Question: View Policies Current Attempt in Progress Ivanhoe Flooring has a December 31 year end and uses the perpetual inventory system. Ivanhoe does not expect any

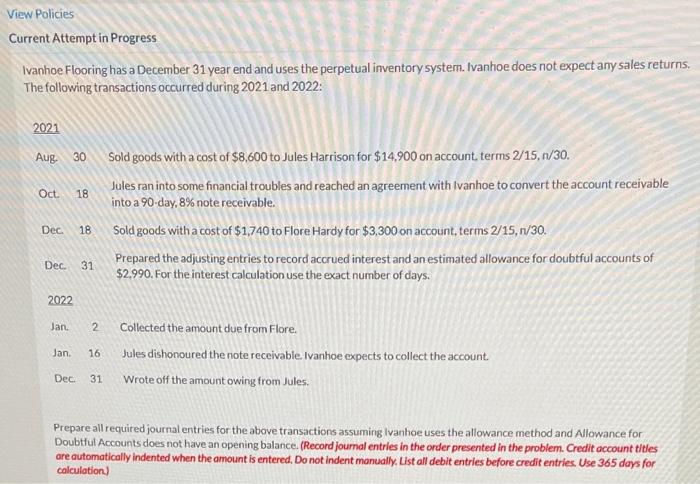

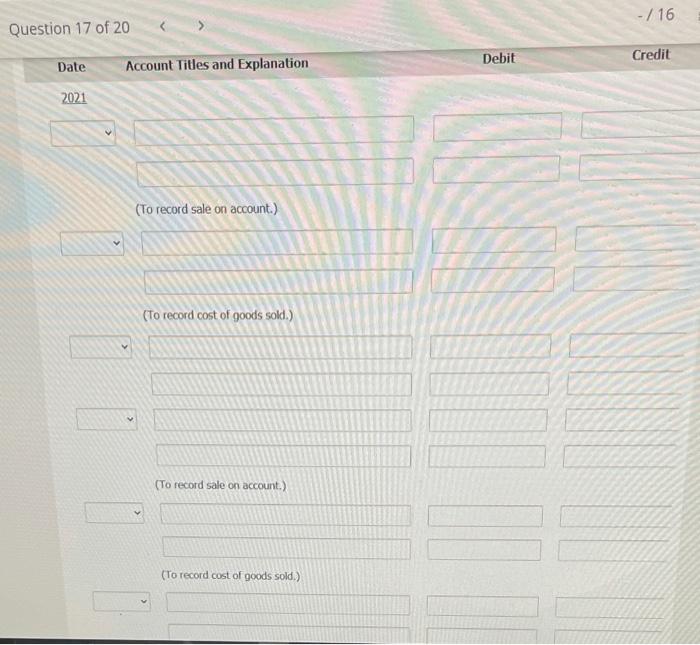

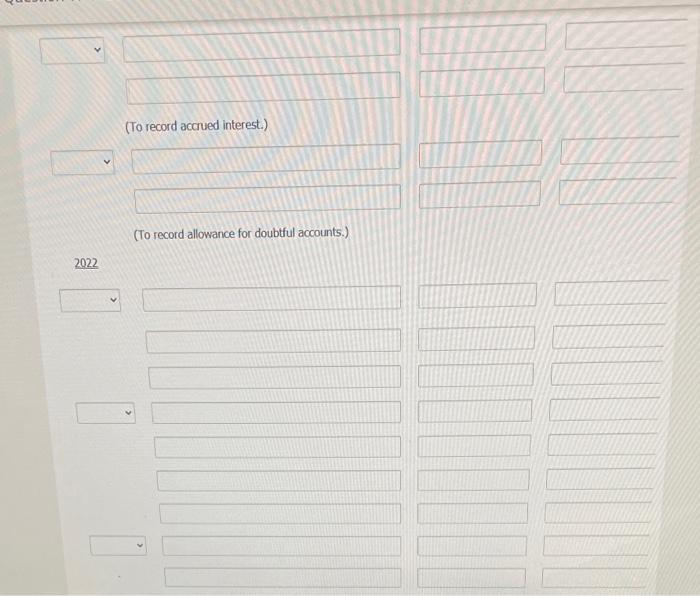

View Policies Current Attempt in Progress Ivanhoe Flooring has a December 31 year end and uses the perpetual inventory system. Ivanhoe does not expect any sales returns The following transactions occurred during 2021 and 2022: 2021 Aug 30 Oct. 18 Sold goods with a cost of $8,600 to Jules Harrison for $14,900 on account terms 2/15, n/30. Jules ran into some financial troubles and reached an agreement with Ivanhoe to convert the account receivable into a 90-day, 8% note receivable. Sold goods with a cost of $1740 to Flore Hardy for $3,300 on account, terms 2/15, 1/30. Prepared the adjusting entries to record accrued interest and an estimated allowance for doubtful accounts of $2.990. For the interest calculation use the exact number of days. Dec 18 Dec 31 2022 Jan 2 Jan 16 Collected the amount due from Flore. Jules dishonoured the note receivable. Ivanhoe expects to collect the account. Wrote off the amount owing from Jules. Dec 31 Prepare all required journal entries for the above transactions assuming Ivanhoe uses the allowance method and Allowance for Doubtful Accounts does not have an opening balance. (Record journal entries in the order presented in the problem. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. Use 365 days for calculation) - / 16 Question 17 of 20 Debit Credit Date Account Titles and Explanation 2021 (To record sale on account) (To record cost of goods sold.) > (To record sale on account.) (To record cost of goods sold.) (To record accrued interest.) (To record allowance for doubtful accounts.) 2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts