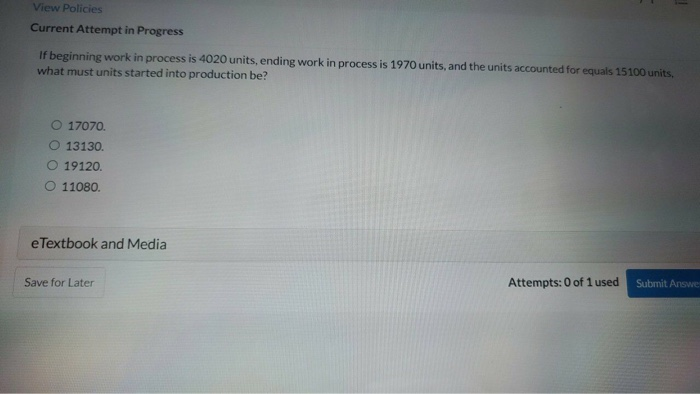

Question: View Policies Current Attempt in Progress If beginning work in process is 4020 units, ending work in process is 1970 units, and the units accounted

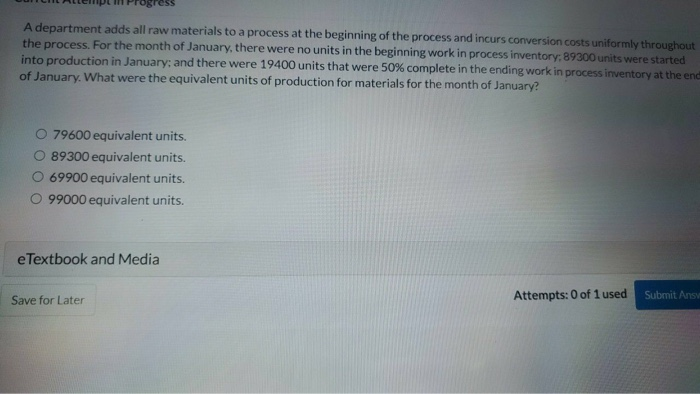

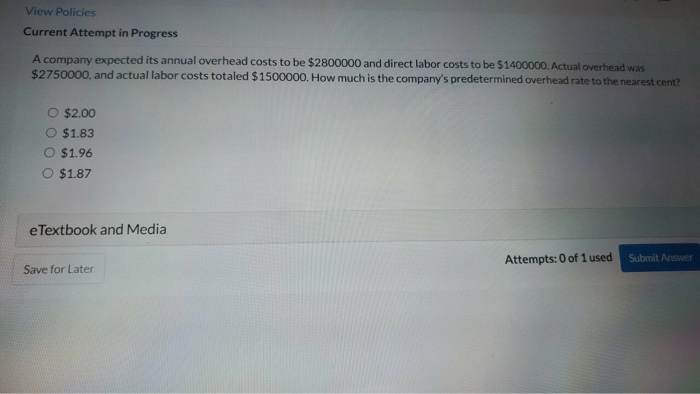

View Policies Current Attempt in Progress If beginning work in process is 4020 units, ending work in process is 1970 units, and the units accounted for equals 15100 units, what must units started into production be? O 17070 O 13130. O 19120. O 11080. e Textbook and Media Save for Later Attempts: 0 of 1 used Submit Answe A department adds all raw materials to a process at the beginning of the process and incurs conversion costs uniformly throughout the process. For the month of January, there were no units in the beginning work in process inventory: 89300 units were started into production in January; and there were 19400 units that were 50% complete in the ending work in process inventory at the end of January. What were the equivalent units of production for materials for the month of January? 79600 equivalent units. O 89300 equivalent units. 69900 equivalent units. 99000 equivalent units. e Textbook and Media Save for Later Attempts: 0 of 1 used Submit Ans View Policies Current Attempt in Progress A company expected its annual overhead costs to be $2800000 and direct labor costs to be $1400000. Actual overhead was $2750000, and actual labor costs totaled $1500000. How much is the company's predetermined overhead rate to the nearest cent? $2.00 O $1.83 $1.96 O $1.87 e Textbook and Media Attempts: 0 of 1 used Submit Answer Save for Later

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts