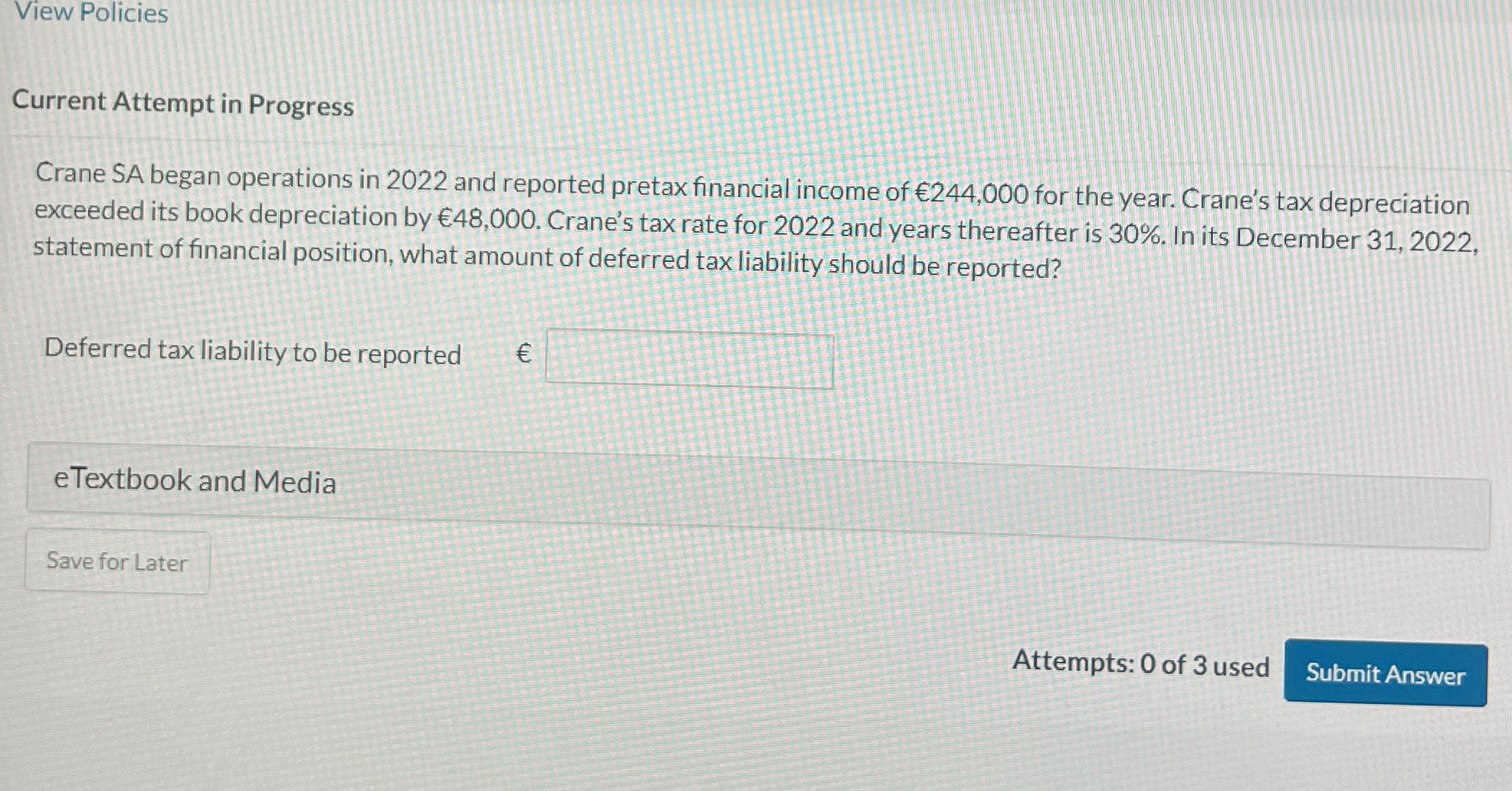

Crane SA began operations in and reported pretax financial income of for the year. Crane's tax depreciation exceeded its book depreciation by Crane's tax rate for and years thereafter is In its December statement of financial position, what amount of deferred tax liability should be reported?

Deferred tax liability to be reported

eTextbook and Media

Attempts: of used

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock