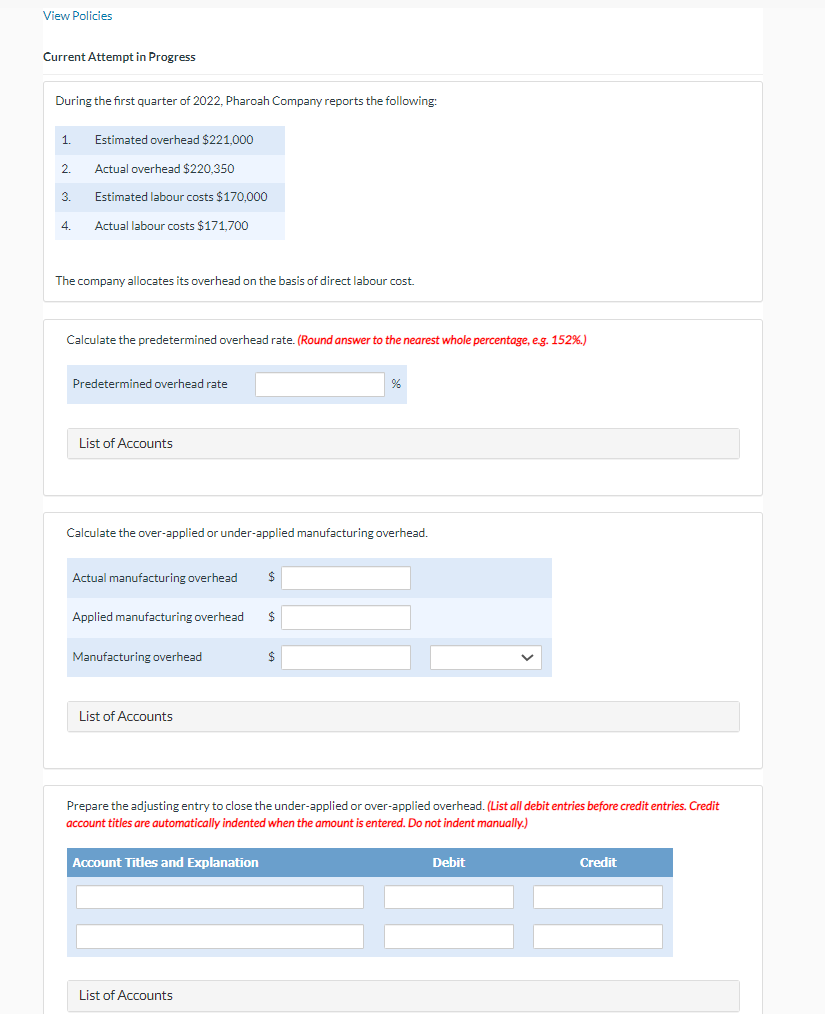

Question: View Policies Current Attempt in Progress During the first quarter of 2022, Pharoah Company reports the following: 1. Estimated overhead $221,000 2. Actual overhead

View Policies Current Attempt in Progress During the first quarter of 2022, Pharoah Company reports the following: 1. Estimated overhead $221,000 2. Actual overhead $220,350 3. Estimated labour costs $170,000 4. Actual labour costs $171,700 The company allocates its overhead on the basis of direct labour cost. Calculate the predetermined overhead rate. (Round answer to the nearest whole percentage, e.g. 152%.) Predetermined overhead rate List of Accounts % Calculate the over-applied or under-applied manufacturing overhead. Actual manufacturing overhead $ Applied manufacturing overhead $ Manufacturing overhead List of Accounts Prepare the adjusting entry to close the under-applied or over-applied overhead. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Account Titles and Explanation List of Accounts Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts