Question: View Policies Current Attempt in Progress Marin Inc. operates a retail operation that purchases and sells snowmobiles, among other outdoor products. The company purchases all

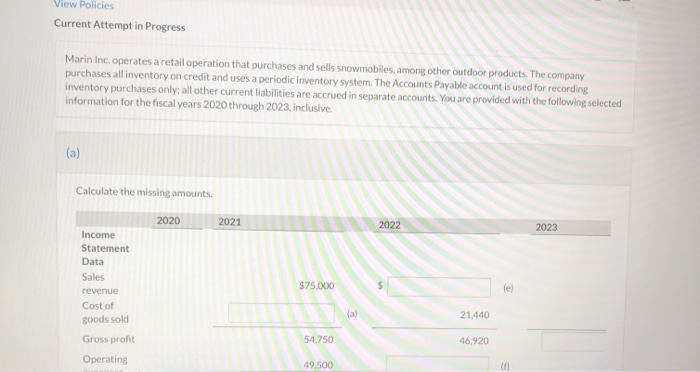

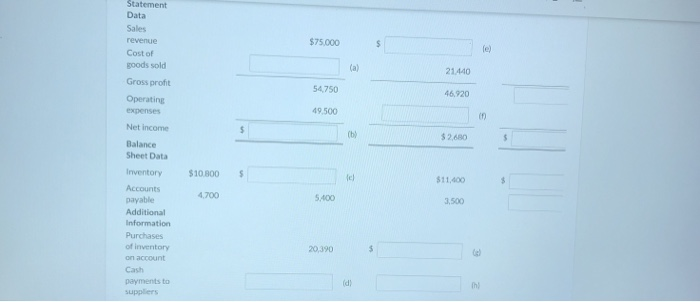

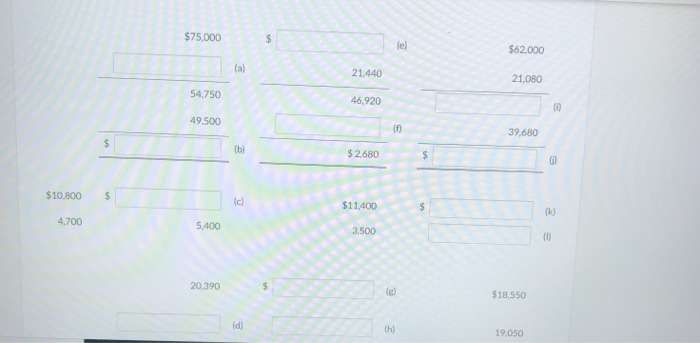

View Policies Current Attempt in Progress Marin Inc. operates a retail operation that purchases and sells snowmobiles, among other outdoor products. The company purchases all inventory on credit and uses a periodic inventory system. The Accounts Payable account is used for recording inventory purchases only; all other current liabilities are accrued in separate accounts. You are provided with the following selected information for the fiscal years 2020 through 2023, inclusive. (a) Calculate the missing amounts. 2020 2021 2022 2023 Income Statement Data Sales revenue Cost of goods sold $75,000 le) (a 21.440 Gross pront 54.750 46,920 Operating 49.500 Statement Data Sales revenue Cost of goods sold $75.000 $ le) (a) 21.040 54.750 46,920 49.500 $ (b $ 2.680 $10.800 $ Tel $11.400 $ Gross profit Operating expenses Net Income Balance Sheet Data Inventory Accounts payable Additional Information Purchases of inventory on account Cash payments to suppliers 4.700 5.00 3,500 20,390 $ (d) th $75.000 $ le) $62.000 (a) 21,440 21.080 54.750 46.920 0) 49.500 39.680 $ (b) $ 2.680 $ e $10.800 (c) $11.400 $ (k) 4.700 5.400 3,500 (0) 20,390 (s $18,550 (d) (h) 19.050

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts