Question: View Policies Current Attempt in Progress In its first year of operations. Oriole Company recognized $24,640 in service revenue, 65,280 of which was on account

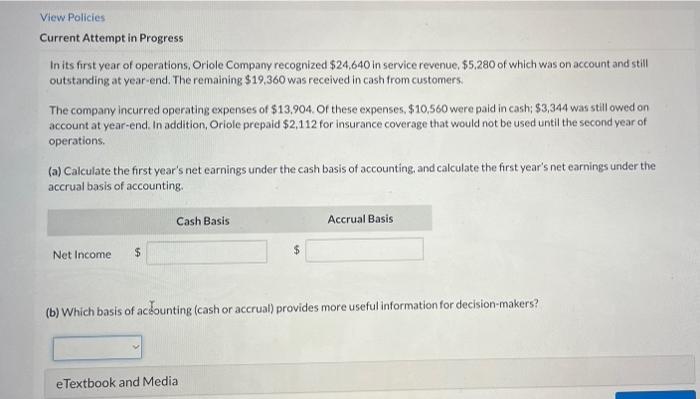

View Policies Current Attempt in Progress In its first year of operations. Oriole Company recognized $24,640 in service revenue, 65,280 of which was on account and still outstanding at year-end. The remaining $19,360 was received in cash from customers. The company incurred operating expenses of $13,904 of these expenses $10,560 were paid in cash: $3,344 was still owed on account at year-end. In addition, Oriole prepaid $2,112 for Insurance coverage that would not be used until the second year of operations (a) Calculate the first year's net earnings under the cash basis of accounting, and calculate the first year's net earnings under the accrual basis of accounting. Cash Basis Accrual Basis Net Income $ (b) Which basis of acounting (cash or accrual) provides more useful information for decision-makers? e Textbook and Media

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts