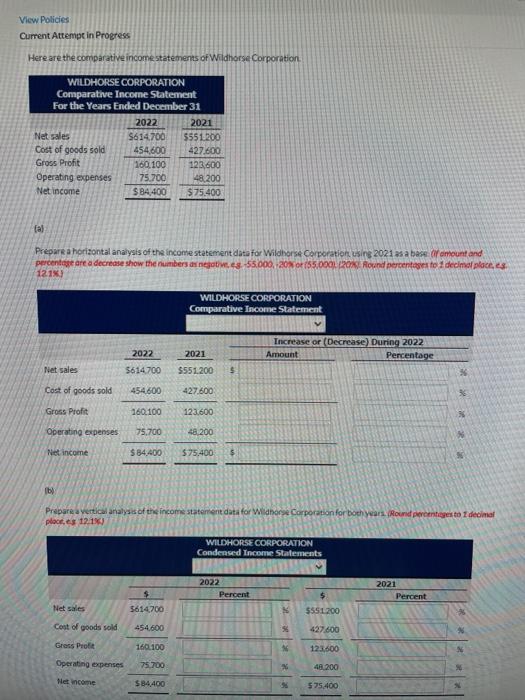

Question: View Policies Current Attempt in Progress Here are the comparative income statements of Wildhorse Corporation WILDHORSE CORPORATION Comparative Income Statement For the Years Ended December

View Policies Current Attempt in Progress Here are the comparative income statements of Wildhorse Corporation WILDHORSE CORPORATION Comparative Income Statement For the Years Ended December 31 2022 2021 Net sales 5614700 5551200 Cost of goods sold 454,600 427,600 Gross Profit 160,100 123,600 Operating expenses 75.700 48.200 Net income SBA 400 $75.400 al Prepare a horizontal analysis of the income statement data for Wildhorse Corporation using 2021 as a base Of amount and percentage are a decrease show the numbers area 48-55.000, 200/55.00011201Round percentato i decimal place, 121) WILDHORSE CORPORATION Comparative Income Statement Increase or (Decrease) During 2022 Amount Percentage 2022 2021 $551.200 Net sales 5614700 $ X Cost of goods sold 454600 427,600 Gross Profit 260.100 123600 Operating expenses 75.700 48,200 Nincome $84.400 575.400 b) Prepare a vertical analysis of the income statement data for Wildhorse Corporation for both years. Roundperetesto I decimal places 12.1%) WILDHORSE CORPORATION Condensed Income Statements 2022 Percent 2021 Percent Net sales 5614700 555L200 Cost of goods sold 454,600 427.600 Gress Pro 160.100 M 123600 Operating expenses 75.700 48.200 Net income $84400 575.400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts