Question: View Policies Current Attempt in Progress On August 1, 2021, the beginning of its current fiscal year, the following opening account balances, listed in alphabetical

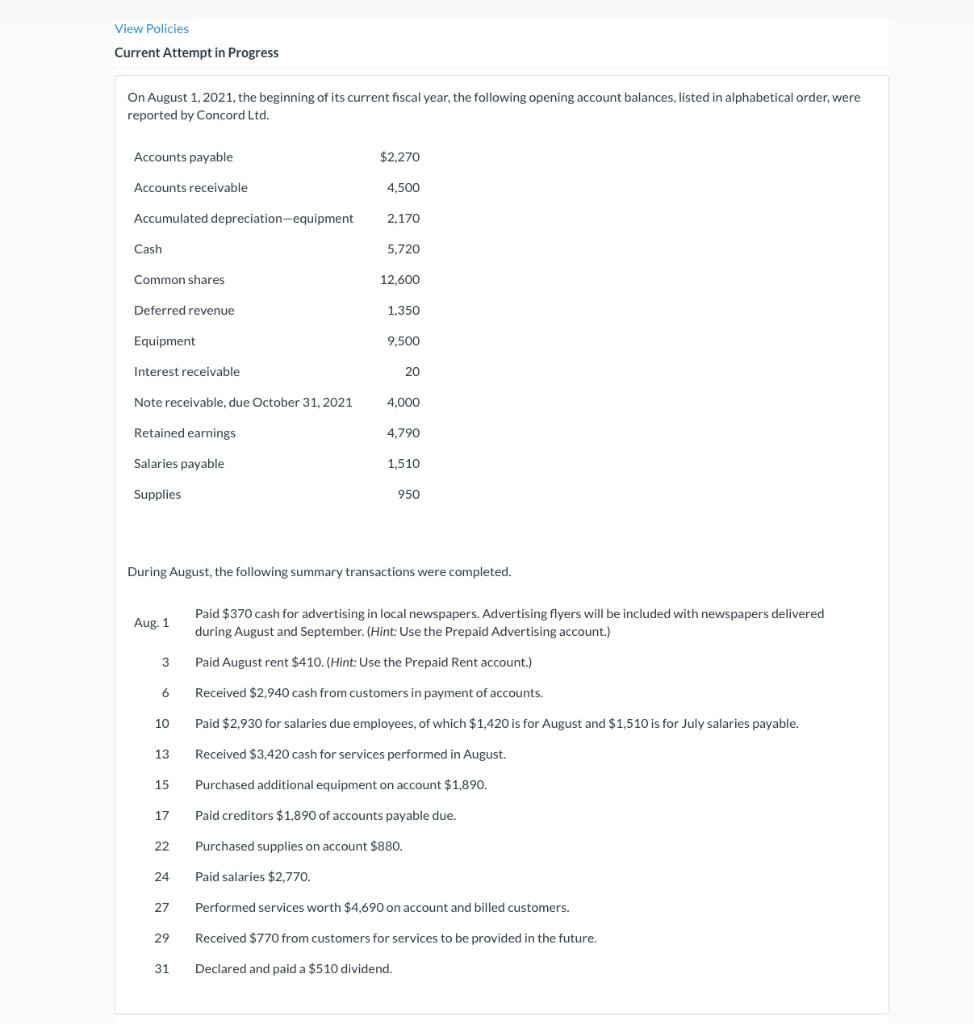

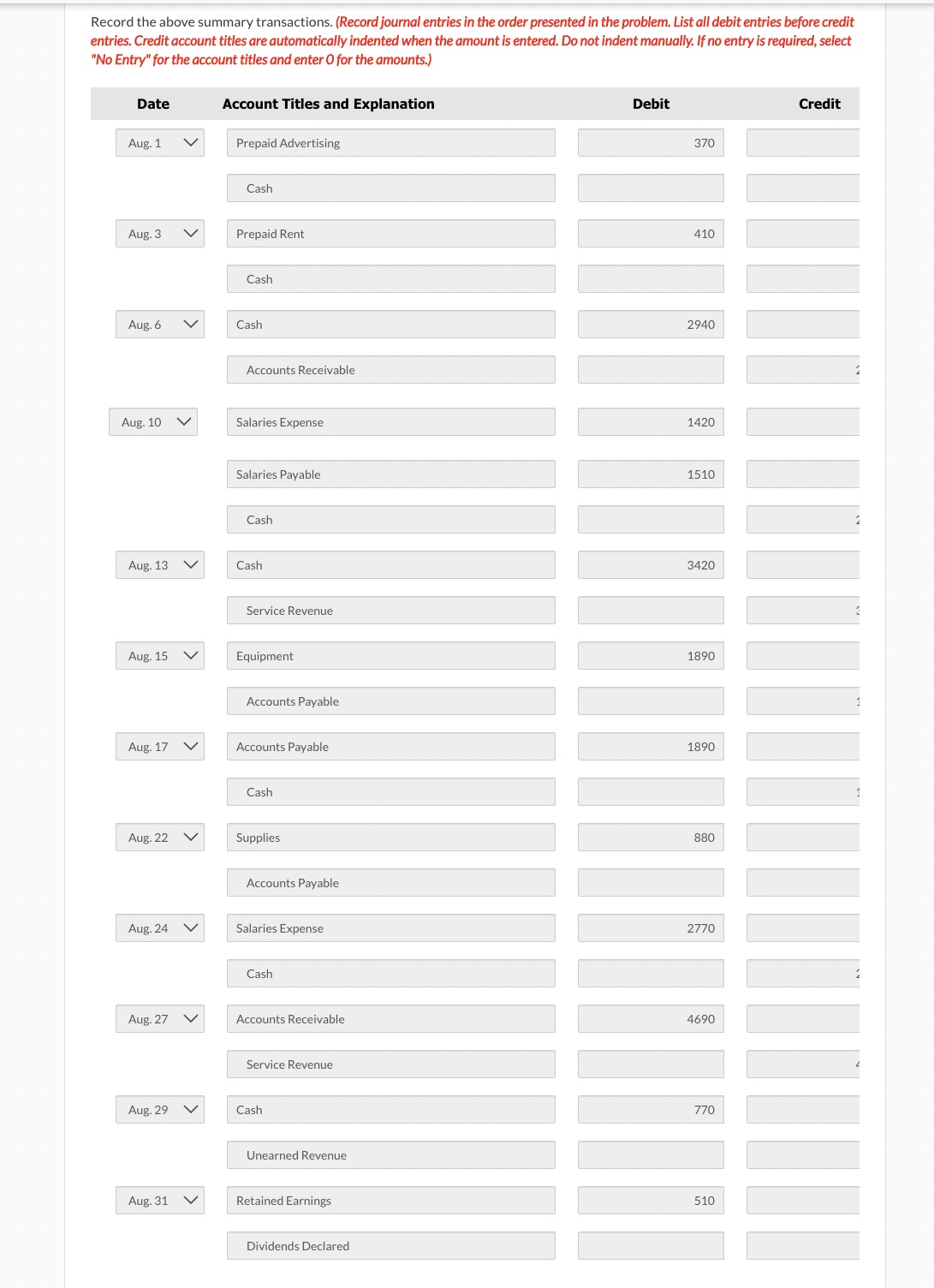

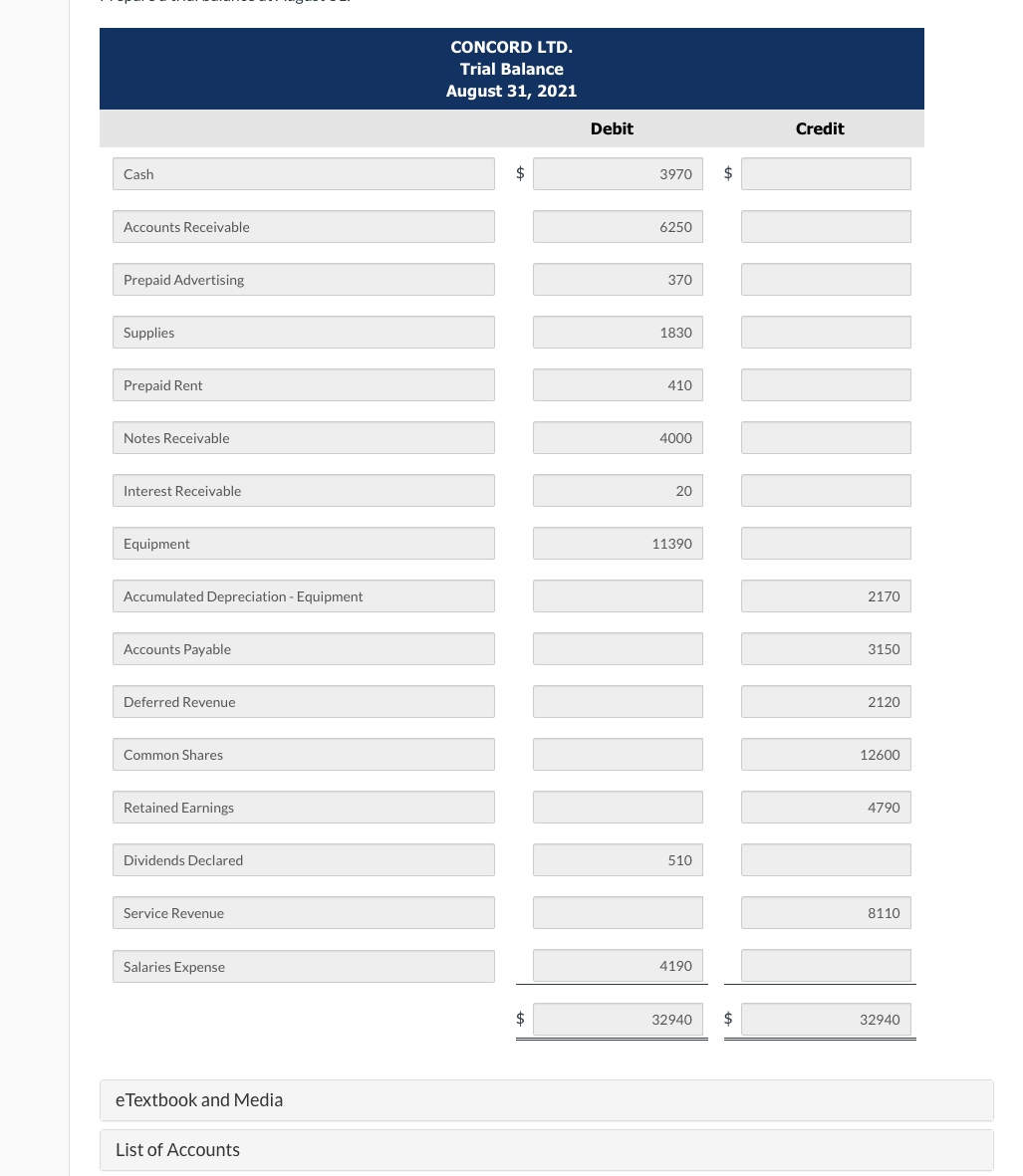

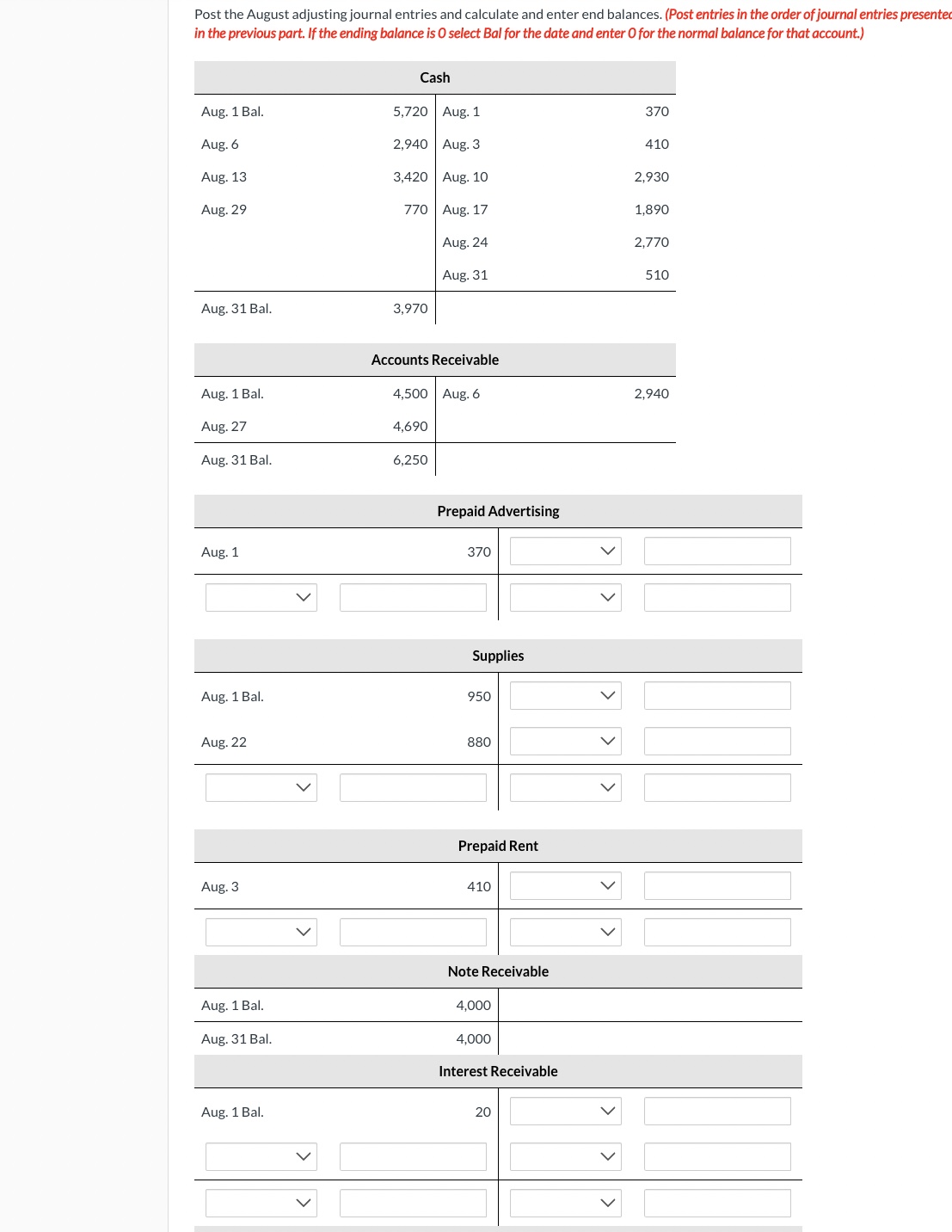

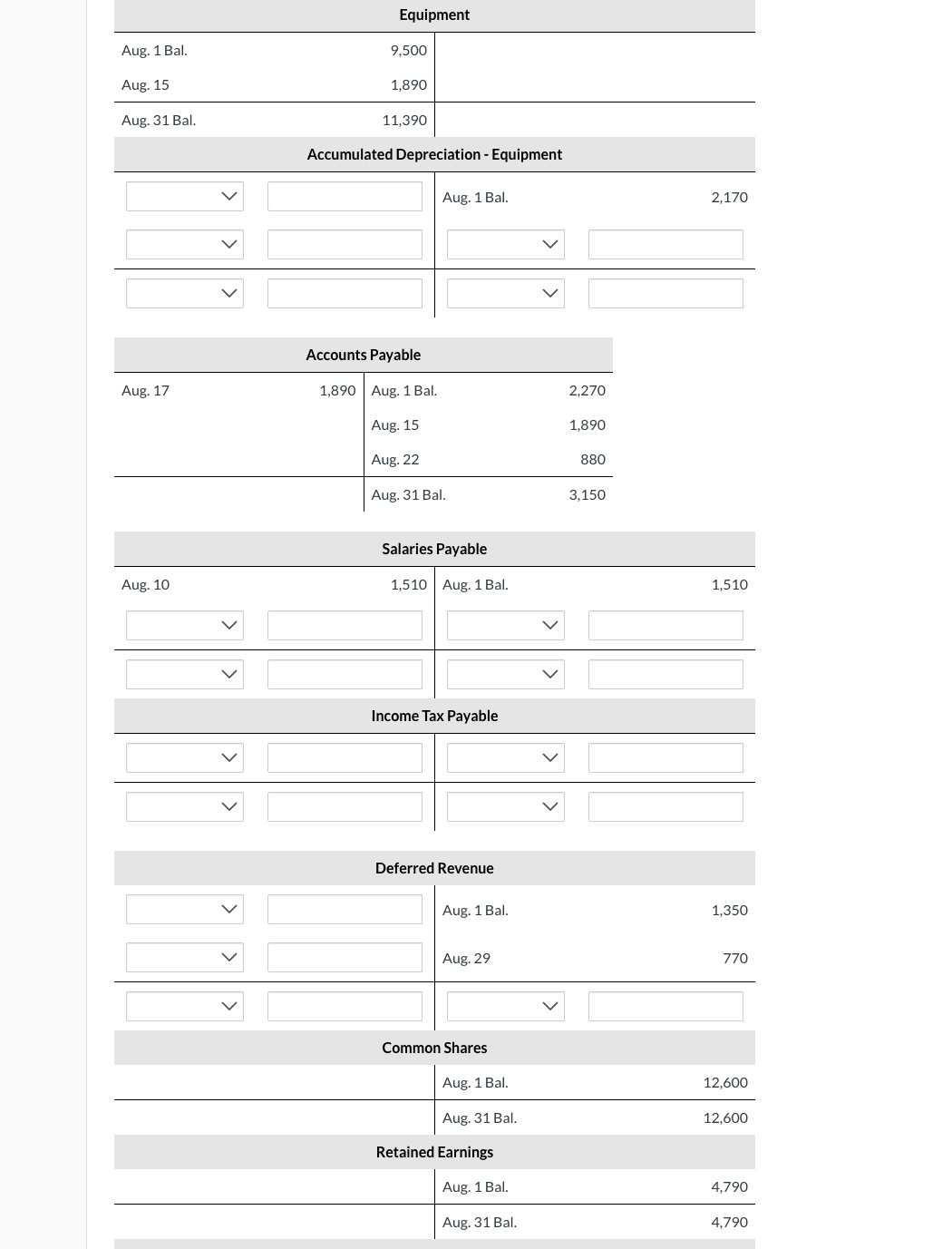

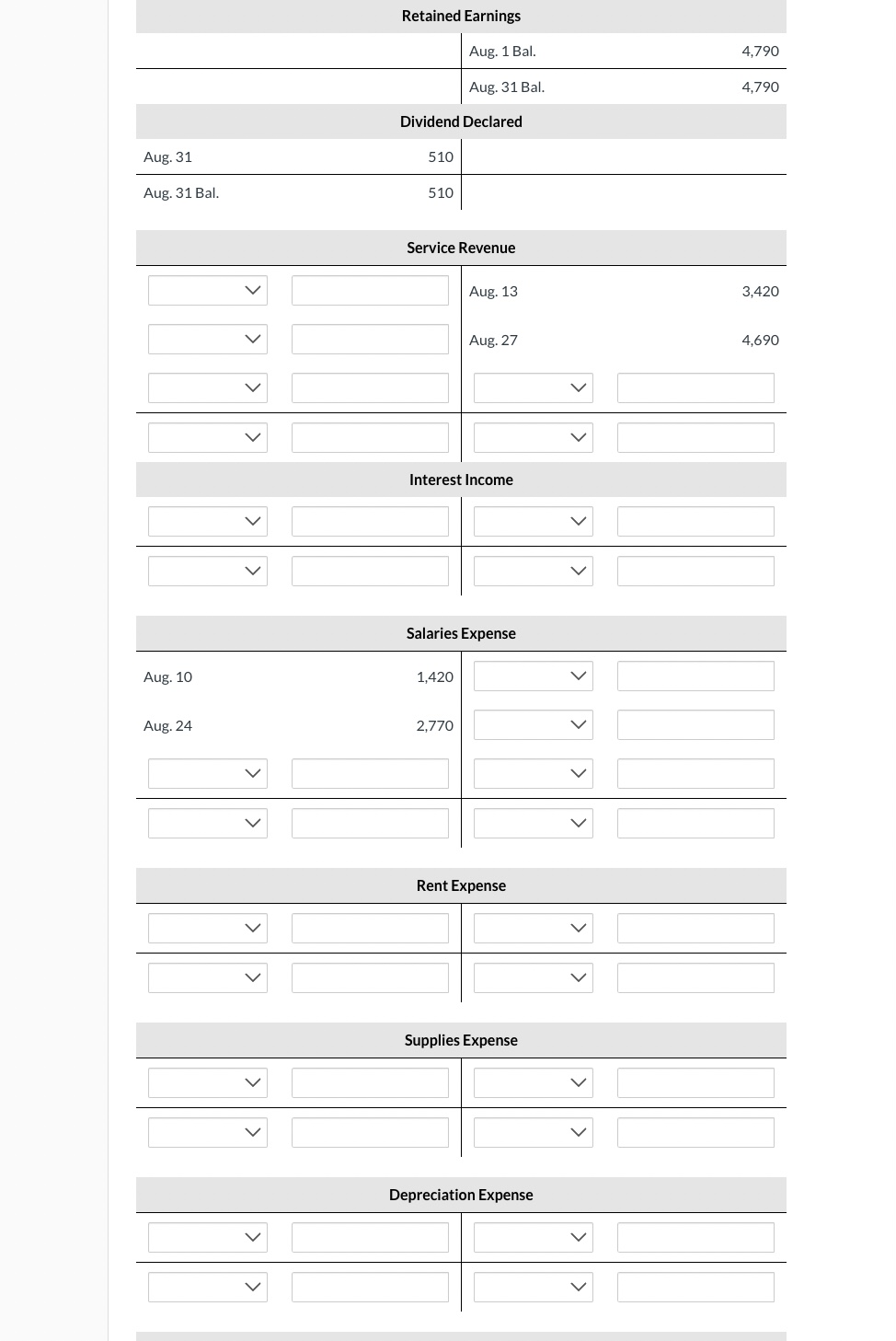

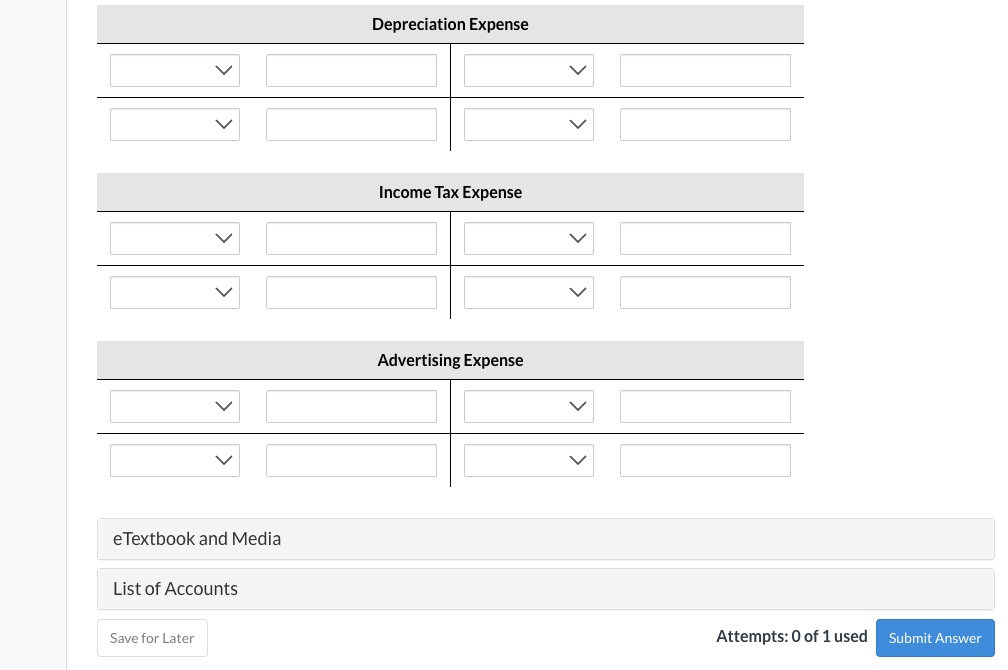

View Policies Current Attempt in Progress On August 1, 2021, the beginning of its current fiscal year, the following opening account balances, listed in alphabetical order, were reported by Concord Ltd. During August, the following summary transactions were completed. Aug. 1 Paid $370 cash for advertising in local newspapers. Advertising flyers will be included with newspapers delivered during August and September. (Hint: Use the Prepaid Advertising account.) 3 Paid August rent \$410. (Hint: Use the Prepaid Rent account.) 6 Received $2,940 cash from customers in payment of accounts. 10 Paid $2,930 for salaries due employees, of which $1,420 is for August and $1,510 is for July salaries payable. 13 Received $3,420 cash for services performed in August. 15 Purchased additional equipment on account $1,890. 17 Paid creditors $1,890 of accounts payable due. 22 Purchased supplies on account $880. 24 Paid salaries $2,770. 27 Performed services worth $4,690 on account and billed customers. 29 Received $770 from customers for services to be provided in the future. 31 Declared and paid a $510 dividend. Record the above summary transactions. (Record journal entries in the order presented in the problem. List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select CONCORD LTD. Trial Balance August 31, 2021 Cash Accounts Receivable 6250 Prepaid Advertising \begin{tabular}{|r|} \hline 370 \\ \hline \end{tabular} Supplies Prepaid Rent Notes Receivable Interest Receivable 1830 Equipment 410 Accumulated Depreciation - Equipment 4000 Accounts Payable Deferred Revenue Common Shares Retained Earnings 20 Credit urnal entries presente count.) Equipment \begin{tabular}{lr|r} \hline Aug. 1 Bal. & 9,500 & \\ Aug. 15 & 1,890 & \\ \hline Aug. 31 Bal. & 11,390 & \end{tabular} Accumulated Depreciation - Equipment Aug. 1Bal. 2,170 Accounts Payable \begin{tabular}{l|lr} \hline Aug. 17 1,890 & Aug. 1 Bal. & 2,270 \\ & Aug. 15 & 1,890 \\ & Aug. 22 & 880 \\ \hline & Aug. 31 Bal. & 3,150 \end{tabular} Salaries Payable \begin{tabular}{|r|r|l|} \hline Aug. 10 & 1,510 & Aug. 1 Bal. \\ \hline & 1,510 \\ \hline & & \\ \hline \end{tabular} Income Tax Payable Deferred Revenue Aug. 1 Bal. 1,350 Aug. 29 770 Common Shares Retained Earnings \begin{tabular}{lr|l} & Aug. 1 Bal. & 4,790 \\ \hline & Aug. 31 Bal. & 4,790 \\ & \multicolumn{2}{|l}{} \\ & \multicolumn{2}{|c}{ Dividend Declared } \\ Aug. 31 & 510 & \\ \hline Aug. 31 Bal. & 510 & \end{tabular} Service Revenue Aug. 13 Aug. 27 4,690 Interest Income Salaries Expense Aug. 10 Aug. 24 Rent Expense Supplies Expense Depreciation Expense Depreciation Expense Income Tax Expense Advertising Expense eTextbook and Media List of Accounts Save for Later Attempts: 0 of 1 used Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts